Nvidia has received considerable attention as the market’s premiere artificial intelligence (AI) stock. This is for good reason, as its graphics processing units (GPUs) are in high demand to provide the computing power necessary to train these new generative AI models.

However, this can’t be done with just one or two GPUs. Instead, companies often use thousands of these devices connected together to accelerate the training time. This connectivity portion is where Broadcom (NASDAQ: AVGO) comes in and will also be a huge beneficiary of the AI movement.

So, could Broadcom duplicate Nvidia’s massive rise?

Broadcom’s product line is wide

Broadcom is a much wider company than Nvidia, as it not only sells these switches but also has application-specific integrated circuits (ASICs). These are (you guessed it) designed to handle a very specific task. Alphabet‘s tensor processing unit (TPU) is a chip that can outperform Nvidia’s GPUs when an AI workload is set up correctly, and it is an example of an ASIC that Broadcom helped create. There are many more examples of Broadcom-designed ASICs that will compete against Nvidia GPUs, and this represents a significant growth opportunity.

Should these GPU alternatives catch on, they could deliver significant growth for Broadcom. Although, management doesn’t think these applications will ever compete toe-to-toe with Nvidia’s GPUs.

Thanks to its large VMware acquisition, Broadcom also has a software wing that ranges from cybersecurity to virtual desktops. It also has mainframe software, which is critical when companies greatly expand their computing capacity.

If it sounds like Broadcom does a lot, that’s because it does. This may be a problem for Broadcom over the long haul because it’s not focused on any one area. So, if its connectivity switch business explodes while the software side struggles, the results may not look as good as Nvidia’s, which is directly focused on its primary product. But this can also be a benefit since the growth should be fairly steady with fewer boom-and-bust cycles like Nvidia experiences.

If you’re looking to capitalize on a business with a large AI upside but without the business volatility, Broadcom could be a great pick. However, don’t expect the same level of performance that Nvidia has given investors.

But is the stock a buy at today’s prices?

The stock isn’t cheap

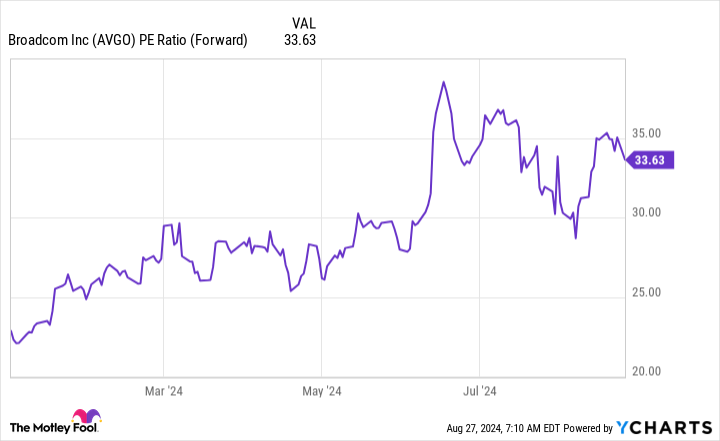

Because Broadcom is undergoing a transformation period, the best way to value it is to use its forward price-to-earnings (P/E) ratio.

At 34 times forward earnings, the stock isn’t cheap. However, with revenue rising 43% year over year in Q2, investors will give it a pass. One thing to keep in mind, though, is that its VMware acquisition accounted for a large part of that growth. If you subtract that out, revenue rose 12% year over year. That’s solid growth but maybe not enough to justify its stock price.

However, the company’s earnings are slated to grow significantly over the next few years.

This growth should drive the stock higher and provide investors ample growth to pay the premium on the stock today. While Broadcom isn’t going to match Nvidia’s performance anytime soon, it does have strong tailwinds blowing in its favor and should see strong growth thanks to AI. It’s a solid stock to buy in the market, especially for someone looking for a bit steadier business.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Could Broadcom Duplicate Nvidia’s Performance as a Premiere Artificial Intelligence (AI) Stock? was originally published by The Motley Fool

Read the full article here