(Bloomberg) — S&P Global Ratings is weighing downgrading Boeing Co.’s credit score to junk as the company continues to suffer from the fallout of a protracted labor strike.

Most Read from Bloomberg

The credit grader estimates that the planemaker will incur a cash outflow of approximately $10 billion in 2024, due in part to costs associated with the strike. The company is also likely to need additional funding to meet its day-to-day cash needs and finance debt maturities, according to a statement Tuesday.

Junk rated companies usually face higher borrowing costs than their investment-grade counterparts. Boeing has $4 billion of debt coming due in 2025 and also $8 billion coming due in 2026, Moody’s Ratings said last month.

Even one downgrade can boost a company’s borrowing costs, but two or more often make it ineligible for inclusion in the biggest high-grade corporate bond indexes, forcing many investors to sell their bonds, and often dramatically boosting a company’s future funding expenses.

Financial Pressure

Boeing Co. has been under growing financial pressure since early 2024, when a hole blew into the side of an airborne 737 Max 9 forced the company to slow down production in order to improve its manufacturing practices. As a result, Boeing is making fewer of its 737 Max aircraft that are the company’s biggest cash generator.

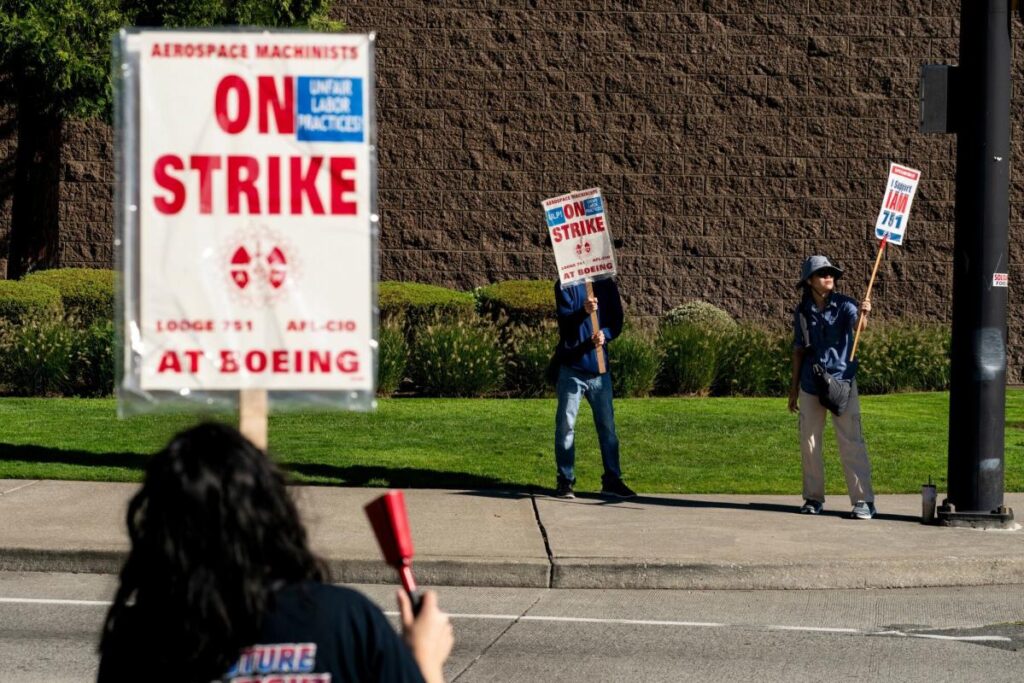

The pressure has gotten worse still in recent weeks after workers of its biggest union went on strike. That’s ground production of the 737 aircraft to a halt, with no clarity on when the two sides will find a compromise. Boeing is losing an estimated $100 million in sales each day that the strike continues, and workers are demanding significantly higher pay.

If the strike continues toward the end of the year, a credit rating downgrade is more likely, according to S&P. S&P currently rates the company at BBB-, the lowest investment-grade level.

(Updates with information from S&P’s statement from second paragraph. An earlier version of this story corrected the name of the ratings firm in first paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here