To say that Super Micro Computer (NASDAQ: SMCI) has gone through a lot of volatility recently is an understatement. It entered the year at around $280 per share before exploding higher to nearly $1,200 by the beginning of March. Now, it has tumbled down to around $410 per share. Depending on when you purchased the stock, you’re either still happy or extremely disappointed.

But has all of this recent volatility opened up a buying opportunity? Or are there huge red flags?

Super Micro Computer’s core business is excelling

The Super Micro Computer (often called Supermicro) investment thesis was fairly simple: There is a huge demand for Nvidia‘s data center GPUs, so there will be a huge demand for Supermicro’s products. Supermicro makes different components that go into large computing servers and servers themselves.

While this space is more crowded than the GPU space Nvidia dominates, Supermicro sets itself apart by offering highly customizable servers and the most energy-efficient offerings on the market. Energy efficiency is key, as the operating expenses for these massive computing units are quite large.

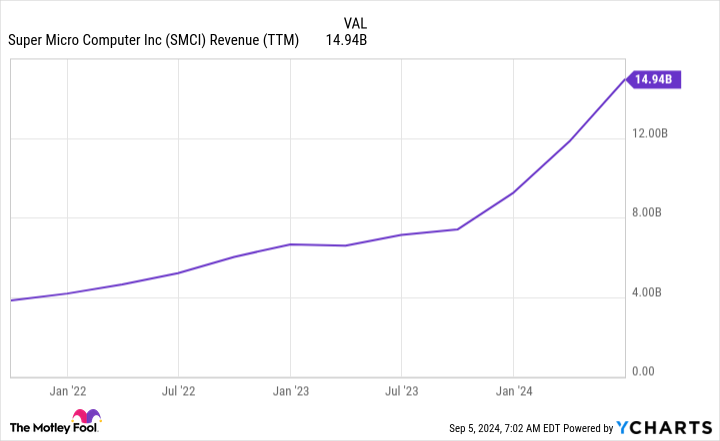

This thesis played out perfectly over the past few quarters, as Supermicro’s revenue growth was outstanding.

It also projected strong growth for fiscal year 2025 (ending June 30, 2025), with revenue expected to grow between 74% and 101% year over year, indicating total revenue between $26 billion and $30 billion.

This would have been a well-received figure in a vacuum, and investors would have cheered it on.

But there were two problems.

Can you trust Supermicro’s financials?

These figures are only good if you can trust them. Supermicro has been fined by the Securities and Exchange Commission (SEC) for previous accounting violations, but these practices may be returning, according to famed short-seller Hindenburg Research. To make matters worse, Supermicro delayed filing its end-of-year form 10-K due to assessing the effectiveness of internal controls.

While Supermicro’s CEO released a statement denying Hindenburg’s allegation, the damage has already been done to the stock, as it is down around 25% since the report came out.

Another factor in Supermciro’s fall is its shrinking gross margin. Management points to the ramping up of its new liquid-cooled technology as a source of the shrinkage, but it will take most of fiscal 2025 for it to return to normal.

This margin squeeze could really affect Supermicro’s profits, as it is still possible that they may not recover throughout the year.

A shrinking gross margin can also come from increased competition, causing Supermicro to cut its prices. Investors won’t know for sure for a while, but this is a trend to watch.

Neither of these two factors excites investors, but the massive sell-off they triggered may have plunged the stock to a point where some are willing to buy.

The stock looks incredibly cheap after the sell-off

Despite the shrinking marring profile, Supermicro’s stock trades for a mere 12.3 times forward earnings.

That’s incredibly cheap for a company expected to grow sales substantially over the next year. It’s also a bargain in general, so buying shares here may not be a bad idea.

However, there are many unknowns about Supermicro that will come into focus over the next year. While I haven’t bought the stock yet, I’m considering it. But if I do buy it, it will only be a small percentage of my portfolio, as this investment could still get worse. If it works out, then that small percentage will still have a large effect on my portfolio.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is This Artificial Intelligence (AI) Stock a Bargain After Recent Volatility? was originally published by The Motley Fool

Read the full article here