(Bloomberg) — Chinese stocks slid following a much-anticipated meeting between Presidents Joe Biden and Xi Jinping, as traders saw only modest progress in the strained ties and as fresh data renewed concern over the world’s second-largest economy.

Most Read from Bloomberg

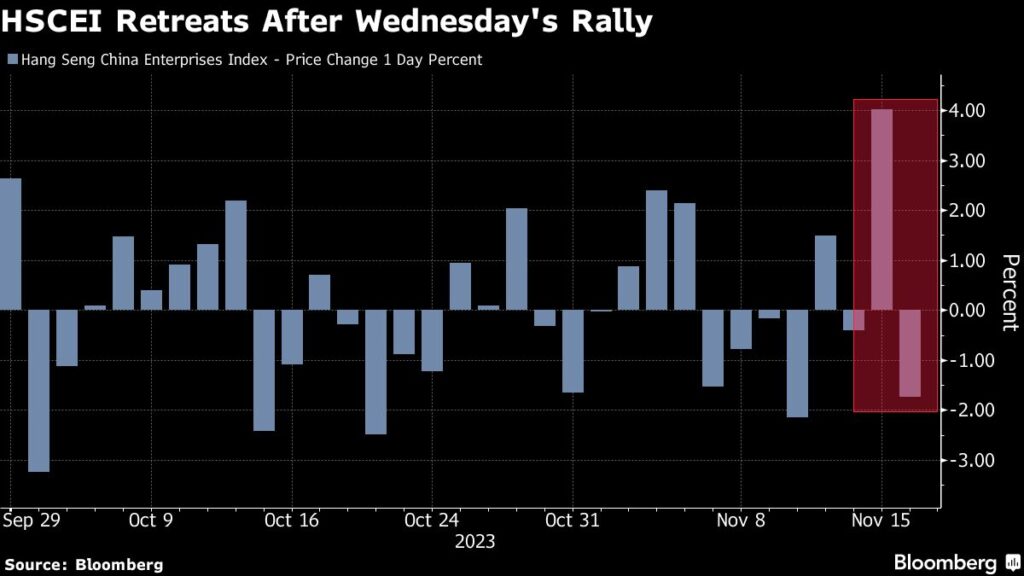

The Hang Seng China Enterprises Index fell about 1% as of 2:16 p.m. local time to lead losses among major Asia equity gauges. It jumped 4% in the previous session partly as investors looked to the summit for catalysts. On the mainland, the benchmark CSI 300 Index was set to snap a two-day gain, down 0.7%.

Hopes were running high that the Xi-Biden talk will prove a turning point after geopolitical tensions dragged Chinese stocks for much of the year. While Biden said the talks had yielded progress in amending relations, traders appeared to be taking the remarks with a grain of salt. Foreigners were back to selling mainland shares as of mid-Thursday.

READ: Biden-Xi Meeting Delivers Small Wins and Promises of Better Ties

Investors say Biden calling Xi a dictator once again — in response to a question at his press conference — potentially casts a shadow over the progress made by both sides.

“The China investment landscape is likely to remain complex in the near term,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore, adding that the meeting is a step in the right direction. Biden’s comments “referring to Xi Jinping as a dictator are contributing to today’s decline in the Chinese stock market.”

In a sign of how much remains to be done, there was no evidence of progress on bigger issues like US curbs on microchip exports, tariffs or tensions in the South China Sea, where both countries’ ships and planes have had a series of provocative encounters.

Some sectors mentioned in the bilateral meeting as areas of cooperation rallied. Shares of Chinese airlines rose after the leaders agreed to significantly increase direct flights next year.

Home Prices

The property sector continued to be a source of bad news, with data Thursday showing home prices fell the most in eight years in October in a sign that the industry’s slump is worsening. That comes after the monthly economic report showed a mixed recovery in the Chinese economy.

“Investors may be taking some profit after a strong performance yesterday and are still trying to balance the positive developments from the APEC meeting between Xi-Biden and a somewhat mixed monthly economic report from China,” said David Chao, a strategist at Invesco Asset Management in Singapore.

The Hang Seng Tech Index slumped close to 3% before paring some of its losses. Xiaomi Corp was the biggest drag. The stock plunged more than 6% as investors showed little excitement at the smartphone giant’s debut electric vehicle, a five-seat sedan with a panoramic glass roof.

The move today might be “sell on good news” following the EV development given the recent rally in Xiaomi shares, said Steven Leung, director at Uob Kay Hian Hong Kong Ltd. The next thing investors are watching will be its earnings next week, he added.

–With assistance from Charlotte Yang and Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here