When Cava (NYSE: CAVA) went public in June 2023, it was hailed by some as the new Chipotle Mexican Grill (NYSE: CMG). It operates a similar model of fast-casual restaurants offering healthy, fresh food, with its Mediterranean-style fare providing a different spin on the concept.

Cava is meeting investor expectations, and just over a year into being a public company, it’s heading in the right direction. Should Chipotle investors take a look? Here are three things to think about before opening a position in either stock.

1. Cava is growing much faster — for now

As a young company, Cava’s growing at a rapid pace. It’s taking a page from the Chipotle playbook, but since Chipotle is much more mature, the Mexican food chain’s growth isn’t quite as high.

|

Company |

Q2 2024 Sales Growth (YoY) |

Q2 2024 Comps Growth (YoY) |

Q2 2024 EPS |

Q2 2024 EPS Growth (YoY) |

Restaurant-Level Profit Margin |

|---|---|---|---|---|---|

|

Cava |

35.2% |

14.4% |

$0.17 |

(22%) |

26.5% |

|

Chipotle |

18.2% |

11.1% |

$0.33 |

32% |

28.9% |

Data sources: Cava and Chipotle quarterly filings. EPS = earnings per share. YoY = year over year.

Cava’s total sales growth rate was almost double Chipotle’s, but its comparable sales growth was only a tad higher. Chipotle reliably delivers steady double-digit percentage growth, even if that’s at a lower rate than a new competitor, and its comparable sales growth is outstanding. So is its profitability.

2. Cava’s opportunity may be more limited

You might think Cava has a longer runway because it’s young and has only 341 stores. However, its management team sees the opportunity to expand the chain to a total of about 1,000 stores over the eight or so next years. Chipotle, by contrast, has its model down pat and a proven track record of popularity, and it plans to double its store count in North America to 7,000. Cava’s opportunity percentage-wise may be higher, but its overall opportunity still appears smaller in comparison.

In the second quarter, Cava opened 18 stores and plans to open at least 54 for the full year. Chipotle opened 52 stores just in the quarter and plans for about 300 for the year.

Chipotle is also expanding internationally. Cava may follow that strategy at some point if all goes well, but overseas markets are not even on its radar yet.

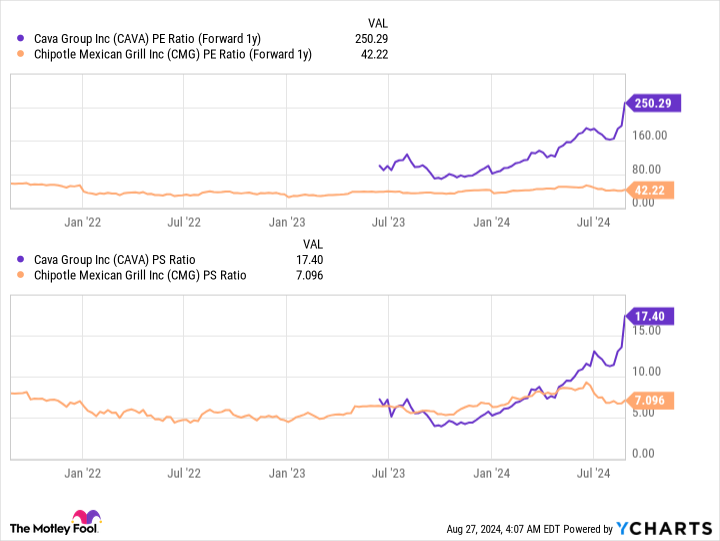

2. Cava’s stock may not be worth the price

The problem with hot stocks is that they often get hot before the average investor even hears about them. Initial public offering (IPO) stocks often start out these days at ridiculous valuations, making them non-starters for a disciplined retail investor. Even when they do continue to rise after that initial surge, it’s usually a prelude to an eventual fall; these stocks simply can’t support their unreasonable valuations for too long. In that context, consider Cava, which is up more than 200% since its IPO just over a year ago.

That’s clearly a Cava issue, but Chipotle stock isn’t cheap either, although it has delivered phenomenal gains for investors who have held on. Chipotle stock is down since June, and it has wobbled a bit since the news broke a couple of weeks ago that superstar Chief Executive Officer Brian Niccol is leaving it to lead Starbucks.

At the current price, Cava stock just does not look compelling. For all of its great performance and potential, I don’t think it can sustain this kind of valuation for long. Is there a chance that it will keep up this streak and hold onto this valuation? There is — but the share price has absolutely no wiggle room for any mistakes. Cava stock surged higher after the excellent second-quarter results, and it will plunge if there’s any hint of weakness in the business. That’s how it usually works with hyped-up stocks.

Risk-tolerant investors might be more interested in Cava stock, but most investors should see this as an opportunity to buy Chitpotle’s reliable market-beating stock on the dip.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends Cava Group and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Is Cava Beating Chipotle at Its Own Game? 3 Things Investors Should Know Before Buying Either of These Stocks was originally published by The Motley Fool

Read the full article here