(Bloomberg) — Goldman Sachs Group Inc. has a message for benchmark managers who are weighing big reshufflings of their indexes to account for a handful of stocks growing to interstellar size: slow down.

Most Read from Bloomberg

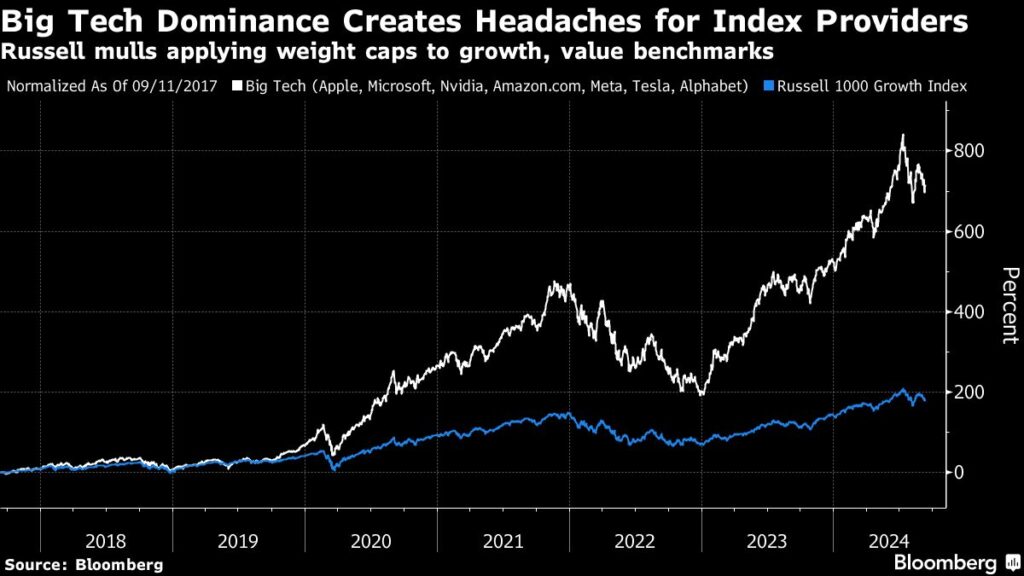

Plans are underway among several providers to tweak index methodologies to limit the influence of megastocks like Apple Inc. and Microsoft Corp., whose weighting in some gauges is pushing up against regulatory limits aimed at preserving diversification. While that’s a worthy goal, Goldman strategist David Kostin says that rewiring indexes to which tens of trillions of dollars are benchmarked is a task that should be approached with caution.

Goldman mentioned FTSE Russell, which is considering installing caps on how much influence super-big stocks have in gauges tracking styles like value and growth. Given that Russell already offers alternative versions of the indexes — capped ones, aimed at equity funds leery of too much concentration risk — there may not be reason to change anything, according to Kostin.

“We believe index providers should continue to create and maintain capped versions of indices,” he wrote in a note. “Funds can then choose to use these capped indices as benchmarks to avoid breaching regulatory threshold.”

The impetus for redoing indexes to shrink the sway of very large companies is understandable, particularly from the perspective of fund managers tasked with beating benchmarks, Kostin said. Besides needing to heed regulatory limits, those investors have struggled to keep up with gauges in which three or four stocks account for virtually all of the upside. Fail to own them and you’re fated to trail, is the problem.

Russell last month conducted a consultation with market participants on whether to apply weight caps to its standard style gauges. At that time, the firm said the proposal was driven by requests from some fund clients fretting in particular over the Russell 1000 Growth Index’s (ticker RLG) runaway returns.

Russell in an email Tuesday said its advisory committees will review the feedback and present the results to the index governance board by the end of September. Should a decision be made to apply caps to the standard style indexes, the firm plans to launch a series of uncapped indexes that will continue to fully reflect the market segments.

“FTSE Russell has received growing sentiment from clients regarding the need for the Russell US Style Indexes to align with regulatory diversification rules for investable products,” Catherine Yoshimoto, director of product management at FTSE Russell, said in a statement.

There is a lot at stake. Russell’s style indexes are benchmarks for $7.2 trillion of assets, or 68% of the total linked to all its products.

Kostin showed how redoing index rules to add caps would make the indexes look more like the average mutual fund portfolio, where managers have been reluctant to put too many eggs in one basket.

Take large-cap growth funds. When RLG is used as a yardstick, the average fund is under-exposed to the six largest stocks — which also include Nvidia Corp., Amazon.com Inc., Meta Platforms Inc. and Alphabet Inc. — by a staggering 12.7 percentage points.

Against the capped version of RLG, the Russell 1000 Growth 40 Act Daily Capped Total Return Index (ticker R1G40A), the average under-ownership to the big six shrinks to 1.4 percentage points.

The percentage of outperforming funds improves too, with 44% beating R1G40A this year versus 39% against RLG.

Creating headaches for index managers and fund professionals alike are longstanding diversification restrictions for regulated investment companies that limit any single security to 25% of a portfolio and the aggregate weight of the largest holdings — those with a 5% representation or greater — to 50%. Established to safeguard investors from over-exposure to too few names, the 25/5/50 restrictions can be punishing with the likes of Nvidia and Apple getting bigger and bigger.

Russell’s latest consultation highlights the challenge facing today’s all-powerful index juggernauts to balance the need to create market-neutral measures while serving a fund community that struggles to keep up with an increasingly top-heavy market.

To cope with the diversification rules, indexes like the Nasdaq 100 curb the influence of the largest stocks directly. Others like S&P Dow Jones Indices usually provide two versions for a major benchmark, with the uncapped gauge reflecting the market while the capped one stays in compliance with regulatory limits.

Applying weight limits to indexes such as RLG doesn’t make sense particularly when a capped version already exists, according to Kostin.

“We believe indices weighted by market cap should not be capped but that index providers should offer capped versions that can be used as benchmarks,” he said. “Capping means the indices would no longer accurately represent the relative performance of certain stocks.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here