TIA, the native token of the modular blockchain network Celestia, has surged 14% after it announced the commencement of its second funding round.

At press time, Celestia (TIA) was trading at $6.2, having surged to an intraday high of $6.86—marking a rise of over 40% from its weekly low. The token’s daily trading volume doubled from the previous day to $410 million.

Meanwhile, its market capitalization reached $1.34 billion, securing its position as the 65th largest cryptocurrency, according to CoinGecko. Following the latest price jump, TIA also gained a top trending status on the crypto data aggregator.

Despite the recent price rally, TIA still has to climb 69.8% to break past its all-time high of $20.85 seen on February.

TIA’s price rally follows a key milestone, with the Celestia Foundation announcing an additional $100 million in funding, bringing its total to $155 million. The funding round coincided with Celestia’s core developer community unveiling the project’s technical roadmap, both of which traders perceived as positive developments.

Eyes on $6.60 resistance level

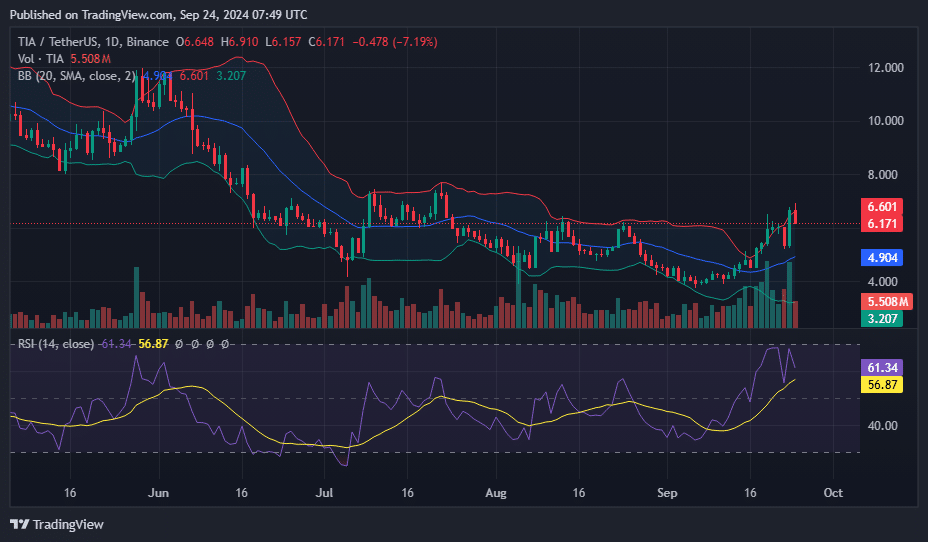

TIA’s price has now fallen to $6.171, hovering just below the upper Bollinger Band, which is currently at $6.601. This suggests that the token recently encountered resistance near the upper band, leading to a sharp pullback, as indicated by the price being near the middle band.

The Relative Strength Index RSI is at 56.87, retreating from overbought levels, which points to weakening bullish momentum. However, the RSI is still above the neutral zone, signaling that there is room for potential upward movement if buyers step in.

If TIA can regain momentum and break above the $6.60 resistance level, it could push higher, with $7 as the next target. In contrast, failure to maintain current support levels could result in a further decline, with the middle Bollinger Band around $4.994 serving as the first support zone. Traders should be cautious of further consolidation or volatility near these key levels.

Read the full article here