Think of how Nvidia’s GeForce 8800 chip, launched in 2006, changed the gaming landscape. Now, almost two decades later, Nvidia is still making that progression, with its Blackwell designed to change the world of artificial intelligence.

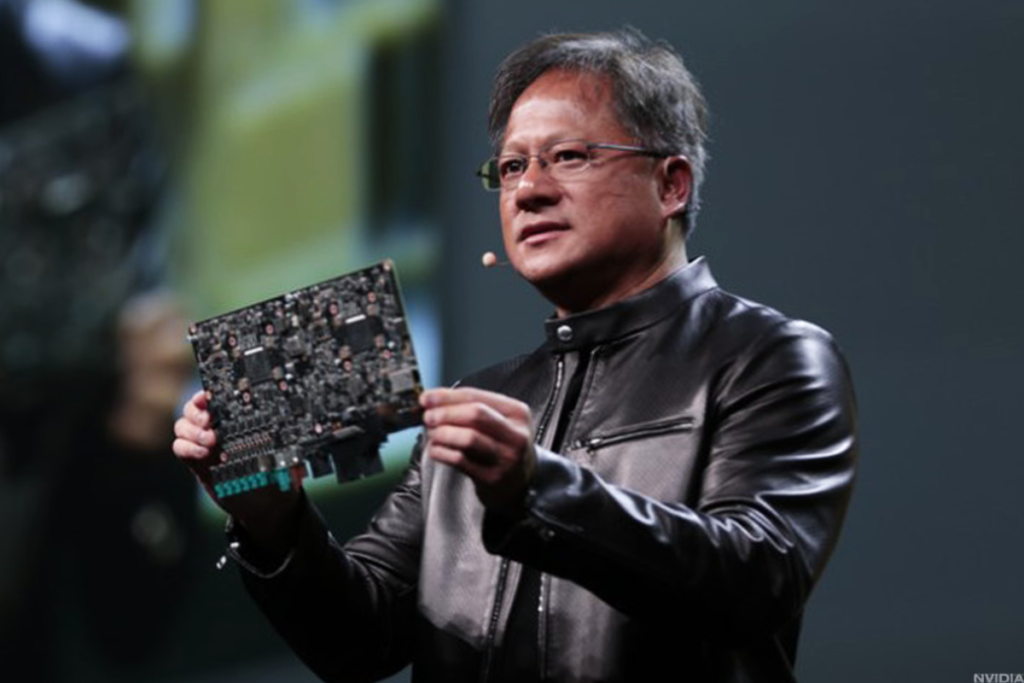

Demand is “insane,” Nvidia’s chief executive Jensen Huang recently said. Major cloud providers like AWS, Azure, and Google Cloud are integrating Blackwell into their infrastructure to support high-performance AI workloads.

Related: Nvidia CEO Jensen Huang just told investors what’s next for the AI chipmaker

Oracle announced on October 2 that it would need 131,072 Nvidia Blackwell GPUs as part of a $6.5 billion investment to establish a new public cloud region in Malaysia, another proof of a strong need for advanced AI processing capabilities.

Blackwell is a platform Nvidia launched in March that allows organizations to run real-time generative AI on models with trillions of parameters. These large language models are trained on extensive datasets to understand and generate responses in human language.

“Blackwell is in full production,” Huang said in an interview with CNBC. “The demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.”

Hyperscaler buyers like Amazon (AMZN) , Microsoft (MSFT) , and Alphabet (GOOGL) are expected to spend around $160 billion in 2024 on AI infrastructure, according to Bernstein analysts. The cost of Blackwell is expected to range between $30,000 and $40,000 per unit.

Huang emphasized the importance of continuous updates to Nvidia’s AI infrastructure, with the company releasing new platforms annually. “If we can increase the performance, like we’ve done for Hopper and Blackwell … we’re effectively increasing the revenue or throughput for our customers on these infrastructures by a couple to three times each year,” Huang added.

Nvidia’s financial performance exceeds expectations

Nvidia’s latest earnings report further solidifies its strong position in the AI market.

On August 28, the company posted earnings per share of 68 cents, beating Wall Street expectations of 64 cents. Revenue hit $30.04 billion, up 122%, surpassing the anticipated $28.7 billion.

Nvidia forecasts $32.5 billion in revenue for the current quarter, an 80% increase from last year.

Related: Veteran trader targets Nvidia as shares slide

Nvidia plans to ship Blackwell GPUs to clients in Q4 of this year, with a consumer release expected in 2025. “In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue,” Nvidia Chief Financial Officer Colette Kress said during the August earnings call.

Nvidia’s stock has surged by over 150% this year, following an impressive 240% gain in 2023. The company is now worth over $3 trillion, one of the most valuable companies in the world just behind Apple and Microsoft.

Analyst sees “compelling” growth and valuation for Nvidia

JPMorgan remains confident in Nvidia’s outlook, maintaining an overweight rating and a $155 price target, thefly.com reported.

“Nvidia remains on track to ship its next-generation Blackwell graphic processing unit platform in high volume production in Q4,” the analyst tells investors in a research note on October 2, adding that investors do not have to pay too much attention to the recent sell-side noise on rackscale portfolio changes.

Nvidia is halting development of its dual-rack 72-way GB200-based NVL36×2, TF International Securities’s analyst Ming-Chi Kuo said on Oct. 1.

Last month, Bank of America reiterated a buy rating and $165 price target on Nvidia, which the firm also calls its top sector pick.

The firm warned of several near-term headwinds, including Blackwell’s delay and gross margin pressure, a potential DOJ probe, competition, AI monetization, cloud capex, weak seasonality, and the U.S. elections.

More AI Stocks:

However, this could also create a buying opportunity. The stock is trading within the lowest quartile of valuation in the past five years, the analyst said.

The firm highlights Nvidia’s “compelling growth” and says upcoming supply chain updates in the next few weeks will confirm Blackwell product shipments, which they see as the main factor for a recovery.

Related: The 10 best investing books, according to our stock market pros

Read the full article here