(Bloomberg) — Macquarie Group Ltd.’s profit suffered after fewer asset sales and weakness in its commodities and global markets business. A surprise buyback of as much as A$2 billion ($1.29 billion) offered some relief to investors.

Most Read from Bloomberg

Net income tumbled 39% to A$1.42 billion in the six months to Sept. 30, missing the average A$1.69 billion estimate of three analysts surveyed by Bloomberg.

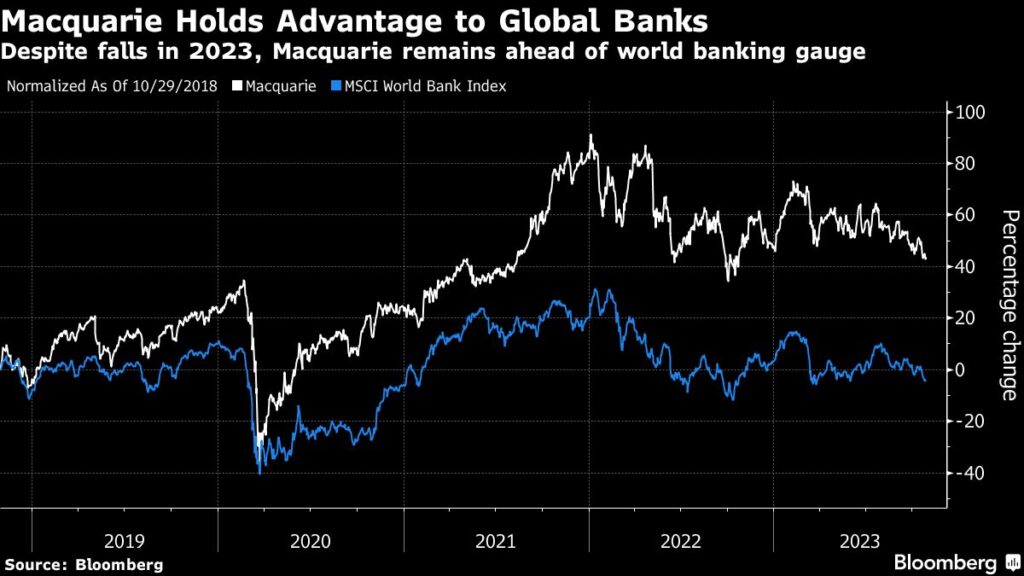

Investors were primed for a soft result after the Sydney-based bank and asset manager twice in recent months dialed down expectations for profitability. As Chief Executive Officer Shemara Wikramanayake prepares shareholders for more challenging times, Macquarie shares are still outperforming global bank stocks this year as its diverse set of businesses provides a cushion to investment-banking focused rivals.

Guidance suggests some stabilization in the second half of the year, “but overall we would expect the market to continue to cut earnings expectations for Macquarie,” John Storey, an analyst at UBS Group AG, wrote in a report. “The only silver lining, in our view, is the buyback, which might indicate Macquarie view the stock as undervalued.”

Profit contribution from Macquarie Asset Management was down 71% due to the timing of asset realizations in green investments and higher expenses. The commodities and global markets unit’s contribution was 31% lower as volatility subsided.

“Our annuity-style businesses saw growth in loan books, deposits and assets under management, but the first-half result was substantially down compared to a strong period of realizations in the prior corresponding period,” Wikramanayake said in the statement Friday. There’s an “expectation that green energy realizations will be predominately in the second half.”

Read More: Macquarie Falls on Profit Miss, Cost Pressures: Street Wrap

The shares lost 1% as of 11:22 a.m. in Sydney Friday, while the S&P/ASX 200 Index rose 1.1%.

What Bloomberg Intelligence Says

Macquarie’s big buyback might be a savvy trade, given its possible 20% discount to 2021’s capital raise and could offset the return impact of a very weak first half. Surplus capital remains sufficient to support growth and possible asset management M&A, which would be very accretive to returns — Matt Ingram, senior industry analyst at Bloomberg Intelligence. Read the BI report here.

–With assistance from Georgina McKay.

(Adds Friday’s share price from sixth paragraph, Bloomberg Intelligence comments in seventh)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here