The word AI (artificial intelligence) brings in visions of robots and complicated computer algorithms. Indeed, a lot goes on behind the scenes in making the robots and chatbots that become the face of AI technology and the company behind its development. Many companies are contributing to the AI revolution, including chip designers and manufacturers, coders, data analytics companies, and hardware and software makers. This makes it difficult for investors to choose the best AI stock.

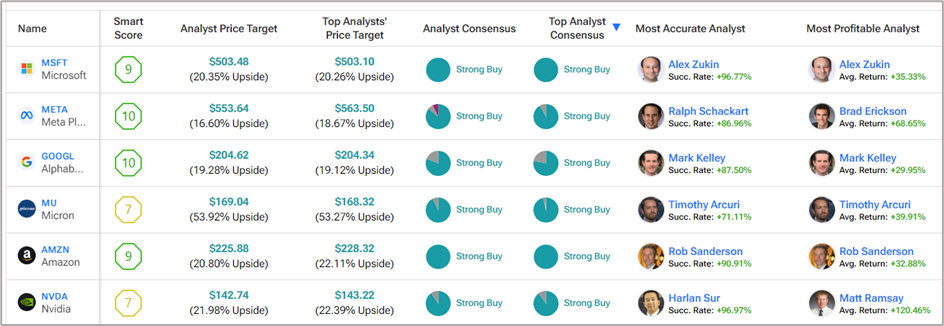

Well, we will try to simplify the process based purely on TipRanks tools. We leveraged TipRanks’ Stock Comparison tool for Best Artificial Intelligence stocks to see how the leading AI companies perform on TipRanks Essentials’ parameters. We sorted these companies based on the Strong Buy analyst consensus rating, giving us our top six companies.

Incidentally, just yesterday, both Microsoft (MSFT) and AMD (AMD) painted a highly optimistic demand outlook for high-performance GPUs in their latest quarterly earnings call, leading to a rise in the stock prices of several chip stocks.

As an investor, the most important thing to watch is the share price growth potential. Consequently, our next logical step was to scan these six companies to see which one had the highest “Most Accurate Analyst” return as well as the “Most Profitable Analyst” return. Here’s what we found: chipmaker Nvidia (NVDA) has earned the highest returns on both counts. Let’s dive deeper into them.

Nvidia on a Tear, Up 136% YTD

Semiconductor company Nvidia is on a tear this year, gaining more than 136% year-to-date. Chances are that the company is set for more upside potential, thanks to the burgeoning demand for its advanced chips and technology.

Let us look at the two five-star analysts, who have sort of mastered the art of investing in NVDA stock. For Nvidia, the “Most Accurate Analyst” in the past one year has been J.P. Morgan’s Harlan Sur, boasting a 97% success rate and an average return of 104.17%. Interestingly, for Sur, the best stock rating to date is NVDA stock, when he generated a magnanimous 256.3% return between March 22, 2023 to March 22, 2024. On TipRanks, Sur ranks 39 out of 8,966 analysts.

On the other hand, the “Most Profitable Analyst” on NVDA stock is TD Cowen’s Matt Ramsay, who has a success rate of 90% and generated a massive average return of 120.46% in the past year.

Similar to Sur, Ramsay’s best rating to date has also been on Nvidia stock. Between October 10, 2022 and October 10, 2023, Ramsay generated a massive 292.60% return on his Buy call on NVDA stock. Interstingly, Ramsay fares better than Sur on TipRanks, as he ranks 13 out of the 8,966 analysts ranked on TipRanks.

Disclosure

Read the full article here