(Bloomberg) — Amid the selloff in UK bonds this week triggered by Chancellor of the Exchequer Rachel Reeves’ budget plan to ramp up taxes, borrowing and spending, there were jitters in Labour’s cabinet — but for a different reason.

Most Read from Bloomberg

They feared her numbers weren’t large enough to meaningfully improve public services in time for the next general election due in 2029.

While traders reacted to £142 billion ($184 billion) of extra borrowing over the course of the parliament to fund investment projects, as well as a £40 billion tax rise and underwhelming economic growth projections, Labour ministers and aides were looking past the government’s initial splurge in day-to-day spending to what happens in the years before Britons next go to the polls.

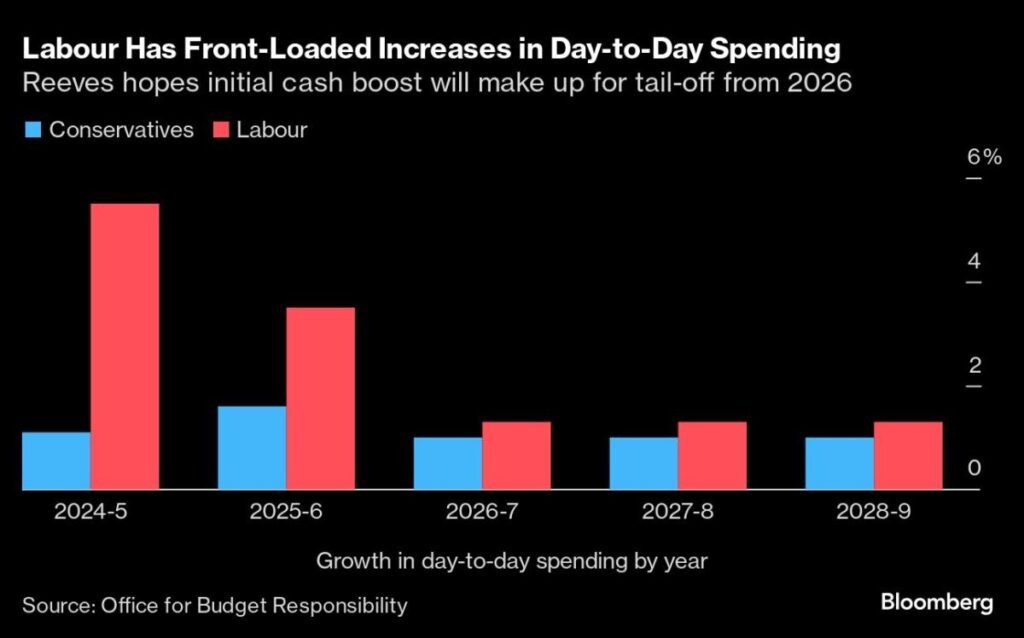

Public spending is due to rise by an average 2% in real terms starting this year, but it is front-loaded before tailing off significantly from 2026. Departments with unprotected budgets, such as transport or justice, are heading for real-terms cuts later in the parliament, according to the Institute for Fiscal Studies think tank. That is tantamount to austerity, one party official said privately.

Such complaints underscore the tightrope Reeves was walking as she tried to navigate markets — still primed from the memory of the meltdown under Liz Truss two years ago — and a governing Labour Party determined to rebuild Britain’s ailing public services which still bear the scars of the austerity years that defined the Conservative administration after the financial crisis.

Reeves’ budget, one party official said, would mean spending constraints in areas of importance to voters, from bus and rail services to flood defenses and even Home Office efforts to cut crime. Having been elected on a “change” platform and Prime Minister Keir Starmer’s promise of a decade of national renewal, some Labour politicians wondered about winning a second term.

Speaking to Bloomberg on Thursday, Reeves defended her budget and said her priority is “economic and fiscal stability.” She denied that her spending plans would mean a return to austerity, and said her aim was to “wipe the slate clean” after inheriting what she called a fiscal black hole from the Tories.

By Friday, the sharp bond selloff — which never approached the scale of the Truss-era turmoil — had abated, leaving the yield on benchmark 10-year gilts about 20 basis points higher than five days ago. Still, the market reaction was far from ideal given Starmer and Reeves sold Labour as a force for stability after years of political and economic turmoil under the Conservatives.

Yet the reaction from some Labour politicians, albeit mostly in private, suggest pressure on Reeves is unlikely to dissipate especially with the next spending review to set departmental budgets looming in first half of next year.

“It remains to be seen whether the short-term cash injection will be enough to get services back on their feet and make that degree of future spending restraint realistic,” said IFS economist Ben Zaranko. “The problem for Rachel Reeves is that decisions over departmental allocations in those future years have to be made in the spring — before those improvements have had chance to materialize — and her cabinet colleagues will be lobbying hard for top-ups.”

One minister said the Treasury had to work creatively and collaboratively with departments to deal with budget pressures at the next review, rather than pretending they don’t exist. Colleagues want Reeves to take personal charge, the person said, rather than leaving them to deputy Darren Jones, whose uncompromising approach they said had caused upset across cabinet.

Ministers who protested to Starmer in recent weeks about the cuts they were being asked to make would not back down at the next spending review, another lawmaker said. That signaled the next flash-point between the Treasury and the cabinet could be one of the defining moments of this administration.

A potential crunch could come even sooner. Some Labour MPs are worried about how far £1.3 billion granted to local government services will stretch across councils, after the Local Government Association said last month a funding deficit of more than £2 billion had left a quarter of town halls in England likely to need emergency bailouts in the coming years. Local authorities will find out what proportion of the grant they receive in December.

The issue really boils down to the fact that having spent 14 years in opposition, many in Starmer’s party want to talk about and deliver on core Labour issues, whether it’s public services and especially the National Health Service, reforming social care or tackling poverty. But coming into power, they’ve been faced with Reeves’ warning about a £22 billion black hole that needs fixing even before the government gets to improvements.

Former Labour shadow chancellor Ed Balls described Reeves’ budget as “big and bold and historic” but that the spending uplift was “painfully tight.”

“When you start thinking as the years go on about what this actually means for teachers pay, housebuilding, local government services, policing, there’s going to an ongoing debate about whether this is really the end of austerity as felt by the delivery of public services,” he said on his Political Currency podcast.

Still, the message from markets for any Labour lawmakers demanding higher spending appeared clear this week: you’ll need to have a plan to pay for it.

Having raised taxes by the most in at least three decades on Wednesday, Reeves will be reluctant to do so again on anything like the same scale — though she predictably declined to rule out further tax rises in the current parliament in her Bloomberg interview.

“No chancellor is going to be able to tie their hands in that way,” she said.

The government’s preference would be to find additional spending capacity through economic growth, and the message from Downing Street this week was that the Office for Budget Responsibility’s disappointing forecasts didn’t take into account the impact of Labour policies such as planning reform.

Yet some Labour people in the so-called Blairite faction — considered to be on the right of the party and followers of former premier Tony Blair — said Reeves’ budget lacked growth-enhancing measures, according to one lawmaker, suggesting the chancellor’s approach was more left-wing than they would like.

“The growth forecasts aren’t the summit of my ambition,” Reeves told Bloomberg. “We are doing planning reform, pensions reform, skills reform, to get our country growing again. We’re unlocking long-term patient capital to help small businesses and start-up and scale-up businesses to grow. All of that could have a big impact on growth.”

Along with the easing market jitters, there was some respite for Reeves via a poll from Arden Strategies by JL Partners. Just under half of Britons support her decision to raise taxes by £40 billion, with 36% saying it was unnecessary. Reeves’ plan to borrow more to invest was backed by 54% of respondents.

“The budget sets a different direction for the country, with a more open approach about the need for more investment in the National Health Service and infrastructure,” said Jim Murphy, CEO of Arden and a former Labour MP. “This poll suggests that the public are open to Labour’s argument.”

–With assistance from Joe Mayes.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here