The Nasdaq-100 Technology Sector index delivered an outstanding performance in 2023 with an impressive gain of 68%. Tech stocks found their mojo once again thanks to favorable economic developments, as well as the artificial intelligence (AI) gravy train.

The good news is that the Nasdaq-100 seems set to soar higher in 2024, thanks to potential interest rate cuts by the Federal Reserve, slim chances of a recession, the cooling inflation, and the booming adoption of AI that’s likely to help some big tech names sustain their fantastic growth. It is worth noting that the Nasdaq-100 index has experienced only seven down years since it was launched in January 1985.

What’s more, the index tends to bounce back strongly in the years following a down year. For instance, the Nasdaq-100 was up 53% in 2009 and 19% in 2010 following a 42% slide in 2008. A similar trend was seen in 2019 and 2020, when the index jumped 38% and 47%, respectively, following a 1% pullback in 2018. As such, there is a strong likelihood of the Nasdaq-100 heading higher in 2024, especially considering the economic tailwinds mentioned above.

This is why now would be a good time for investors to buy some of the Nasdaq-100 index’s top-performing stocks before they head higher in the New Year. Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN) are two such names that could keep crushing the market in 2024 following gains of 245% and 77% in 2023. Let’s look at the reasons why.

1. Nvidia

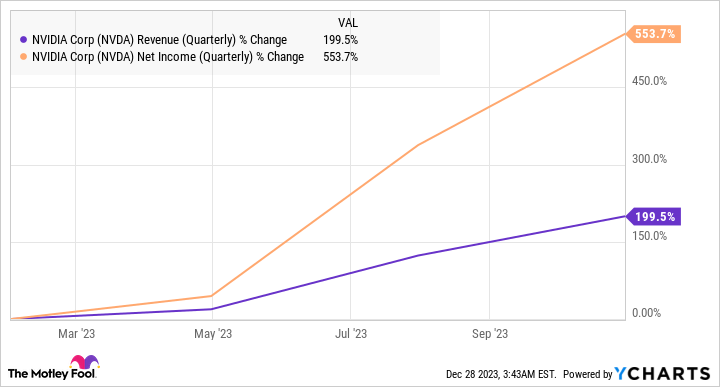

Generative AI adoption supercharged Nvidia’s growth in 2023 and sent its shares soaring. The chip giant’s big jump seems deserved, as its dominant control over the market for AI chips has led to a big surge in its revenue and earnings over the past couple of quarters.

Nvidia is on track to finish fiscal 2024 (which ends in January 2024) with revenue of $59 billion, a 118% spike over the previous fiscal year. Additionally, the company’s immense pricing power in this market has led to an even bigger jump in its earnings. Nvidia’s flagship H100 AI graphics card is priced between $25,000 and $40,000 and reportedly costs around $3,300 to manufacture, according to investment banking firm Raymond James.

This explains why analysts are forecasting Nvidia’s bottom line to jump nearly 3.7x year over year to $12.29 per share in fiscal 2024. More importantly, Nvidia is setting itself up to sustain its red-hot growth in the New Year by securing a greater supply of components for its AI chips. Supply chain sources suggest that the company has made substantial advance payments of $540 million and $770 million, respectively, to memory manufacturers SK Hynix and Micron Technology to get its hands on high-bandwidth memory (HBM) chips, which are deployed in its AI graphics cards.

Reports also indicate that Nvidia has signed a contract for HBM chips with Samsung as well. Meanwhile, Nvidia’s foundry partner Taiwan Semiconductor Manufacturing, popularly known as TSMC, is enhancing its advanced chip packaging capacity to manufacture more AI chips in 2024. All this could help Nvidia triple the output of its highly popular H100 AI graphics cards in the New Year, as pointed out by the British daily newspaper Financial Times.

With Gartner predicting a 25% jump in AI chip revenue in 2024 to $67 billion, Nvidia is doing the right thing by securing more supply. This will allow it to maintain its dominance in the AI chip market, where it reportedly has a share of 80%. Not surprisingly, consensus estimates are forecasting a 56% jump in Nvidia’s revenue next year to $92 billion. Its earnings are predicted to jump 67%.

However, don’t be surprised to see Nvidia clocking stronger growth on the back of a big jump in the production of its AI chips, which could help its shares deliver eye-popping gains once again in 2024. Given that Nvidia is trading at a price/earnings-to-growth ratio (PEG ratio) of just 0.5, buying this AI stock is a no-brainer, as a PEG ratio below 1 means that a stock is undervalued.

2. Amazon

E-commerce and cloud computing giant Amazon has been rewarded handsomely on the market for the impressive growth that it has been delivering in recent quarters. The company’s revenue in the first nine months of 2023 has increased almost 11% year over year to $405 billion, and its guidance for the final quarter indicates that it could deliver annual revenue of $568.5 billion. That would be an increase of roughly 11% from 2022 levels.

More importantly, Amazon’s growth is expected to remain robust in 2024 and 2025 as well, as the following chart indicates.

However, there is a good chance that Amazon could deliver stronger growth on the back of higher e-commerce spending, as well as the growing adoption of cloud-based AI services.

According to eMarketer, global e-commerce revenue is likely to increase by 9.4% in 2024 to $6.3 trillion, up from 2023’s estimated growth of 8.9%. It is worth noting that Amazon has been outperforming the global e-commerce market’s growth of late. In the third quarter, for instance, the company’s North American e-commerce revenue was up 11% year over year, while international revenue increased by a similar figure in constant currency terms.

So the global e-commerce market’s sunny prospects in 2024 are likely to help accelerate the company’s growth. However, there is another catalyst that could start moving the needle in a more significant way and help it outpace Wall Street’s expectations — cloud computing.

The tech giant’s cloud computing offering — Amazon Web Services (AWS) — is the leading player in the cloud infrastructure services market, with a share of 32%, according to Synergy Research Group. This puts Amazon in a nice position to capitalize on the growing demand for cloud-based AI services.

It is estimated that the cloud AI market could grow at an annual pace of 36% through 2032 and generate a whopping $887 billion in annual revenue at the end of the forecast period. Amazon has already started capitalizing on this opportunity. The company’s AI offerings on AWS are being used by the likes of BMW, NatWest, PwC, and Genpact, among others, to integrate AI into their operations.

As such, it wouldn’t be surprising to see an acceleration in AWS’ growth in 2024 and beyond as the adoption of AI services in the cloud increases. Given that Amazon is currently trading at 2.9 times sales compared to its five-year average sales multiple of 3.4, investors are getting a relatively good deal on the stock right now. They may not want to miss this opportunity — another solid year for the Nasdaq-100 in 2024 could send this tech stock soaring, especially considering the lucrative catalysts it is sitting on.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Bayerische Motoren Werke Aktiengesellschaft and Gartner. The Motley Fool has a disclosure policy.

2 Stocks to Buy Hand Over Fist Before the Nasdaq Soars Higher in 2024 was originally published by The Motley Fool

Read the full article here