Wall Street soared Friday on news that employers are still hiring in strong numbers, recovering from slumps caused by fears that escalating Middle East tensions could impact global energy supply.

-

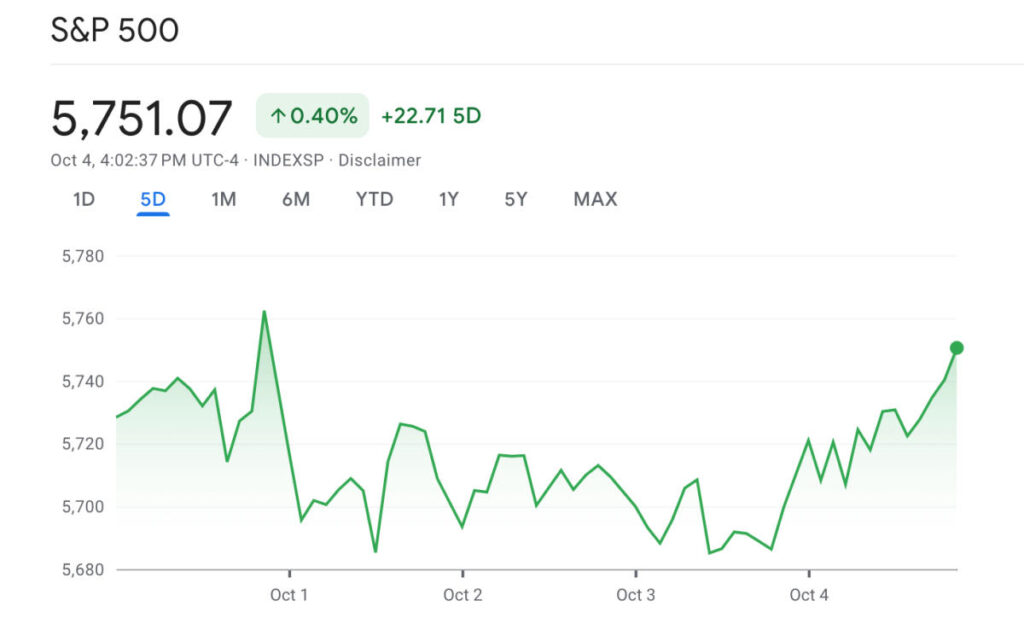

S&P 500: 5,751.07 ⬆️ up 0.90%

-

Nasdaq Composite: 18,137.85 ⬆️ up 1.22%

-

Dow Jones Industrial Average: 42,352.75 ⬆️ up 0.81%

-

STOXX Europe 600: 518.56 ⬆️ up 0.44%

-

Hang Seng Index: 22,736.87 ⬆️ up 2.82%

-

Nikkei 225: 38,635.62 ⬆️ up 0.22%

-

Bitcoin: $62,336.70 ⬆️ up 2.62%

U.S.: Wall Street gains on stellar jobs report

U.S. employers added 254,000 jobs in September, surpassing estimates and signaling continued economic strength. The S&P 500 closed up 0.90%, and the Dow neared its record, up 0.81%. Meanwhile, the tech-heavy Nasdaq climbed 1.22% with big gains for Nvidia, Broadcom, and Advanced Micro Devices.

The news erased losses from earlier in the week, as the S&P 500 finished with a 0.22% weekly gain, while the Dow added 0.09%, and the Nasdaq ticked up 0.1%.

Europe: U.S. jobs report lifts markets abroad

Europe markets were mixed in early trading but gained on the U.S. jobs report. The STOXX Europe 600 closed up 0.44%, and the U.K.’s FTSE 100 made up for losses early in the day, hovering near its Thursday close.

China: Hong Kong rally resumes after holiday

Hong Kong shares resumed their rally on the back of China’s stimulus measures, jumping 2.82% after traders took profits following a three-week rise of some 30%.

Japan: Markets end week near where they started

The Nikkei 225 ended a yo-yo week with a slight 0.22% gain after new Prime Minister Shigeru Ishiba outlined his economic agenda, which includes above-inflation pay raises and assistance for low-income households.

This story was originally featured on Fortune.com

Read the full article here