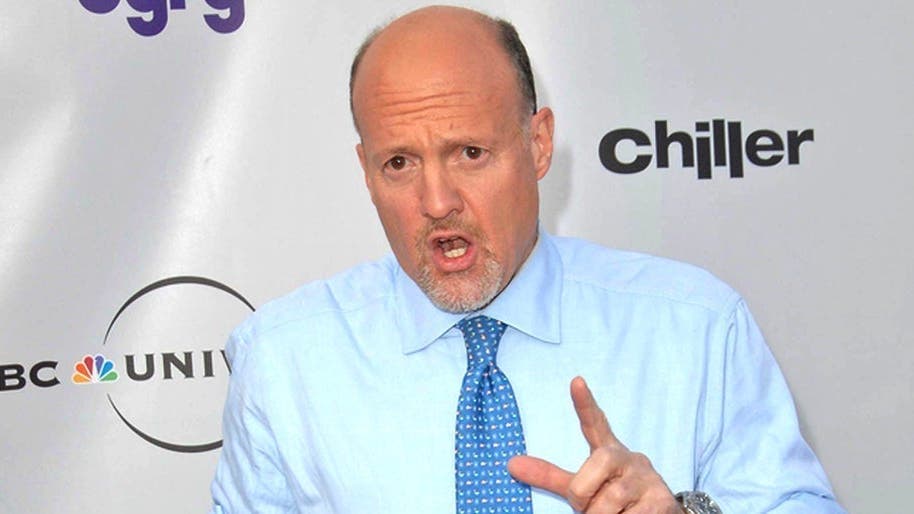

Jim Cramer has compared GameStop Corp. (NYSE:GME) to an overvalued special purpose acquisition company.

What Happened: Cramer the host of CNBC’s “Mad Money” host criticized GameStop’s business model, suggesting it resembles a SPAC due to its reliance on raising capital despite poor business performance. He emphasized the need for GameStop to present a clear strategy to justify its stock price.

Don’t Miss:

“When you think of GameStop, you need to imagine a SPAC — and not just any SPAC, it’s a massively overvalued one that needs to purchase something incredible at an insane discount,” Cramer said.

GameStop reported a 31% year-over-year sales decline, marking its fourth consecutive quarter of losses. Despite this, the company turned a profit from interest on its $4.2 billion cash reserve.

Trending: Here’s the AI-powered startup that turns traders into influencers achieving 12% monthly growth – invest in it at only 10 cents per share.

Cramer echoed an analyst’s view that GameStop should consider closing physical stores and operate as a bank. He also noted that many investors hope for acquisitions that could boost the stock’s value, a bet he is unwilling to take.

Why It Matters: GameStop’s recent financial results have been a cause for concern among investors. On Monday, the company reported second-quarter net sales of $798 million, falling short of the $895.7 million consensus estimate. The revenue miss was primarily due to lower-than-expected sales in hardware, accessories, and collectibles.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Analysts have been vocal about GameStop’s struggles. Wedbush analyst Michael Pachter reiterated an Underperform rating and suggested the company could close all its physical stores and operate as a bank to manage its losses. Pachter questioned why GameStop shares traded at a premium to its cash reserves without a clear strategy.

Adding to the volatility, the “Roaring Kitty” account, known for its influence on meme stocks, recently posted a cryptic message on X, leading to speculation and increased trading volume for GameStop shares.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Jim Cramer Agrees GameStop Should Consider Operating As A Bank And Labels The Meme Stock As ‘Massively Overvalued’ SPAC originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the full article here