Key Takeaways

-

Human resources services provider Paychex beat first-quarter profit and sales forecasts Tuesday as it reported increasing its client base.

-

The company said it also benefited from “strong expense discipline.”

-

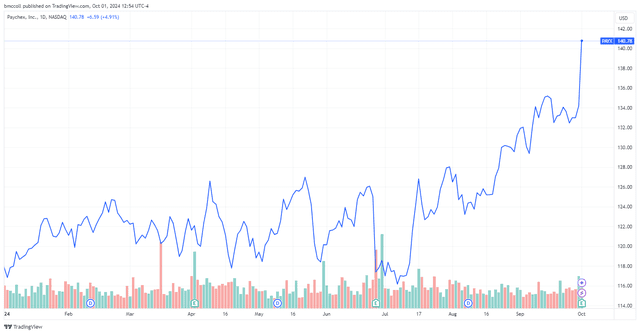

Paychex shares jumped to an all-time high after the earnings report.

Shares of Paychex (PAYX) sailed to an all-time high Tuesday when the human resources services provider posted better-than-anticipated results while reporting that it expanded its client base.

The company posted fiscal 2025 first-quarter earnings per share (EPS) of $1.18, with revenue rising 2.5% year-over-year to $1.32 billion. Both were above consensus estimates of analysts polled by Visible Alpha.

Sales at its Professional Employer Organization (PEO) and Insurance Solutions unit advanced 7.2% to $319.3 million, boosted by a gain in the number of average PEO worksite employees and higher insurance revenue. Management Solutions segment sales were up 0.6% to $961.7 million as the total clients served and product penetration increased, according to Paychex.

Shares surged 5% to $140.87 in recent trading after earlier hitting a record $141.59, making Paychex the top gainer among S&P 500 stocks for the day.

‘Strong Expense Discipline’ Cited for Quarter’s Gains

Chief Executive Officer (CEO) John Gibson said the solid performance in the latest quarter came even with the negative impact of the expiration of the Employee Retention Tax Credit (ERTC) program and one fewer payroll processing day. He added that “despite these headwinds,” the company delivered solid EPS growth “through strong expense discipline.”

Gibson also announced several new products that offer “digital and artificial intelligence (AI)-driven solutions” aimed at helping clients attract, retain, and engage their workforce.

Paychex shares are up more than 18% year-to-date.

Read the original article on Investopedia.

Read the full article here