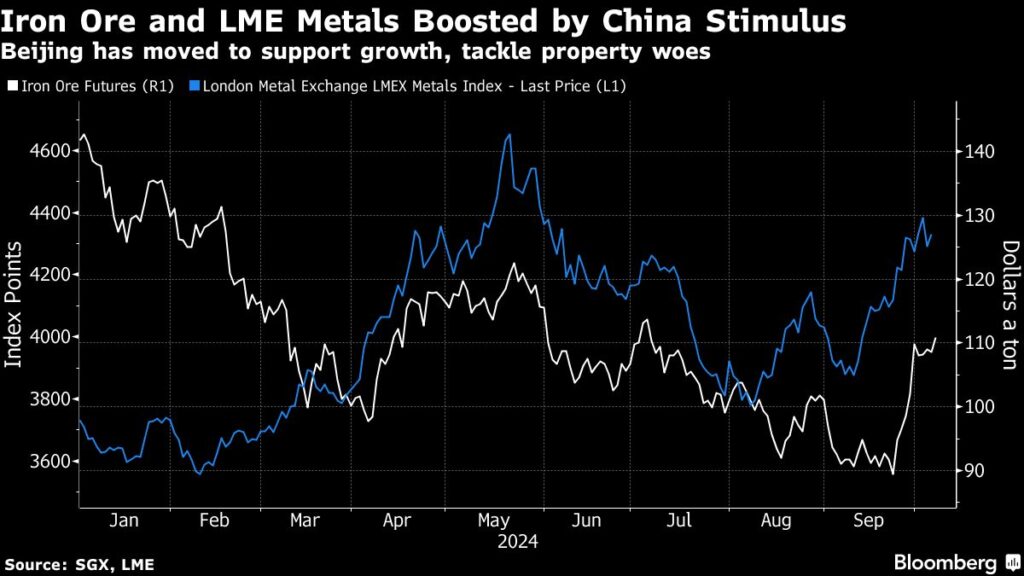

(Bloomberg) — China’s largest stimulus package in years has given commodities a shot in the arm. The reopening of mainland markets on Tuesday will provide a sense of whether the rally has room to run.

Most Read from Bloomberg

Iron ore, copper and zinc have all managed to retain or add to their price gains over China’s week-long holiday, with Beijing’s focus on measures to revive the property market, plus the unusual pace and intensity of announcements, buoying sentiment.

Until now, Beijing has struggled to jumpstart an economy that hasn’t fired on all cylinders since before the pandemic, in large part because of its only limited and piecemeal efforts. The flurry of measures since the end of September marks a recognition that more heft is required, prompting a spectacular stock market rally.

Chinese industrial delegates to LME Week, a major metals conference in London, were optimistic that this could be the long-awaited turning point for the world’s largest importer of raw materials. But not every corner of the commodities complex has been as exuberant, and some analysts have already cautioned it’s too soon for a victory lap.

“Commodities have benefited from the support measures that continue to come through,” said Warren Patterson, head of commodities strategy at ING Groep NV. However, “we need to see property prices stabilize and we also need to see excess housing inventory return to more normal levels, before getting really optimistic.”

Chinese authorities delivered a triple dose of support late last month: the central bank unveiled a broad package of monetary stimulus; the Politburo vowed to steady the housing market and provide sufficient fiscal spending; and then leading urban centers eased property curbs.

An announcement over the weekend that the National Development and Reform Commission, China’s top economic planner, will hold a briefing on Tuesday morning has the market hoping for more.

“It’s not even what they have already announced,” said Saad Rahim, chief economist at Trafigura Group. “But I think it’s the intent as well to say ‘we can do another batch, and another batch after that’,” he told Bloomberg TV last week.

Taken together, the measures could total 5 trillion yuan ($712 billion), Rahim said. “This is large enough to move the needle.”

Iron ore has been the standout, surging by almost a quarter over the past two weeks, with industrial metals like copper and aluminum also doing well. The share prices of global mining majors — including BHP Group Ltd. and Rio Tinto Plc — have been caught up in the optimism.

Housing Inventory

Despite the upswing, there are still plenty of concerns that Beijing will need to act even more forcefully if it’s to snap the economy out of its deflationary funk — and restore China to its status as the growth engine for major commodities.

“Most Chinese people’s assets are in housing, and that has dropped so significantly, that’s holding back their consumption,” Linda Yueh, adjunct professor of economics at the London Business School, told a seminar at LME Week. One of the things that China needs, more than an equity-market recovery, is to resolve property sector issues, she said.

China’s housing inventory is at 43 million units, plus a further 8 million under construction, Morgan Stanley analysts including Chetan Ahya said in a note. But with sales of only 8 million a year, lifting prices and reviving demand will be challenging, they said.

There’s also the limited scope of the impact of the measures outside metals — another note of caution for bulls and for those looking for evidence that changes at the top are trickling down. There would need to be more measures that increased disposable incomes to have an impact on foodstuffs and agriculture, according to Zhang Zhidong, head of agricultural research at Guolian Futures. In oil, traders have been taking most of their cues from the combustible situation in the Middle East.

–With assistance from Weilun Soon, Sarah Chen and Hallie Gu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here