- Nvidia stock surged over 3% to near-record highs on Monday as excitement builds for its Blackwell GPU.

- The Blackwell GPU’s pricing of about $500,000 has eased concerns about Nvidia’s margins.

- Bank of America said cloud hyperscalers are in an “AI arms race,” which should be a positive for Nvidia.

Nvidia stock jumped more than 3% on Monday to near-record highs as investor excitement around the chipmaker’s upcoming Blackwell GPU product cycle grows.

Shares of Nvidia hit an intra-day high of $139.41, less than 1% below the all-time high price of $140.76, which was reached in mid-June.

The stock is trading at a forward price-to-earnings multiple of about 35x, which is below its three-year and five-year averages, suggesting that the stock isn’t grossly overvalued, according to Citi.

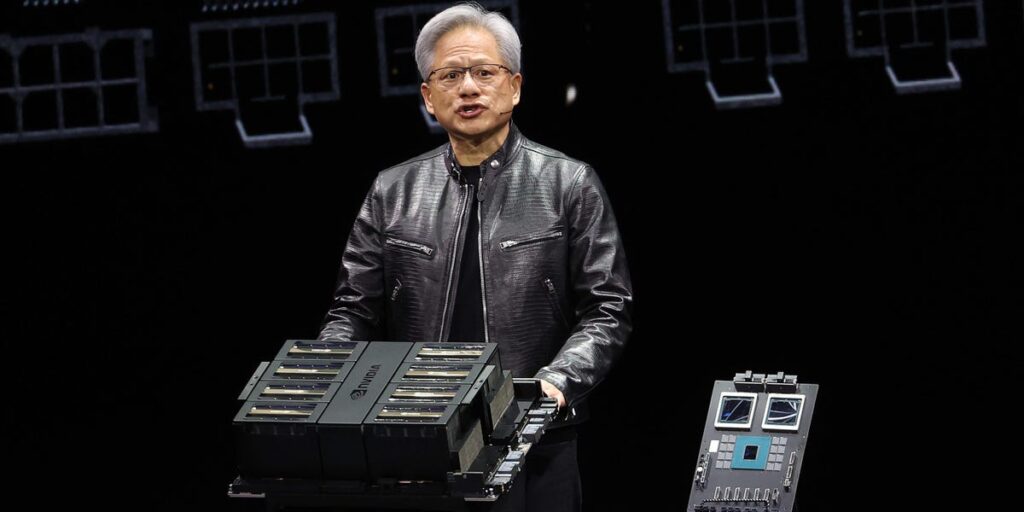

Monday’s gain came amid a wave of Wall Street research reports on Nvidia, along with pricing details for Nvidia’s next-generation GPU chip.

The initial list prices for Nvidia’s Blackwell GPU chip were around $500,000, which Wells Fargo called an “incremental positive” in a note on Monday.

“We do think the 40%+ higher pricing of the DGX B200 vs DGX H100 systems could be considered higher than expectations,” Wells Fargo analyst Aaron Rakers said, adding that the pricing should ease investor concerns about Nvidia’s gross margin dynamics.

The release of Nvidia’s next-generation AI-enabling GPU chip comes at a time when cloud hyperscalers, including Microsoft, Amazon, and Alphabet, are in an “AI arms race,” according to Bank of America.

“Capex estimates continued to rise: since March, for every $1 of upward revision in 2024 sales estimates for hyperscalers, there was $19 of upward revision in capex estimates,” Bank of America said in a Monday note.

In a note on Friday, Goldman Sachs increased its Nvidia price target to $150 from $135, arguing that the company’s competitive moat is only getting stronger.

Nvidia’s competitive moat is centered on its large installed base, “which, in turn, fuels the virtuous positive cycle that entails more developers,” Goldman Sachs said.

Additionally, Nvidia’s “ability to innovate not just at the chip level but at the data center level” is a competitive advantage for the company, along with its “robust and growing software offerings,” Goldman Sachs said.

And as for the potential looming competition from custom silicon chips being developed internally by Nvidia’s largest customers, known as ASICS, Citi isn’t too worried about them.

“Nvidia still king,” Citi said in its note on Monday.

“Due to the limitations in the hardware use cases, building custom silicon may be only suited for large hyperscalers. That nevertheless does not take away from the need for GPUs in both training and inference as GPUs remain at the forefront of performance benchmarks and offer the ability to grow one’s AI infrastructure at scale,” Citi said.

Investors will be closely watching Nvidia’s upcoming third-quarter earnings release in late November for clues about the progress of its Blackwell chip launch.

Read the full article here