-

Traders are piling into deep out-of-the-money call options for GameStop ahead of its earnings.

-

The trading activity suggests investor appetite for meme stocks could once again be perking up.

-

The $20 call option for GameStop expiring December 8 had open interest of more than 15,000 contracts.

Traders are piling into deep out-of-the-money call options for GameStop stock ahead of the retailer’s upcoming third-quarter earnings report, suggesting that investor appetite for meme stocks could be perking up again.

Call option contracts tied to GameStop expiring on December 8 with a $20 strike price saw a surge in trading volume in recent days, with the contracts having open interest of more than 15,000 contracts as of Wednesday morning.

More than 4,000 of these specific contracts traded hands in the first 30 minutes of Wednesday’s trading session.

Traders buying these call options are betting that GameStop’s stock price will surge about 28% from current levels to above $20 before December 8. The options will expire worthless if GameStop stock is trading below $20 by December 8.

GameStop is scheduled to report its earnings results after the market close on December 6, meaning that traders are pinning their hopes on the company’s earnings results to jolt the stock price higher.

GameStop stock has experienced a surge this week. Shares jumped 17% on Wednesday, and were up 13% on Tuesday, bringing its two-day gain to 32%.

Trading activity in the $20 call options has been driven by small block trades, according to Bloomberg, which suggests that a lot of the buying could be driven by retail investors rather than institutions.

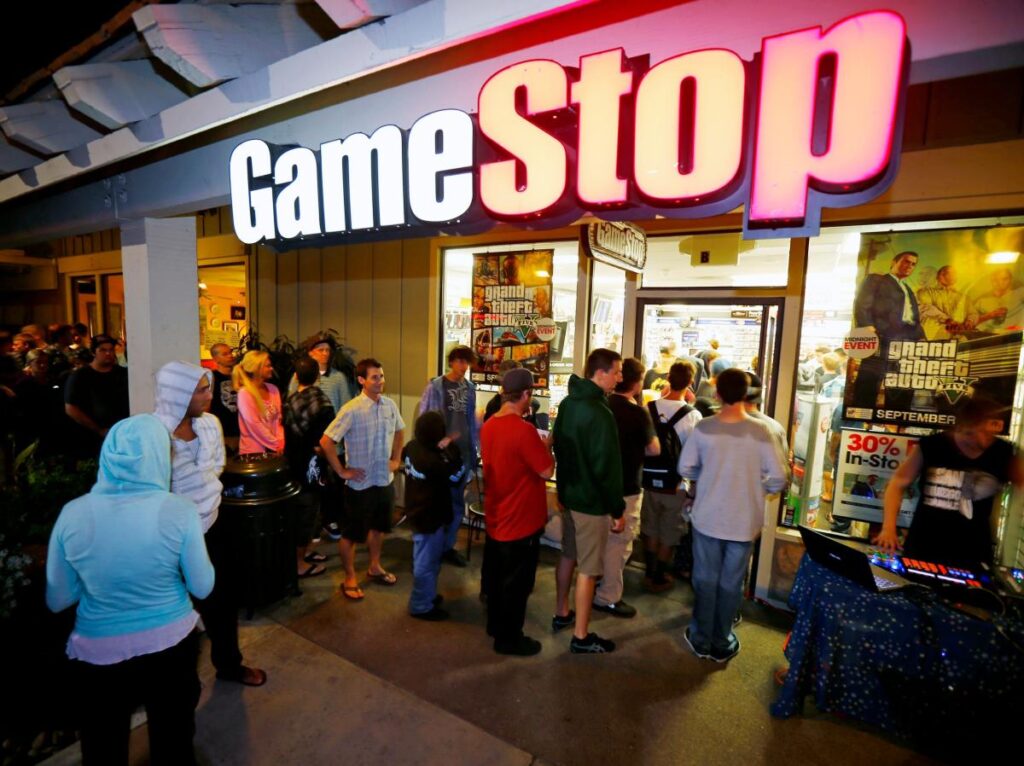

GameStop has long been considered the original meme stock that set off a flurry of market activity in early 2021, as retail investors piled into the stock market amid the COVID-19 pandemic.

Since GameStop peaked at a split-adjusted high of $120.75 in January 2021, the stock has declined 87%. Investors are pinning their bullish GameStop hopes on a turnaround effort led by its current Chairman and CEO, Ryan Cohen.

Whether GameStop continues its recent surge or not, the stock is likely to see continued volatility in either direction as it gears up to release earnings. A calculation of GameStop’s December 8 at-the-money options contracts shows an implied 26% move to the upside or downside for the stock price ahead of the company’s earnings report, based on Wednesday morning option prices.

Read the original article on Business Insider

Read the full article here