(Bloomberg) — Malaysia’s consumer stocks are set for a bounce thanks to tailwinds from a stronger ringgit, according to the country’s top-performing fund.

Most Read from Bloomberg

Companies are likely to see better margins as import of raw inputs become cheaper, said Kok Lin Teoh, the founder and chief investment officer of Singular Asset Management. “We expect valuations of consumer companies to increase, driven by higher earnings growth over the next two to three years.”

Teoh, who manages about $400 million across Asia-focused funds, is turning to domestic consumption-related shares to position the Malaysia-based Singular Value Fund for its next leg of gains.

“We are doing a bit more adjustment in reducing export oriented industry holdings because the ringgit has strengthened,” he said in an interview in September. “We are moving back into more domestic-oriented sectors,” including banks and consumer stocks.

After falling to a 26-year low early this year, the Malaysian ringgit is outperforming its emerging market peers with a 14% increase in the three months through September. The stronger currency, coupled with a rise in civil servants’ wages and higher disposable incomes, may spur consumer spending.

The consumer sector is also “likely to benefit from higher economic expansion,” Teoh said.

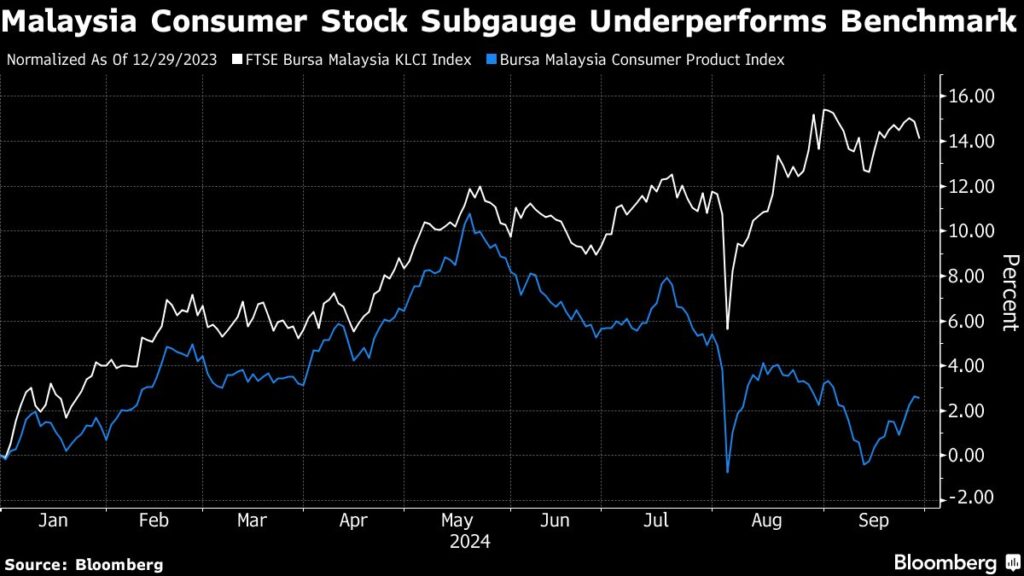

A subgauge of local consumer stocks has only risen 2.6% this year, lagging the 14% climb in the benchmark FTSE Bursa Malaysia KLCI Index.

Teoh’s 387 million ringgit ($93.6 million) Singular Value Fund has beaten 95% of peers this year with returns of 31%, Bloomberg-compiled data show. While the asset management firm doesn’t reveal details on its holdings, Teoh said it is repositioning into financial stocks and firms that will benefit from growing investments into Malaysia.

“The government has stabilized the political situation and it’s attracting a lot of direct investment in the country,” said Teoh. “We are positioned for many” of these investment themes.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here