You did it, Warren. Berkshire Hathaway (NYSE: BRK.A) just surpassed a trillion-dollar market cap, the eighth non-state-owned company in history to reach this milestone. It started from a small textile mill over 50 years ago, and now the small team of investors and business operators headed up by legendary investor Warren Buffett has just reached a huge numerical milestone. It now has a larger market cap than technology stalwarts such as Tesla and Taiwan Semiconductor Manufacturing.

Not bad for a stodgy insurance and investment conglomerate from the heartland of America. Despite Buffett getting on in years (he is now 93 years old), the conglomerate is in as good of a spot as ever. Here’s what the milestone means for the stock and why Berkshire Hathaway is one of the most resilient businesses in the world.

$17 million to $1 trillion in market value

Back in the late 60s, Warren Buffett took control of Berkshire Hathaway by buying up 49% of its shares. At the time, it was a struggling textile mill, and he only had to pay $8.3 million for the stake. That put Berkshire Hathaway’s total market value at around $17 million.

Fast forward to today, and Berkshire Hathaway just surpassed a market cap of $1 trillion. That is an increase in market value of 58,823 times since Buffett took over the company. On a per-share basis, Buffett’s average purchase of Berkshire stock was $14.86 back in the 1960s. Today, the stock trades at a price of $696,502. That’s not a typo; a single share of Berkshire Hathaway is worth more than most people’s annual salaries (you can still buy a stake through the affordable B shares, though).

That is a 46,871 times increase from Buffett’s initial purchase. While slightly less than the increase in market cap, this shows the efficiency of Buffett’s wealth-building strategy. He didn’t dilute shareholders by much at all in order to reach a trillion-dollar market value. Someone who invested $1,000 with Buffett at the start would now have a stake worth $47 million. This is why Buffett is the indisputable best investor ever.

A resilient business model and fortress balance sheet

Why has Berkshire Hathaway been so successful? There are two key reasons outside of the general skills of Buffett when it comes to making money.

First, Berkshire focused on insurance operations. Insurance brings in float, which is cash you have on the balance sheet that you pay out in claims later. Buffett used this float to make great investments in stocks such as Coca-Cola and American Express. Second, Berkshire acquired businesses with durable cash flows ranging from railroads, electric utilities, retail companies and even See’s Candies. The one thing these businesses have in common is they throw off a ton of cash to the parent company that Buffett can use to invest. He aimed to generate as much cash as possible that he could use to buy undervalued stocks.

Now, the company is one of the largest in the world and has a fortress balance sheet. After selling off a lot of its Apple investment in 2024, the company has a monster cash pile. All the cash, treasuries, and investments that Berkshire Hathaway owns add up to a value of over $600 billion at the end of Q2. Again, not a typo. There are only 13 other companies in the world with market caps above Berkshire Hathaway’s investment and cash pile. That is what I call a rock-solid balance sheet and why Berkshire Hathaway is one of the most resilient companies in the world.

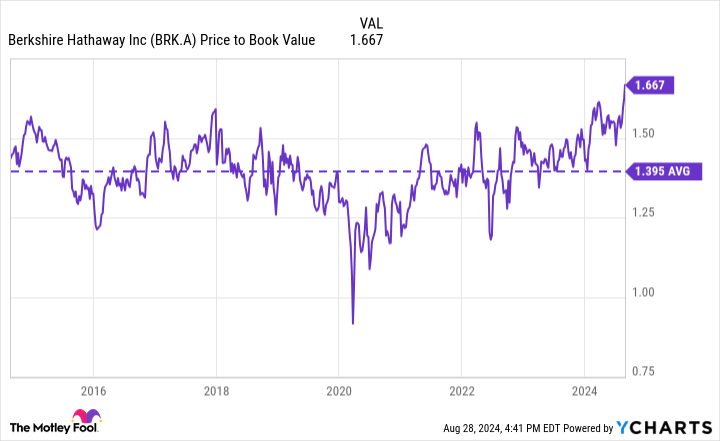

BRK.A Price to Book Value data by YCharts.

Is Berkshire Hathaway stock a buy today?

Even though it is thought of as a boring, stodgy conglomerate these days, Berkshire Hathaway has gone on quite a run over the past few years. In the last five years, Berkshire stock has posted a total return of 132%, which is beating the S&P 500’s return of 112%. It is trading at a record-high, price-to-book value (P/B) of 1.67 for the last 10 years. The average over the last 10 years has been 1.40.

P/B tells investors what price you are paying for the assets on Berkshire’s balance sheet. This is a valuable tool for an investment, insurance, and financials-focused company like Berkshire Hathaway. If the P/B is above 1, that means you are paying a premium to the stated value. Buffett and the Berkshire Hathaway team definitely deserve a premium given their track record. How much is the real question investors should be asking.

I think it will be hard for investors to lose money owning Berkshire Hathaway stock over the long term, even at this inflated multiple. But with its trillion-dollar market cap, don’t expect huge outperformance from the stock over the next 10 and 20 years.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

Warren Buffett Just Joined the $1 Trillion Market-Cap Club. Here’s What You Need to Know was originally published by The Motley Fool

Read the full article here