(Bloomberg) — Emerging-market stocks slumped after China fell short of unveiling additional major stimulus at a closely monitored press conference, raising doubts about the sustainability of a recent rally.

Most Read from Bloomberg

The MSCI Inc. gauge for developing-nation equities was down 2.3% as of 12:45 p.m. in New York Tuesday, its biggest intraday decline in two months. Asian companies underperformed and a subindex for Latin America stocks fell for a second session.

Officials at China’s economic planning agency National Development and Reform Commission said they are confident in reaching economic targets this year, but failed to announce new fiscal spending.

“The NDRC press conference was a big disappointment versus expectations,” said Ashish Chugh, a portfolio manager and head of global emerging-market equities at Loomis, Sayles & Co., who expects China stocks to keep selling off. “We continue to prefer Indian equities.”

Currencies fell for a sixth session, with the Chilean peso lagging all regional peers after data showed inflation in Chile rose less than forecast last month. The country’s central bank is expected to cut interest rates next week.

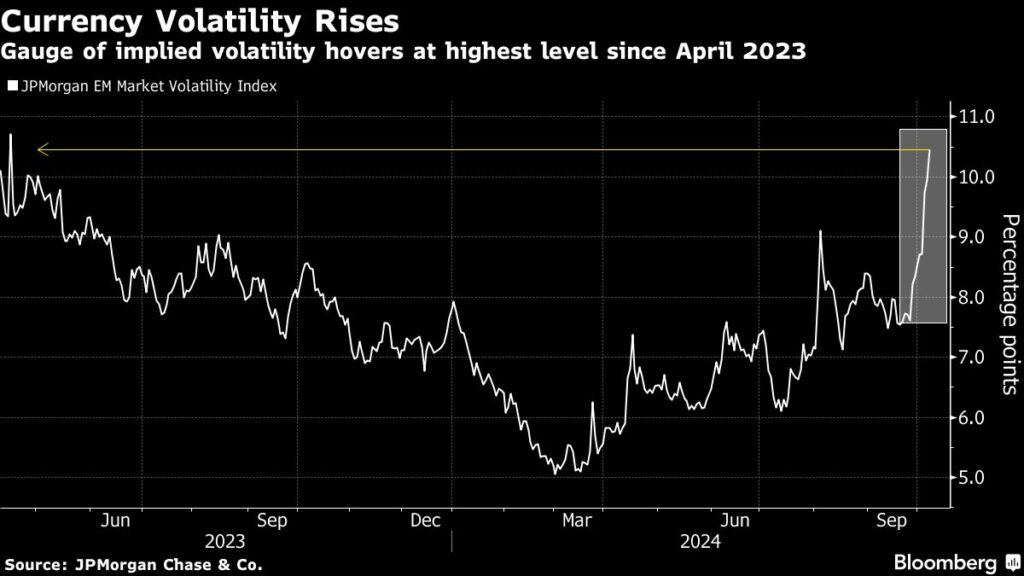

The currency moves come amid an increase in volatility, with the US presidential election starting to give emerging-market investors the jitters. One-month implied volatility in developing-nation currencies, derived from options prices, has climbed for eight successive days as it now incorporates the post-vote period, according to a JPMorgan Chase & Co. index.

That’s the longest streak since January 2019, highlighting a degree of nervousness among traders ahead of the November vote.

The candidates — former President Donald Trump and current Vice President Kamala Harris — are expected to impact emerging-market assets differently.

A Harris presidency would likely result in policy continuity, limiting potential market volatility, which could support risk assets and likely trigger a relief rally, strategists at UBS Group AG wrote in a note to clients. Conversely, a Trump victory would probably be more disruptive as investors reassess risks tied to his trade policies as well as geopolitics, potentially causing additional further volatility in developing-nation currencies.

The election uncertainty comes after these currencies capped a three-month rally spurred by a dovish Federal Reserve and the weakening dollar. The recent strength in the US labor market dampens the likelihood of another big interest-rate cut, and fears of more expansive fiscal policy following the US election — as well as the potential for borrowing costs to stay higher for longer — are spooking investors.

JPMorgan’s measure of future currency volatility rose above 10 percentage points on Monday, its highest level since April 2023. It widened its gap over a similar gauge of currency turbulence in the Group of Seven advanced nations to the most since early June.

“We believe this is due to the uncertainties regarding US elections, with hedges being put on and volatility being bid up,” said Phoenix Kalen, head of emerging-markets research at Societe Generale SA’s London Branch.

–With assistance from Peter Laca.

(Updates with daily moves throughout. A previous version corrected second-to-last paragraph to say the metric touched the highest level since April 2023.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here