On June 18, fast-casual chain Chipotle Mexican Grill (NYSE: CMG) underwent a 50-for-1 stock split, one of the largest in U.S. stock market history. Stock splits are typically done to lower a company’s share price and make it more accessible to more investors, so it was very timely for a stock that has been one of the best-performing in recent years.

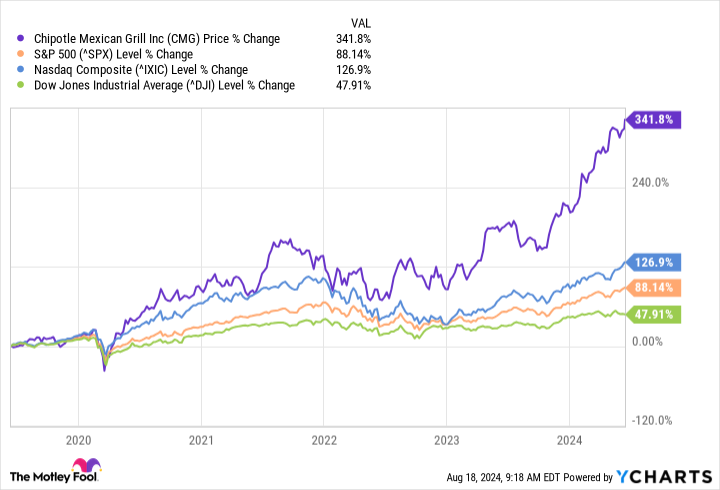

In the five years leading up to its stock split, Chipotle’s stock was up around 340%, considerably outperforming every major index over that span.

Unfortunately, it hasn’t been all smooth sailing for Chipotle since the historic stock split, with the stock down around 16% since then. This decline was sped up when it announced the departure of its CEO, Brian Niccol, who will be taking over at Starbucks beginning in September.

Given the slump since its stock split and news of its CEO departing, investors may be wondering if Chipotle is still a stock to be all in on. Let’s take a look.

Niccol left Chipotle in great financial standing

It’s one thing for a company to lose its head person in charge when things are in turmoil; it’s another thing when it happens while the company is thriving. Luckily, the latter is the case for Chipotle. Since becoming CEO in March 2018, Niccol has helped transform Chipotle from a company generating around $1.1 billion in revenue to $3 billion in the second quarter of this year.

With this increase in revenue has come a healthy bank account as well. When Niccol took over, Chipotle had around $231 million in cash and cash equivalents. In its latest quarter, this number was over $800 million — even after spending over $400 million in 2022.

Chipotle’s financial standing gives its CFO Jack Hartung — who is now delaying his retirement — a nice foundation to help ensure a smooth transition during this time. That should be reassuring to investors.

Chipotle’s growth momentum is going strong

Chipotle continues to open new restaurants at an impressive pace, including 52 new company-operated restaurants in the second quarter alone. The company isn’t opening restaurants at the expense of its bottom line, either; it’s managing to do so while becoming more profitable.

In Q2, Chipotle’s restaurant sales increased 11.1% year over year, and its restaurant-level operating margins went from 27.5% to 28.9%. Being able to open new restaurants while simultaneously increasing margins shows that Chipotle is striking a sweet spot between growth and profitability, which isn’t always easy for restaurants. Sometimes, restaurants sacrifice profitability in the name of expansion.

Chipotle management expects restaurant sales to grow in the mid- to high-single-digit range this year, aided by 285 to 315 new restaurant openings. If it can do so while continuing to improve margins, it’ll be in great shape.

Going all in right now might not be the best approach

Even after its recent declines, Chipotle’s stock remains expensive by most standards. Its price-to-earnings (P/E) ratio is over 53, more than double that of restaurant giants like McDonald’s and Yum! Brands (owner of Taco Bell, Pizza Hut, KFC, and The Habit Burger Grill).

That said, Chipotle is still much cheaper than it has historically been over the past five years. Its P/E ratio over that time has been around 75 on average, which is absurdly high.

There are questions surrounding Chipotle in the short term — including who will become its new permanent CEO and how they decide to lead the company — but its long-term prospects haven’t changed much. It’s a company with a lot of momentum that should continue for the foreseeable future.

My advice would be to use dollar-cost averaging to invest in the stock. This allows you to begin (or increase) a stake while also ensuring you don’t go all-in and end up overexposed during this transitional period.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Stefon Walters has positions in McDonald’s. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Down Over 16% Since Its Stock Split, Should Investors Load Up on Chipotle’s Stock During This Sell-Off? was originally published by The Motley Fool

Read the full article here