One of the most prominent themes of monetary policy over the last few years is an intense scrutiny on interest rates — and for good reason. In 2022 and 2023, the Federal Reserve hiked interest rates 11 times in an effort to stifle abnormally high levels of inflation.

Although inflation still persists, the current level of 2.9% has materially cooled from its high points during the summer of 2022. The current picture surrounding unemployment data and inflation trends has many economists forecasting that rate cuts may finally be on the horizon. Even Fed Chair Jerome Powell strongly suggested that changes in policy were imminent in a speech he gave in Jackson Hole, Wyoming a couple of weeks ago.

There are many types of businesses that could benefit from reductions in interest rates. In particular, I’ve been looking closely at business development companies (BDCs). Let’s break down the ins and outs of BDCs and look at the ultra-high-yield BDC stock I have on my radar right now.

What are business development companies?

BDCs are pretty interesting. At their core, they’re capital providers to early-stage businesses looking for funding to get their operations off the ground. Furthermore, some BDCs, such as Ares Capital, offer more sophisticated financing solutions — making them appealing to larger public companies as well.

You might be wondering if a BDC is just a fancy term for a bank. Well, not exactly.

BDCs have an unusual corporate structure in that 90% of taxable income is distributed to shareholders on an annual basis. For this reason, BDCs tend to be a favorite for those looking for dividend income.

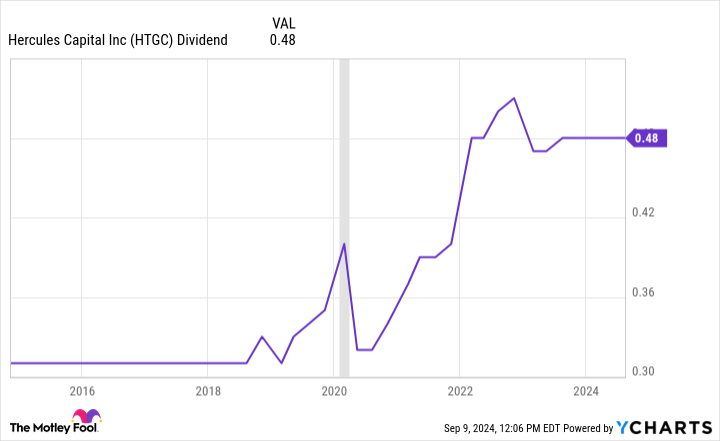

The chart below illustrates the dividend payments for Hercules over the last 10 years. For the most part, Hercules has not only consistently paid a dividend, but it’s also raised its quarterly and supplemental-dividend payments. The notable exception was a brief cut to the supplemental dividend in early 2020 at the beginning of the COVID-19 pandemic (seen in the grey-shaded column).

However, not all BDCs are created equal — far from it. Many BDCs focus on specific sectors, making the risk profile of each portfolio vastly different. Moreover, underwriting protocols vary from one company to the next. For this reason, it’s very important to look at the overall performance of a BDC’s operation in order to gauge the strength of its portfolio and get a sense of its credit controls.

And the BDC I have on my radar is…

One BDC that I think is particularly well positioned to benefit from rate cuts is Hercules Capital (NYSE: HTGC). Hercules is a BDC that focuses on emerging themes in technology, life sciences, and green energy. It specializes in venture debt, making high-yield loans to companies that have previously raised outside funding from venture capital or private equity.

Considering that Hercules is lending money to relatively early-stage businesses, you may think its risk profile is rather high. But I don’t quite see it that way. One metric that I like to use to measure a BDC’s health is net investment income (NII). NII can be helpful when assessing an investment firm’s profitability. The table below reflects NII for Hercules over the last several years.

|

Category |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Six Months Ended June 30, 2024 |

|---|---|---|---|---|---|---|---|

|

Net Investment Income Per Share |

$1.19 |

$1.41 |

$1.39 |

$1.29 |

$1.48 |

$2.09 |

$1.01 |

Data source: Hercules Investor Relations.

Since 2018, Hercules’ NII has consistently increased, which I think serves as a good barometer of management’s underwriting and portfolio management. Moreover, Hercules has consistently rewarded shareholders in the form of raising dividend payments in tandem with its increasing NII.

Why I see Hercules as a no-brainer right now

A reduction to interest rates could benefit Hercules in several ways.

Over time, it becomes less appealing for founders to consistently raise capital from venture capital (VC) firms. Because VCs acquire equity in the businesses that they invest in, the opportunity cost of each subsequent capital raise is dilution to founders and even employees. As a result, business leaders are inclined to allocate capital prudently and cautiously, with the intention of reaching breakeven or positive free cash flow.

Of course, lower interest rates (cheaper debt) could be particularly appealing to venture-backed companies that have proven they’re no longer high-cash-burn operations but are still seeking access to outside funding, such as a term loan or a revolving credit facility. Since debt is non-dilutive, Hercules could be an enticing option in situations like these, which could lead to a new wave of demand for its services.

I’m not overly worried about competition from private credit providers in this space, either. I think Hercules offers a level of flexibility that most traditional banks simply aren’t willing to offer. A middle-market business may be turned away from a bank or will not be able to get as high of a loan as it’s looking for.

Hercules differentiates itself from these firms by offering access to larger sources of capital, yet simultaneously protects itself by attaching covenants to its deal structures. Moreover, Hercules has a unique opportunity to form strong relationships with the VCs that back many of its portfolio companies. This can result in repeat business in the form of refinancing within the portfolio or referral-deal flow.

For these reasons, I’m optimistic that Hercules will continue generating strong growth and be able to maintain and raise its dividend payments over a long-run time horizon.

In addition, a reduction to interest rates can also result in excess capital that would otherwise be geared toward higher interest payments. This could indirectly benefit Hercules, as its portfolio companies could start reaccelerating growth initiatives, leading to higher valuations over time.

Lastly, since corporations often borrow money to fund large-dollar transactions, cheaper debt could inspire some businesses to reevaluate more strategic opportunities, such as mergers and acquisitions. Such liquidity events could be beneficial for Hercules, as some of its portfolio companies could end up becoming acquired by larger enterprises. Moreover, because Hercules often attaches warrants to its investments, I see the potential for rising acquisitions as particularly lucrative.

As of this writing, Hercules carries a dividend yield of 10.4% — nearly 8 times the dividend yield of the SPDR S&P 500 ETF Trust. On top of that, the stock’s five-year total return of 152% handily trounces that of the S&P 500.

Considering the stock’s consistently strong performance, coupled with its ultra-high yield and position to benefit from potential interest rate cuts, I see Hercules as a no-brainer opportunity right now.

Should you invest $1,000 in Hercules Capital right now?

Before you buy stock in Hercules Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hercules Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Ultra-High-Yield Dividend Stock You’ll Want to Have on Your Radar as Rate Cuts Loom was originally published by The Motley Fool

Read the full article here