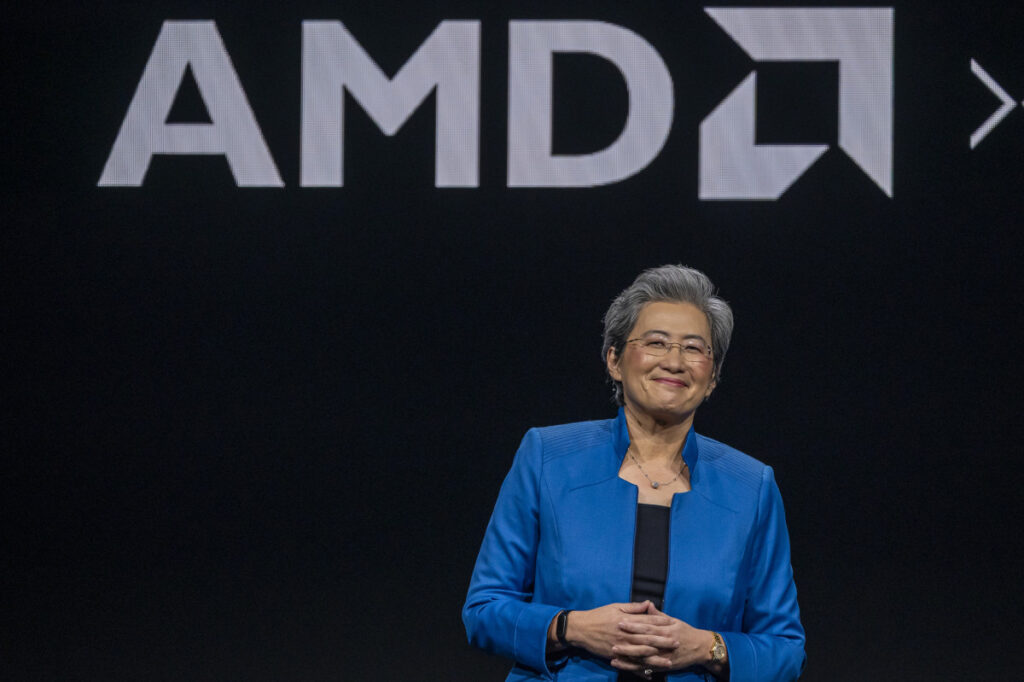

TheStreet/Shutterstock/David Becker/Stringer/Getty Images

AMD CEO sees AI arc over the next 5 years

“I think you have to look at this technology arc for AI over the next five years, and how does it fundamentally change everything that we do?” she said. “And I really believe that AI has that potential.”

When she took over as AMD’s top executive, Su said a major piece of the company’s strategy was to become a high-performance-computing leader.

Related: Analyst updates AMD stock forecast ahead of AI conference

“What makes this a fun job is the technology that we’re working on is impacting the lives of billions of people,” she said. “Most of the things that you do in a day, somewhere, it goes through an AMD processor.”

Su said that probably the biggest thing that sets the company’s strategy apart “is that we really believe in end-to-end AI in every aspect.”

“There are companies that are working on some aspect of AI,” she said. “Our view is, ‘hey, AI is going to be everywhere. AI is going to be throughout our entire product portfolio.’ “

During the interview, Su discussed AMD’s MI300X, a graphics-processing unit designed to support generative artificial intelligence technologies. Generative AI uses machine learning to derive original content from existing text, photos, video and audio.

“When we launched our MI300X last year, we had Microsoft, we had Meta, we had Oracle, as key marquee partners that we’ve come together and built great solutions [with], and that’s what sets us apart in how we approach the market,” she said.

And now AMD is asking people to save the date of Oct. 10 when the company is scheduled to host “Advancing AI 2024.” That’s an in-person and livestreamed event designed to showcase the next-generation AMD Instinct accelerators and 5th Generation AMD EPYC server processors.

The gathering will also feature networking and AI PC updates, highlighting AMD’s growing AI solutions ecosystem.

AMD’s stock is up 147% year-to-date and a team of analysts at Bank of America led by Vivek Arya issued a research report about the company ahead of the October event.

The firm, which maintained a buy rating and $180 price target on AMD shares, said that last’s year AI event in December produced 19% to 80% stock returns one to three months later.

Analyst: AMD can ride AI market

“AMD is off to a remarkable start but it could be tougher to carve a bigger niche between Nvidia’s (NVDA) 80% to 85%+ share, cloud incumbency, 15 year+ software-developer lead on one extreme, and the roughly 10% market share presence of cost-optimized custom application-specific integrated circuits (ASICs) from Broadcom (AVGO) and Marvell Technology (MRVL) on the other extreme,” B of A said.

If, however, AMD is able to show a path to 10% AI share by calendar 2026, the company would conceptually add around $5 billion (on top of $12.6 billion) in sales, with scenario EPS of around $8 to $9, compared with the consensus at $7.37, the investment firm said.

More AI Stocks:

B of A said that AMD is facing competition not just in AI.

The stock is also exposed to pressures from Intel (INTC) , near-term sluggish PC demand, longer-term rising competition from ARM-based rivals in servers and PC CPUs, and profitability in AI silicon as it becomes harder to raise prices or pass along the rising cost of high-bandwidth memory.

The firm noted that the timing of the AI event is interesting in that it takes place before AMD’s scheduled earnings report — slated for the end of October — “in what is normally the quiet period for the company.”

B of A said it was maintaining its buy rating because AMD can capitalize in the PC/server central-processing-unit market by taking share from Intel, which “remains in turmoil with frequent restructuring,” and by riding the expanding AI market, “where the leader, Nvidia, continues to expand the addressable market that is always looking for alternative merchant and ASIC suppliers.”

Last month, Wells Fargo affirmed an overweight rating on AMD with a $205 price target after the company said Oracle Cloud Infrastructure (ORCL) would be deploying the MI300X GPUs to power its newest Oracle Cloud Infrastructure Compute Supercluster instance.

The investment firm said the news was an “incremental positive.” AMD’s news release specifically highlights the MI300X GPUs as well positioned for inference capabilities, a theme the company will emphasize at its Oct. 10 event, Wells Fargo said.

Related: The 10 best investing books, according to our stock market pros

Read the full article here