(Bloomberg) — Traders are bracing for extra volatility on Friday following the US payrolls report that will be scoured for signals as to how much the Federal Reserve will cut interest rates in November.

Most Read from Bloomberg

The options market is betting the S&P 500 Index will move roughly 1% in either direction after Friday’s US employment data, based on the price of that day’s at-the-money straddles, according to Stuart Kaiser, Citigroup Inc.’s head of US equity trading strategy. If it happens, that would be roughly in line with the past two jobs prints, and the biggest move in two weeks.

Traders are looking to the job figures, due at 8:30 a.m. in Washington on Friday, for clues as to whether the labor market is weakening further after US hiring fell short of forecasts in August, with downward revisions to the prior two months.

Payrolls in the world’s largest economy are seen rising 150,000, based on the median estimate in a Bloomberg survey of economists. That’s similar to the August increase and would leave three-month average job growth near its weakest since mid-2019. The jobless rate probably held at 4.2%, while average hourly earnings are projected to have risen 3.8% from a year earlier.

The employment data has surpassed consumer prices in importance for the market in predicting the size and speed of Fed rate cuts, as the central bank shifts its focus from bringing down inflation to stabilizing economic growth.

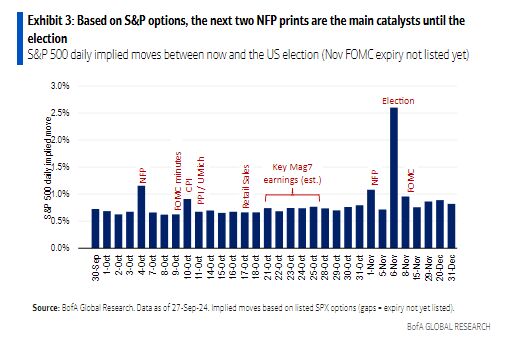

To Bank of America Corp. strategists including Gonzalo Asis, payrolls remain the biggest catalyst for US equities until the election, and a strong print may add fuel to the soft landing trade.

Options volatility across markets is already elevated after flaring tensions in the Middle East after Israel vowed to retaliate against a missile barrage from Iran. The Cboe Volatility Index, or VIX, is trading just above the 20 level that starts to raise concerns for traders.

“Unless the September nonfarm payrolls are significantly south or north of 150,000, I don’t see the volatility blowing out,” said Scott Colyer, chief executive at Advisors Asset Management.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here