TXN Elliott Wave Analysis Trading Lounge.

Texas Instruments Inc. (TXN) Daily Chart.

TXN Elliott Wave technical analysis

Details:

The chart suggests that TXN is currently in the final stages of a triangle pattern within wave 4. As wave 3 previously achieved equality with wave 1, an extension in wave 5 is anticipated. The breakout from this triangle formation is expected to push the price higher, marking the beginning of wave 5.

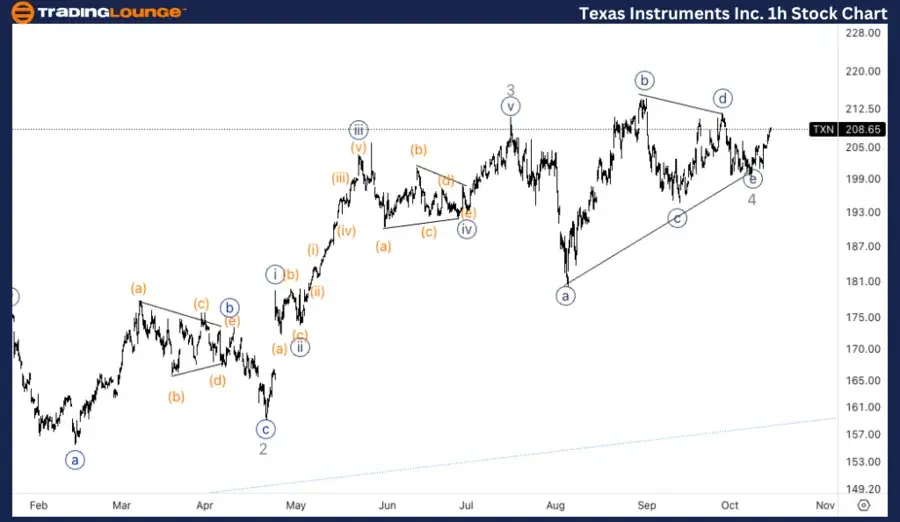

Texas Instruments Inc. (TXN) 1H Chart.

TXN Elliott Wave technical analysis

Details:

The 1-hour chart suggests that TXN has likely completed its correction with wave {e} marking the end of wave 4. The price is now advancing within wave {i}, specifically in wave (iii) of {i}, indicating a resumption of upward momentum. This movement signifies the beginning of the expected wave 5 rally.

Overview of TXN’s Elliott Wave analysis

In this Elliott Wave analysis, both the daily and 1-hour charts suggest an ongoing bullish trend for Texas Instruments Inc. (TXN).

Key Insights from the Daily Chart:

-

Wave 4 is forming a triangle pattern, indicating a consolidation phase.

-

A breakout into wave 5 is expected, potentially driving the price higher.

-

Wave 3’s equality with wave 1 implies a possible extension in the upcoming wave 5.

Key Insights from the 1H Chart:

-

The correction appears to have completed with wave {e}.

-

The price is advancing in wave {i}, specifically within wave (iii) of {i}, suggesting renewed upward momentum.

-

This movement signals the early phase of the wave 5 rally.

Technical analyst: Alessio Barretta.

TXN Elliott Wave technical analysis [Video]

Read the full article here

![Texas Instruments Inc. (TXN) Elliott Wave technical analysis [Video]](https://news.vittaverse.com/wp-content/uploads/2024/02/british-money-and-stock-exchange-graph-17512709_Large.jpg)