Nike (NYSE: NKE) is a bit out of shape these days. The leading sports company’s sales growth has stagnated due to some strategic missteps, and that has weighed on its share price. Nike stock recently traded under $85, putting it more than 30% below its 52-week high.

Here’s a look at whether investors should pick up the shoe stock while it’s in the discount bin.

A tough year, but signs of optimism

Nike is coming off a tough year. The company reported its fiscal 2024 results at the end of June. Full-year sales were $51.4 billion, a mere $200 million increase from fiscal 2023. Meanwhile, sales fell 2% in its fiscal fourth quarter. The company battled a barrage of headwinds, including innovation and inventory issues, which opened the door for competitors like Hoka and On Holdings to grab market share.

Nike has been working to turn things around. It’s investing heavily in product innovation to better compete against upstarts like Hoka and On. The company and its retail partners believe these new products could reignite sales growth. However, that could take some time, with Nike projecting that its sales could decline by a mid-single-digit rate in fiscal 2025.

On a more positive note, while Nike’s sales are still under pressure, the company’s earnings are heading in the right direction. Initiatives to improve pricing and lower costs helped drive a 12% increase in its net income last year to $5.7 billion (its income jumped 45% in the fourth quarter to $1.5 billion).

A relative bargain

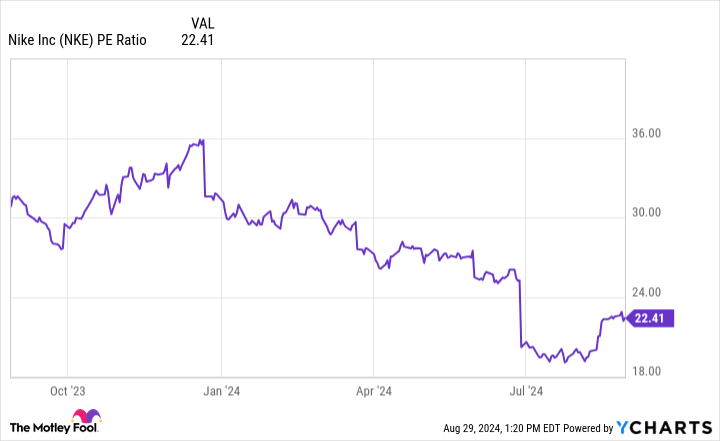

Nike’s improving earnings pushed them up to $3.73 per share last year, or $3.95 per share after adjusting for the impact of some restructuring charges. With its earnings up and its share price down, Nike is trading at a much more attractive valuation these days:

Nike is now trading at a discount to the broader market. The S&P 500 currently trades at 24.5 times earnings, while the Nasdaq-100 index sells for 32 times earnings. Nike’s lower valuation has it trading at a higher dividend yield of 1.8% compared to 1.3% for the S&P 500 and 0.8% for the Nasdaq.

Analysts believe Nike should trade at a premium to the market, given its premium brand and long-term track record. For example, Morningstar has a fair value estimate of $129 per share, marked down from its prior view due to Nike’s expected sales decline in fiscal 2025. On the one hand, that estimate is higher than most analysts’ price targets (the consensus price target for Nike is $91.50 a share). However, Nike still sells at a discount to the price point most analysts believe it should trade.

Nike is capitalizing on the decline in its share price by repurchasing stock. The company bought back 11 million shares for $1 billion in the fourth quarter and 41.4 million shares for $4.4 billion last year. Those repurchases are part of its $18 billion, four-year program approved in June 2022. With its stock price falling, Nike can buy back more shares with the money allocated for buybacks. That’s accelerating the reduction in its outstanding shares, which are now down over 4% in the last two years.

The company has ample cash resources to continue buying back its stock and paying dividends. Nike ended its fiscal year with $11.6 billion in cash on its balance sheet, a $900 million increase from the prior fiscal year, even after repurchasing shares, paying dividends, and investing in capital projects. Nike has also continued increasing its dividend. It raised its payout by 9% last November, extending its dividend growth streak to 22 straight years.

A compelling buy below $85

Nike is working hard to get back to its winning ways. There are some signs that the tide is turning, which bodes well for its future. In the meantime, Nike trades at a discounted valuation. It looks like a bargain buy right now.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.

Is Nike Stock a Buy Below $85 a Share? was originally published by The Motley Fool

Read the full article here