TheStreet

Interest-rate cuts by the Federal Reserve also will help stocks, bulls say, as the reductions boost economic growth, thereby stimulating earnings growth too.

The Fed slashed rates by 50 basis points Sept. 18, and experts expect the central bank to go another 25 or 50 points at its meeting Nov. 6-7.

In 12 of the Fed’s 14 rate-cutting campaigns since 1929, the S&P 500 posted a positive return 12 months after the initial cuts, according to a Schwab report.

Here’s the bearish case for stocks

But bears note that the S&P 500 hasn’t suffered a 10% correction for 288 days (or more than nine months), according to PNC Financial Services. That compares to an average of 172 days (more than five months) between 10% drops since 1928.

Valuations also argue for a market correction, pessimists say. As of Sept. 20, the S&P 500 traded at 21.4 times analysts’ earnings forecasts for the next 12 months, according to FactSet. That’s well above the five-year average of 19.5 and the 10-year average of 18.0.

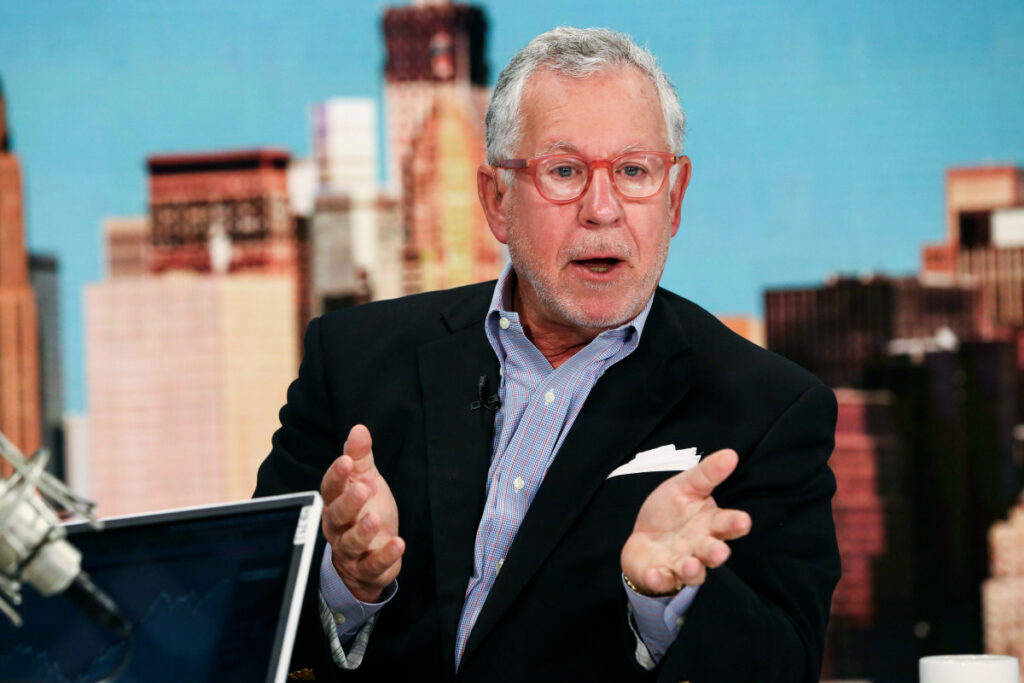

While there has been plenty of talk about these risky fundamentals for the market, TheStreet Pro columnist Doug Kass sees a less publicized risk – the market’s structure.

And he should know. Kass has worked as a hedge fund manager since the 1970s, including a stint as director of research for legendary investor Leon Cooperman’s Omega Advisors.

Related: Veteran fund manager who correctly forecast stock drop updates outlook

“Markets have increasingly become unhinged, both on the down and up sides,” Kass wrote in a recent column.

“As a result, price moves are exaggerated and some very weird stock outliers have populated our markets. Think GameStop, AMC Entertainment and most of Cathie Woods’ Ark Innovation ETF portfolio!” Those stocks ran up and then plunged over the past few years.

“Inefficiencies, sharply exaggerated stock action and investing pain and gain are the byproducts of today’s perilous market structure,” Kass said.

Doug Kass’ concerns about market structure

So what are the structural issues?

1. Passive domination: “The swift transition from active money management to passive has been profound,” Kass said. “Passive strategies account for about 75% of trading volume.”

The passive managers have shortfalls. “They generally know everything about stock prices and nothing about [fundamental] value,” Kass said.

Related: Veteran fund manager views Warren Buffett moves as worrisome

Quantitative funds, whose investments are determined by computer algorithms, “know absolutely nothing about Nvidia’s fundamental outlook but everything about its price momentum,” he said.

“And never discussed is that passive strategies are often dramatically leveraged products, holding obvious risk when momentum changes and everyone is on the same side of the investing boat.”

2. Increased Crazy: “Social media, meme stocks, message boards, etc. have served up some crazy price action,” Kass said. And that action has provided more losses than gains, he said.

“The notion that a small group of traders think they are smarter than the overall population of investors never ends well. And this phenomenon (read: reckless gambling) continues to sprout up.”

Dangers amid options, technology, transparency

1. Option speculation has intensified: The proliferation of zero days to expiration options, which now account for the majority of options trading, is another market structure risk, Kass said. The quick expiration can mean very volatile moves for the options.

Fund manager buys and sells:

2. Technological advances raise risk: “Computer-generated investing strategies, intended to create a sense of safety for retail investors, have often backfired in market history,” Kass said.

3. Heightened risks of expanded transparency: “Today’s transparency has an upside: it provides instantaneous information to the masses,” which was previously limited to the wealthy, he said.

“The problem with transparency, though, is that some of it is inaccurate.” And that can cause major investment losses.

Related: The 10 best investing books, according to our stock market pros

Read the full article here