(Bloomberg) — The head of the second-largest US university endowment is pouring cold water on one of Wall Street’s hottest markets: private credit.

Most Read from Bloomberg

Rich Hall, who took over as chief executive officer of the University of Texas/Texas A&M Investment Management Company in July, said leverage in private credit makes it too risky to boost allocations, even as other endowments and pension funds have been funneling money into what’s now a $1.6 trillion global market.

“We just haven’t really found a great strategic reason for us to own a lot of private credit,” Hall said in an interview at the Austin headquarters of Utimco, as the fund is known.

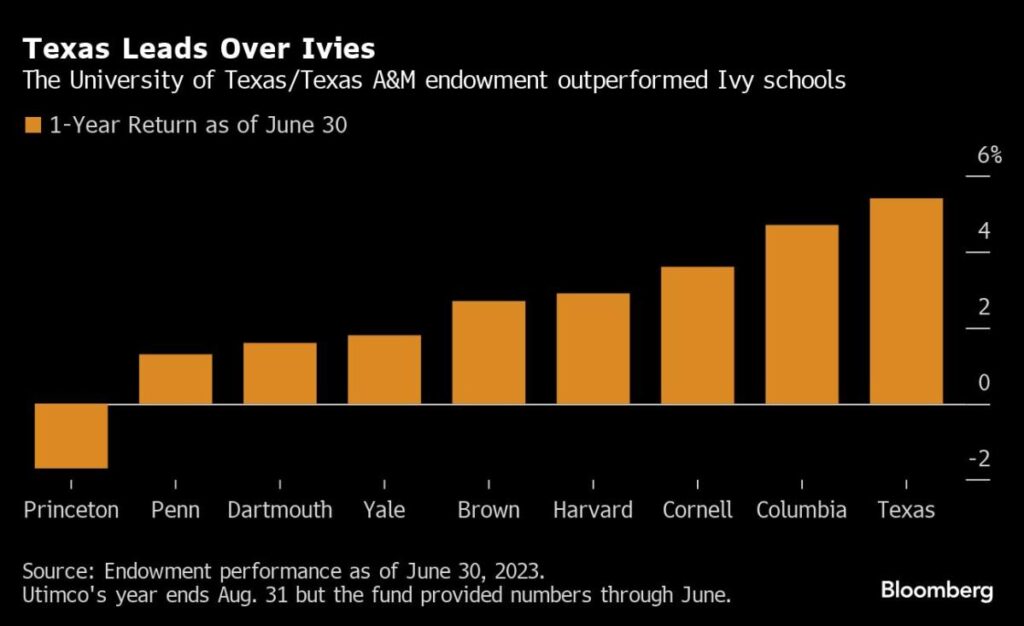

Hall led Utimco to a 5.4% return in the 12 months through June, when he served as chief investment officer, topping all eight Ivy League schools. That helped swell Utimco’s endowment to $55 billion. The University of Texas System portion of that endowment was $45 billion, trailing only Harvard’s $51 billion fund.

The money manager’s coolness toward private credit is a largely contrarian view as investors try to profit from banks pulling back on lending to some industries. The market has swelled from about $300 billion in 2010, according to data provider Preqin Ltd.

Goldman Sachs Group Inc. CEO David Solomon said last month that he expects “significant opportunity” for private credit growth, while BlackRock Inc. launched a private credit fund for retail investors in June. Earlier this year, Blackstone Inc. Chief Operating Officer Jonathan Gray said private credit is seeing a “golden moment.”

Read more: How Private Credit Gives Banks a Run for Their Money: QuickTake

Wall Street’s enthusiasm has also made it to pensions and endowments. The California Public Employees’ Retirement System, the largest public pension in the US, plans to reduce its stock portfolio and expand further into private credit. Illinois’ local police pension fund said it plans to bring private credit to about 5% of its holdings over the long term. And in June, Connecticut Treasurer Erick Russell approved $725 million in private-market commitments for state pensions.

Private credit makes up about 2.2% of Utimco’s portfolio, or $1.2 billion, the endowment said, with Fortress Investment Group the largest individual manager. That’s a decrease from a decade prior when private credit made up 4.5% of the fund.

For Hall, the risks of increasing Utimco’s exposure to private debt outweigh the potential upside.

Private credit managers often use leverage to amplify returns for their funds, meaning that they incur debt to finance a portion of their investments. Depending on the structure of the fund, that could expose investors to extra risks in the event of a downturn or if the amount of credit available to the fund is cut.

“You’re taking a leveraged return to try and get what is otherwise kind of a very vanilla credit return and juice it up a little bit more,” Hall said. “That adds more volatility.”

Hall isn’t alone in showing caution. Several prominent names in the asset management industry have expressed misgivings with the market.

Swiss Life’s investment arm and Scotland’s Baillie Gifford are avoiding the direct-lending craze in part because of transparency fears, a lack of liquidity and good returns elsewhere in the markets. And Abrdn Plc said that it won’t work with the riskier companies that make up much of the private credit market.

Hall is more positive on other alternative assets. At a June board meeting, Utimco directors approved changes to the endowment’s target allocations that included increasing private equity to 30% from 25% and reducing public equity exposure to 27% from 35%. The endowment’s largest private equity managers are ARCH Venture Partners and HarbourVest Partners.

–With assistance from Paula Seligson and Janet Lorin.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here