(Bloomberg) — Japanese stocks were poised for a lift early Tuesday following a tepid US session as Federal Reserve Chair Jerome Powell made fresh comments signaling no urgency for further interest-rate cuts.

Most Read from Bloomberg

Nikkei 225 futures pointed to gains of about 0.7%, a day after the benchmark slumped almost 5% following the ruling party’s leadership race. Sydney shares were set to slip lower, while China and Hong Kong will be closed for holidays. US equity futures dipped in early trading after the S&P 500 gained 0.4% Monday.

Treasuries extended declines, pushing short-term yields higher, after Powell’s cautious stance in saying the Fed will lower interest rates “over time”, while re-emphasizing that the overall economy remains on solid footing in a speech in Nashville. Emerging-market stocks ended the day lower as the Powell comments weighed on sentiment.

In Japan, traders are seeking to shrug off weeks of political insecurity, with Shigeru Ishiba’s victory over Sanae Takaichi wrongfooting investors betting on more monetary stimulus from his rival. A call by the new leader for a national election in a bid to consolidate his rise was broadly welcomed.

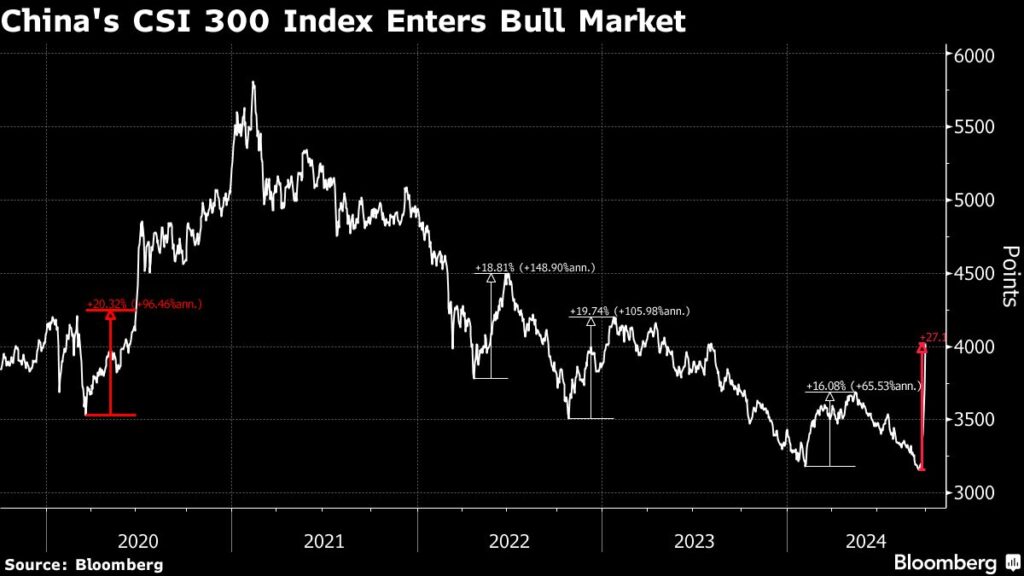

China’s benchmark index, meanwhile, posted the biggest gain since 2008 on Monday. The leap came after three of its largest cities relaxed rules for homebuyers, while the central bank also moved to lower mortgage rates as part of a sweeping stimulus package.

Markets were also bracing for any impact from news that Israel had begun “targeted ground raids” in Lebanon. Oil made slight gains in early trading after a choppy Monday as investors assessed the risks of a wider conflict in the Middle East.

In the US, the S&P 500 secured its fourth-consecutive quarter of gains — the longest such winning stretch since 2021. The tech-heavy Nasdaq 100 notched a similar run.

“The bull market has survived the year’s historically weakest quarter, the third quarter, and it is likely to remain intact through at least the end of the year, as earnings remain strong, interest rates are moving lower and consumers are still spending,” said Emily Bowersock Hill at Bowersock Capital Partners.

“We expect the fourth quarter to be quite similar to the third quarter – elevated volatility, but with a strong finish,” she added.

US bond yields were higher, led by the policy-sensitive two-year note which traded around 3.64% after Powell said the US didn’t have the data yet to make a call on the November meeting.

Still, Treasury debt returned 1.4% this month this month through Friday, as measured by the Bloomberg US Treasury Total Return Index. If the advance holds it will be the market’s longest streak of monthly gains since 2010.

Powell was “a tiny bit hawkish at the margin, but the Fed still has a lot of cutting to do,” according to Vital Knowledge’s Adam Crisafulli. The Fed Chair’s remarks seemed to suggest markets should think about a half-point cut instead of three-quarters of a point for the rest of the year, he added.

Swaps traders reined in their rate cut bets which had traded closer to a three-quarter point move before the US open.

While gauging the outlook for Fed rate cuts, investors must contend with a cocktail of risks, including rising tensions in the Middle East and a looming dockworkers’ strike in critical US ports Tuesday.

Chicago Fed President Austan Goolsbee voiced his concerns about a supply shock if a strike drags on. “That’s going to raise the cost of doing business and lead to shortages,” he told Fox Business.

Corporate Highlights

-

Verizon Communications Inc., the biggest wireless carrier in the US, has agreed to sell thousands of mobile phone towers to digital infrastructure firm Vertical Bridge.

-

DirecTV and Dish have agreed to combine in a deal that will create the biggest pay-TV provider in the US.

-

REA Group Ltd. walked away from its pursuit of Rightmove Plc after being repeatedly rejected by the UK property portal.

Key events this week:

-

Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Richmond Fed President Thomas Barkin and Boston Fed President Susan Collins attend conference on Tuesday

-

ECB policy makers speaking at various locations include Olli Rehn, Luis de Guindos, Isabel Schnabel and Joachim Nagel on Tuesday

-

BOE chief economist Huw Pill speaks at Confederation of British Industry economic growth board on Tuesday

-

Bank of Japan issues summary of opinions for September on Tuesday

-

South Korea CPI, S&P Global Manufacturing PMI on Wednesday

-

Fed speakers include Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

-

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

-

Nikkei 225 futures rose 0.7% as of 8:51 a.m. Tokyo time

-

S&P/ASX 200 futures fell 0.4%

-

Hang Seng futures fell 2.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1141

-

The Japanese yen was little changed at 143.58 per dollar

-

The offshore yuan was little changed at 7.0056 per dollar

Cryptocurrencies

-

Bitcoin fell 0.9% to $63,185.13

-

Ether fell 0.7% to $2,597.50

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here