(Bloomberg) — Betting on some of the world’s riskiest countries has paid off for a first-year hedge fund.

Most Read from Bloomberg

With oversized investments in bonds from war-ravaged Ukraine, debt-ridden Pakistan and defaulted Sri Lanka, Shiprock Capital Management earned a 26% return as of November, according to a letter viewed by Bloomberg. That’s almost nine times the average for emerging-market hedge funds tracked by Bloomberg.

The $187 million London startup says the secret behind its results this year is a focus on recovery from short-term geopolitical and economic disruptions. The result, according to co-founder and chief investment officer Andrey Pavlichenkov, is a portfolio that constantly pulls back to cash and creates more firepower to deploy in similar circumstances.

“We try to concentrate on immediate triggers as opposed to fundamental values that may take years to realize,” Pavlichenkov said. “We have actively positioned the portfolio in either very short-dated bonds or in special situations with near-term catalysts.”

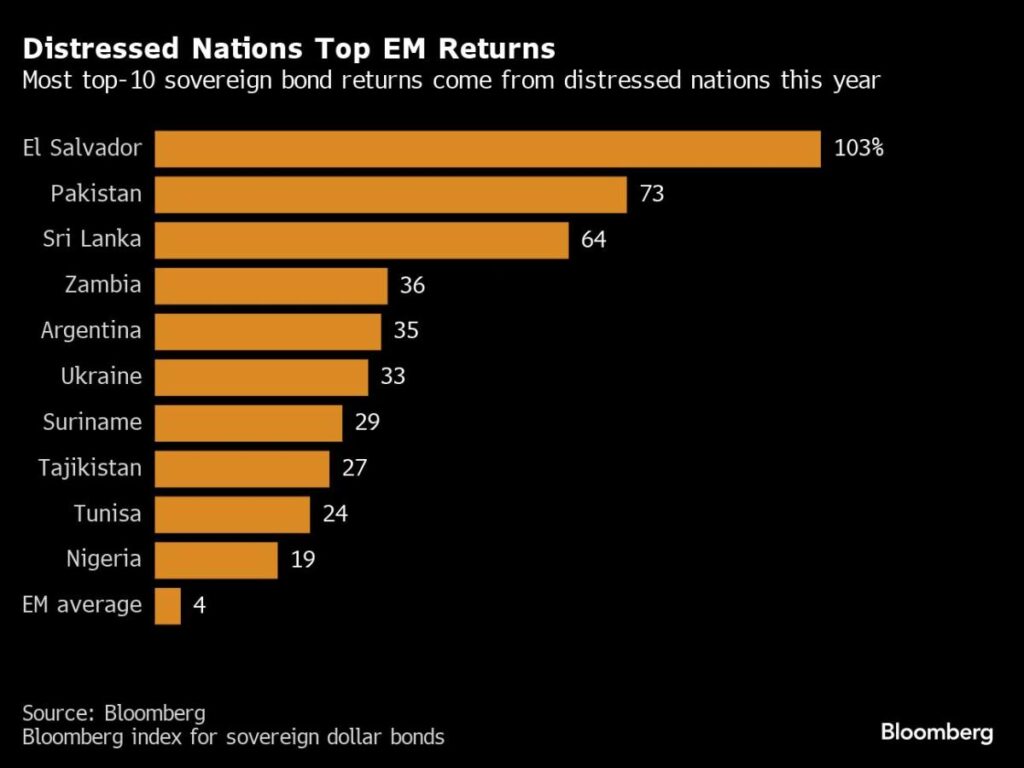

Coming off of the Covid-19 pandemic and Russia’s invasion of Ukraine, 2023 has been a good year for that strategy, with all 10 of the best-performing bonds in developing markets hailing from distressed nations or nations that recently emerged from distress. Bonds that yield at least 10 percentage points more than US Treasuries are commonly considered to be in distress.

“We had a double shock last year: the increase in interest rates and the inflationary shock exacerbated by the Russia-Ukraine war,” he said. “This has unsettled the markets, bringing lots of credit into distress and giving us a lot of options to choose from.”

El Salvador alone generated a 103% return after it won over investors with dollar-bond buybacks. It’s followed by Pakistan, Asia’s biggest recipient of loans from the International Monetary Fund. Defaulted bonds of Sri Lanka and Zambia have advanced on expectations that the restructuring process should be concluded soon, returning more to investors than some worst-case expectations.

Overall, the lowest-rated emerging-market borrowers are heading for their best performance since 2016, a major turnaround after they suffered large losses last year when the war in Ukraine, and spikes in inflation and interest rates, drove a record number of nations into distress. In November alone, the dollar debt of Argentina, Pakistan, Tunisia and Egypt each has handed investors total returns of 10% or more.

Since Ukraine was invaded in February 2022, almost 20 countries have fallen into distress and others including Sri Lanka and Ghana have defaulted. Ethiopia also said this month that it would suspend debt payments and restructure its $1 billion eurobond.

A British citizen born in Russia, Pavlichenkov was previously a senior portfolio manager for emerging-market distressed debt at VR Capital Group, and before that an analyst at Credit Agricole in Moscow. His co-founder is Simon Milledge, who spent 11 years at GML Capital, a hedge fund specialized in emerging-market distressed, special situation and high-yield credit.

Of the 444 emerging-market fixed-income funds tracked by Bloomberg, only five have managed to match Shiprock in generating returns above 20% in dollar terms, according to data compiled by Bloomberg. The average return for emerging-market debt-focused hedge funds this year was 2.95% as of Oct. 31, the data show.

Pavlivhenkov declined to comment on what he’s purchasing now. In the letter dated Nov. 13, he said the fund had lost money on Argentina and Kazakhstan in October and added to positions in Ghana after the government gave an investor update guiding international bondholders to 30% to 40% haircuts.

“We have seen this tactic from Ghana’s adviser quite a few times in past sovereign restructurings, so we took the opportunity to add to our Ghana positions during this price weakness,” the letter said. The fund reported its largest exposure by region in Europe, followed by Latin America, Asia and Africa.

(Adds November bond performances in eighth paragraph)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here