(Bloomberg) — South Korea has ticked every box in an attempt to get its bonds included in a major FTSE Russell index, while India has steered clear of public overhauls — but the latter’s popularity with global investors may give it an edge to join a related benchmark.

Most Read from Bloomberg

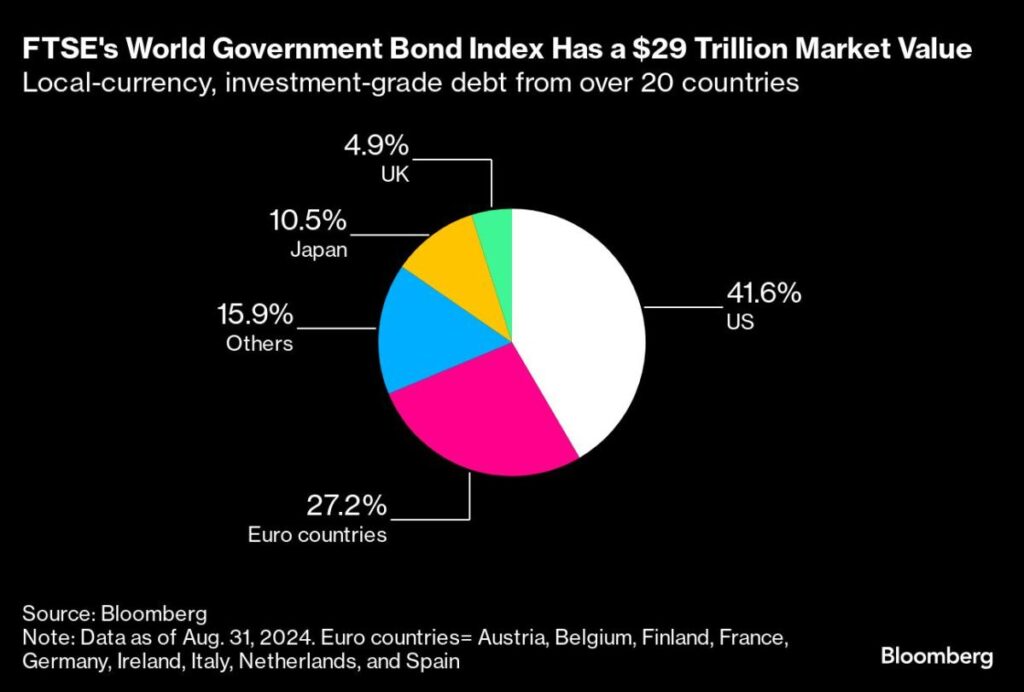

FTSE Russell will on Oct. 8 announce any inclusions into benchmarks including its World Government Bond Index, which tracks $29 trillion of global fixed income. Seoul hopes it finally made the cut after overhauling currency and debt-market operations. At the same time, India has already joined a flagship JPMorgan Chase & Co. gauge despite being a reform laggard, and may get into FTSE Russell’s $4.6 trillion emerging-market bond index this time around.

Vietnam too is in focus, as its stock market is eligible for promotion to emerging status from frontier.

It’s a propitious time to get access to the big investors attracted by such status. Global funds are piling back into up-and-coming economies after years of losses, as US borrowing costs come down, thanks to Federal Reserve interest-rate cuts which have prompted investors to seek better returns overseas. India’s JPMorgan index-eligible bonds have attracted $14 billion of inflows this year through the end of August.

“The current environment is indeed favorable for EM bonds, with many investors seeking higher yields and diversification,” said Althea Spinozzi, head of fixed income research at Saxo Bank AS in Hellerup, Denmark. “Index inclusions tend to attract substantial capital inflows, as global investors who track these benchmarks adjust their portfolios.”

South Korea’s government expects accession to the WGBI to draw as much as 90 trillion won ($68 billion) of inflows. That would be a welcome source of fresh funds, especially given that the rapidly aging country is forecast to step up public borrowing next year.

And South Korea at first glance seems like a top contender to get in, after multiple attempts stretching back more than a decade. Since being added to a watchlist for inclusion in the WGBI two years ago, Seoul has extended trading hours for the won and set up a system with Euroclear so foreign investors don’t have to open accounts with local banks. Korea says it has met all conditions for index entry.

However, there were just 26 transactions in the country’s bonds via Euroclear from July 1 to Aug. 28. Goldman Sachs Group Inc. strategists say such thin volumes mean inclusion is likely to be delayed until 2025, and Morgan Stanley also sees inclusion occurring next year.

Even if Korea doesn’t make the cut this year, “I do expect the language to sound a bit more positive at the review given the efforts made to improve access to both bonds and FX,” said Low Guan Yi, Asia head of fixed income at M&G investments in Singapore.

India’s Situation

India, on the other hand, hasn’t set up an arrangement with Euroclear at all. At its last assessment in March, FTSE Russell cited India for a difficult registration process for foreign investors, along with the amount of time it takes to settle trades and taxation.

Still, that didn’t stop JPMorgan from including Indian government bonds in its own closely followed emerging-market bond index in June. The country benefited from demand for vehicles to invest in major emerging markets, after Russia was excluded due to its invasion of Ukraine.

India’s capital markets regulator said last month it’s working to streamline the registration process for foreign investors buying sovereign debt.

On the equities front, Vietnam is likely to get an upgrade to emerging market from frontier only next year, analysts say. A new rule canceling the requirement that overseas investors fully pre-fund equity trades — considered a major sticking point — takes effect only on Nov. 2.

“The demand is there for emerging-market local debt and equities as well,” said Jon Harrison, managing director for EM macro strategy at TS Lombard in London. “Lower global yields will help to encourage investors.”

Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which administers indexes that compete with those from other providers.

–With assistance from John Cheng and Subhadip Sircar.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here