Jupiter token retreated for two consecutive days even as the volume of transactions in Solana’s ecosystem jumped.

Jupiter (JUP) retreated to $0.08 on Sept. 23, down from last week’s high of $0.89, giving it a market cap of over $1.098 billion.

Data from DeFi Llama shows that Solana’s (SOL) decentralized exchange transactions rose by 18% in the last seven days, bringing the total to over $5.27 billion. It flipped Ethereum, whose transaction volume fell by 29% to $5.1 billion.

Jupiter’s transactions have been robust, with data from Solscan showing that it handled tokens worth $587 million on Sept. 23, giving it a market share of 37%. It has over 10,400 active wallets.

The other top Solana DEX networks like Raydium, Orca, and Meteora also saw higher volumes as meme coins like Popcat (POP) and Dogwifhat (WIF) rebounded.

Recently, however, there are signs that Jupiter’s volume momentum is falling. After peaking at $1.14 billion on Sept. 19, it has dropped to $580 million.

Meanwhile, Jupiter’s total assets have risen by over 5% in the last 30 days to over $1.17 billion, making it the third-largest player in the ecosystem.

Jupiter’s token pulled back a week after the developers acquired SolanaFM, a leading blockchain explorer. This acquisition is expected to help Jupiter grow its ecosystem of infrastructure networks.

A key challenge for Jupiter’s token is its concentrated ownership structure. According to SolanaFM, the top ten addresses in the network hold almost 92% of all tokens in circulation. A highly concentrated token is typically at risk if these holders decide to liquidate their positions.

Jupiter found a strong support

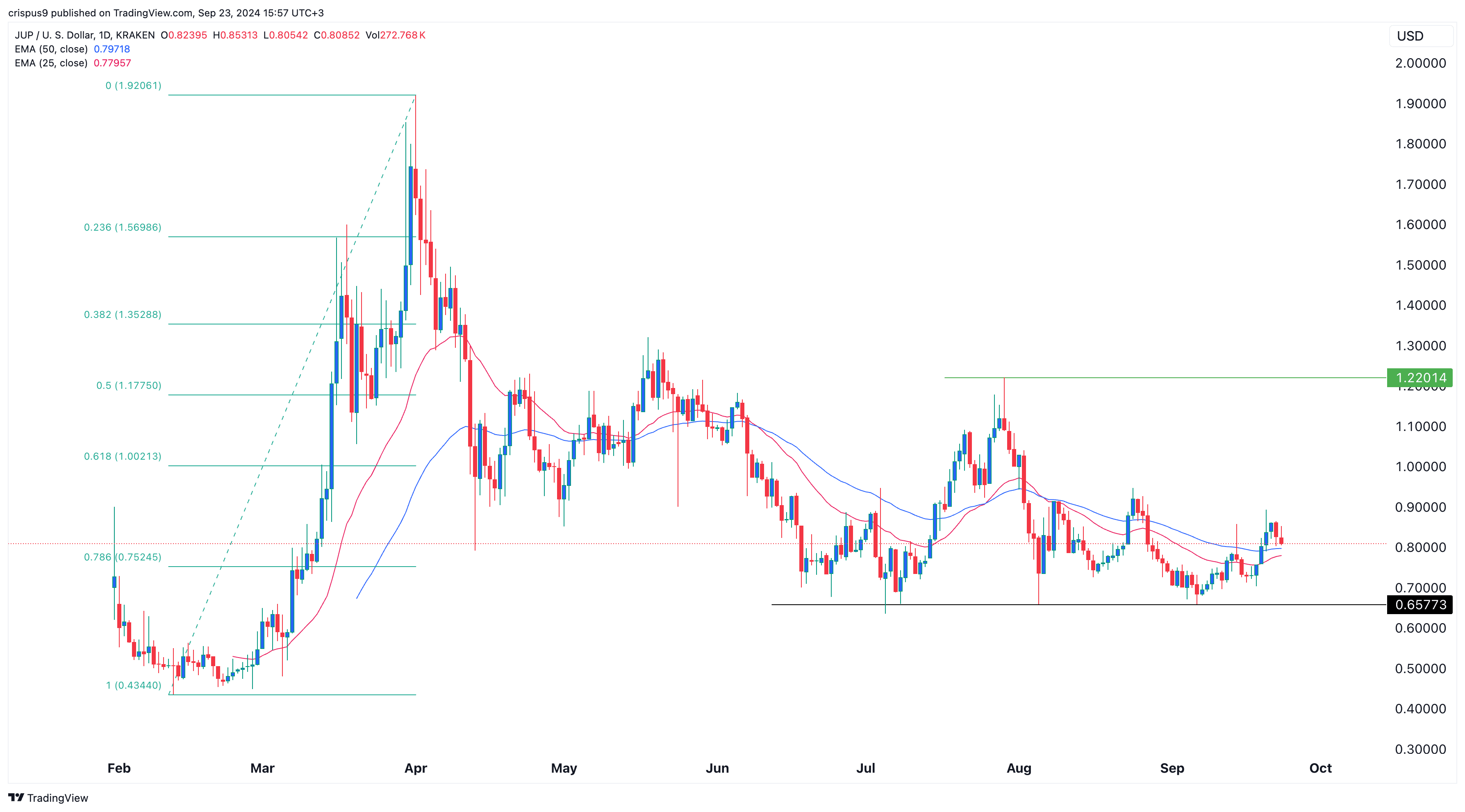

On the daily chart, the Jupiter token found strong support at $0.6577, a level it struggled to cross in July, August, and September. This indicates it has formed a triple-bottom pattern with a neckline at $1.2200.

Jupiter has also remained above the 78.6% Fibonacci Retracement level and is hovering above the 50-day and 25-day moving averages.

Therefore, Jupiter is likely to resume its uptrend as long as it remains above the two moving averages and last week’s high of $0.8932.

Read the full article here