(Bloomberg) — Asian stocks rose as China’s central bank lowered key rates in the latest attempt to shore up the economy and financial markets.

Most Read from Bloomberg

Equity benchmarks in Japan jumped more than 1% while those in South Korea climbed. Futures for the FTSE China A50 Index jumped as much as 2%. The yield on China’s 10-year government bond declined to 2% for the first time on record.

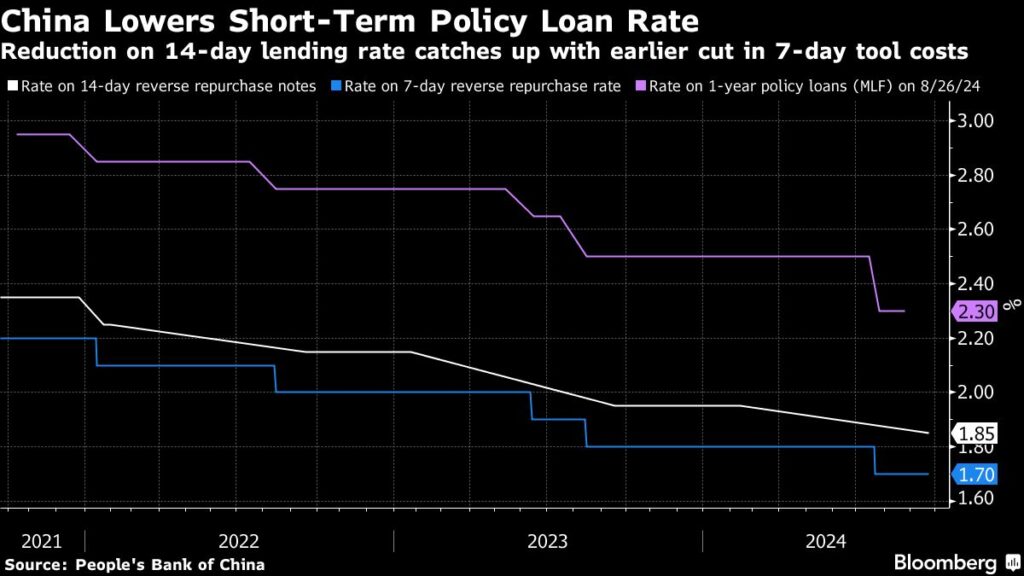

The People’s Bank of China announced a sweep of support for the economy, cutting its key short-term interest rate, and lowering the mortgage rate for existing housing loans. The reserve requirement ratio, or the amount of cash banks must keep in reserve, will be lowered by 0.5 percentage points.

“Looser financial conditions are very supportive for the highly cyclical Asian region,” said Kyle Rodda, a senior market analyst at Capital.com. “In particular, it takes a lot of pressure off Chinese financial markets and the systemic risks plaguing the country.”

US stock futures were little changed after the S&P 500 closed 0.3% higher in the previous session, a whisker away from last week’s all-time high.

US data released Monday showed business activity expanded at a slightly slower pace in early September, while expectations deteriorated and a gauge of prices received climbed to a six-month high, stoking confidence the world’s largest economy can nail a soft landing. Investors are now awaiting data on the Fed’s preferred price metric and US personal spending later this week.

Traders have been wagering on nearly three-quarters of a point of policy easing by year end, suggesting at least one more jumbo rate cut is in store.

The yield on policy-sensitive two-year Treasuries fell one basis point to 3.58%, while longer dated Treasuries were little changed in Asian trading. US government bonds had been under pressure with the Treasury slated to auction $183 billion in front-end supply and up to $25 billion of new issuance in corporates expected this week.

Chicago Fed President Austan Goolsbee said with inflation approaching the central bank’s target the focus should turn to the labor market and “that likely means many more rate cuts over the next year.”

Neel Kashkari at the Minneapolis Fed also pointed to weakness in the job market, saying he backs lowering interest rates by another half percentage point by year end. His counterpart at the Atlanta Fed, Raphael Bostic took a moderate stance. Starting the central bank’s cutting cycle with a large step would help bring interest rates closer to neutral levels, but officials should not commit to a cadence of outsize moves, according to Bostic.

In other key events for Asia, the Reserve Bank of Australia is expected to hold the cash rate at a 12-year high of 4.35% on Tuesday — and keep it there until at least February. The nation’s 10-year yield dipped in early trading.

Gold rose to fresh all-time high as traders digested data and remarks from policymakers. Oil edged higher in early trading Tuesday after Israel launched airstrikes on targets across southern Lebanon, killing nearly 500 people and fanning fears of all-out war.

Key events this week:

-

Australia rate decision, Tuesday

-

Japan Jibun Bank Manufacturing PMI, Services PMI, Tuesday

-

Mexico CPI, Tuesday

-

Bank of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility rate, Wednesday

-

Sweden rate decision, Wednesday

-

Switzerland rate decision, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

Mexico rate decision, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:01 a.m. Tokyo time

-

Hang Seng futures rose 1.1%

-

Japan’s Topix rose 1%

-

Australia’s S&P/ASX 200 was little changed

-

Euro Stoxx 50 futures rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.1111

-

The Japanese yen was little changed at 143.59 per dollar

-

The offshore yuan was little changed at 7.0586 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $63,351.45

-

Ether fell 0.6% to $2,646.6

Bonds

-

The yield on 10-year Treasuries was little changed at 3.74%

-

Japan’s 10-year yield was little changed at 0.825%

-

Australia’s 10-year yield declined two basis points to 3.94%

Commodities

-

West Texas Intermediate crude rose 0.3% to $70.59 a barrel

-

Spot gold fell 0.1% to $2,625.17 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here