3D printing and additive manufacturing (AM) hold a lot of promise. However, though they’re a fast-growing part of the digital revolution happening in the manufacturing world, many 3D printing and AM stocks have failed to live up to the hype over the last decade.

Nano Dimension (NASDAQ: NNDM) is one such stock. It has fallen precipitously since its 2016 IPO, including a 70% decline over the last three years. 2023 was another wild year, with Nano Dimension stock not participating in a recent 3D printing stock rally at the end of the year (Ark Invest’s The 3D Printing ETF rebounded over 30% from the end of October to the end of 2023).

Much of this is due to the company’s ongoing battle with Stratasys (NASDAQ: SSYS), which it is trying to acquire. But could 2024 be the year that Nano Dimension takes off and prints new millionaire investors?

Nano Dimension’s hostile bid for Stratasys

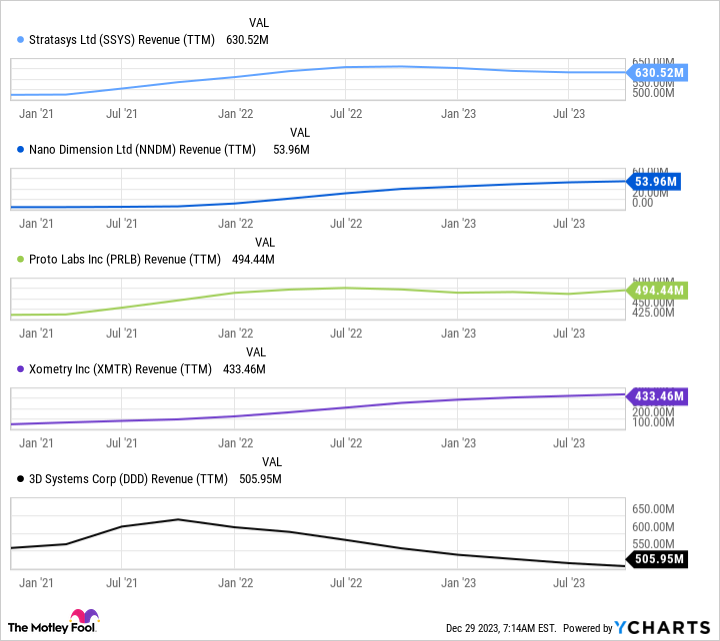

Nano Dimension is a unique business in the 3D printing and AM space. Even when compared to its small peers, Nano Dimension stands out because it generates little in the way of revenue right now.

The company has largely operated as an acquirer of 3D printing and AM start-ups over the last few years, using the sizable cash war chest it amassed during the pandemic-fueled market craze of late 2020 and early 2021. Even as it has burned through some of this cash hoard, Nano Dimension still had over $870 million in cash and short-term investments on hand as of the end of September 2023.

Its latest acquisition target is by far its biggest yet — longtime 3D printing and AM pioneer Stratasys. Stratasys also received an offer to be acquired by 3D Systems, which it rejected as it “significantly undervalue[s] Stratasys.” Nano Dimension acquired a sizable chunk of Stratasys stock, and currently owns 14% of Stratasys’ outstanding shares, putting it in position to at least in part dictate the fate of its larger peer.

Stratasys has been staving off the takeover, even proposing to merge with Desktop Metal earlier in 2023 after an offer from Nano Dimension. Led by Nano Dimension’s opposition to the rival deal, Stratasys’ shareholders voted against the merger with Desktop Metal.

Nano Dimension renewed its bid in December, offering $16.50 per share of Stratasys, for a market cap of about $1.1 billion to $1.2 billion. Nano Dimension said it could increase the offer amount subject to further due diligence. Stratasys has been saying it’s in the midst of reviewing its strategic alternatives.

Wowza, what a story.

It’s a bit of corporate intrigue that illustrates the current situation in 3D printing. A myriad of small upstarts, which of course compete against much larger manufacturing companies and traditional manufacturing equipment suppliers, could benefit from some consolidation, and need further focus on boosting profit margins. As of this writing, only Proto Labs is profitable on a free-cash-flow basis, though Xometry is nearing that milestone.

Will Nano Dimension rocket higher in 2024?

At this juncture, Nano Dimension is a highly speculative and only potentially high-reward stock. This is reflected in the share price action this year, which has remained muted and close to Nano Dimension’s all-time lows. The market cap of about $580 million as of this writing is less than the business’s cash and investments on balance. However, there’s that necessary footnote, as the purchase of Stratasys would wipe out most of that cash — and some additional debt financing would be needed if the acquisition were to ever go through.

Besides, it’s also unclear what a combined Nano Dimension-plus-Stratasys plan would be to reach profitability.

Such is par for the course for an industry in its infancy like 3D printing and additive manufacturing. It’s not abundantly clear which company could emerge as an industry or investment leader, if any were to emerge as a cut-and-dry standout investment. After all, the industrial manufacturing sector tends to be highly fragmented for a reason. There’s no indication that a digitally enhanced take on manufacturing would be any different.

For investors looking for a big payoff, keep any bet on Nano Dimension a small one. There could be millionaire-maker potential, but a very bumpy road lays ahead.

Should you invest $1,000 in Nano Dimension right now?

Before you buy stock in Nano Dimension, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nano Dimension wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Nicholas Rossolillo and his clients have no position in any of the stocks mentioned. The Motley Fool recommends 3d Systems and Proto Labs. The Motley Fool has a disclosure policy.

Could Nano Dimension Stock Print New Millionaire Investors in 2024? was originally published by The Motley Fool

Read the full article here