Shares of Cava Group (NYSE: CAVA) soared after the operator of fast-casual Mediterranean-themed restaurants saw its same-store sales surge when it reported its fiscal 2024 second-quarter results. The stock price has now nearly tripled this year.

Let’s delve into Cava’s most recent earnings report and see whether the stock still makes a good investment after its huge run this year.

A surge in revenue

Cava saw revenue for its fiscal Q2, which ended July 14, jump 35% to $231.4 million. The growth came from a combination of more locations and strong same-store sales growth. Same-restaurant sales soared 14.4% in Q2. Guest traffic climbed 9.5% year over year and traffic was a huge improvement from the 1.2% decline it saw last quarter. The company’s comparable restaurant sales also saw a 4.9% benefit from menu price increases and mix. Even more impressive, Cava was going against difficult comparisons, as a year ago it saw same-restaurant sales growth of 18.8%.

The company credited its introduction of grilled steak as a big driver of its increased traffic and sales. It also noted that sales from lower-income households were strong. Meanwhile, Cava ended the quarter with 341 locations compared to 279 at the end of its fiscal Q1 a year ago. It opened 18 new restaurants in the quarter.

Its restaurant-level margins (RLM) improved slightly to 26.4% from 26.1% a year ago. This metric helps measure the profitability of its restaurants before corporate costs.

The company turned a profit in Q2 of $19.7 million versus $6.5 million a year ago. Adjusted EBITDA, meanwhile, surged 59% year over year to $34.3 million. Cava also generated $48.9 million in operating cash flow in the quarter and $22.7 million in free cash flow. This shows the company is now able to fund its restaurant expansion plans through the cash it generates.

Once again, Cava raised its full-year guidance. It is now forecasting same-restaurant sales growth to come in between 8.5% to 9.5%. This is up from earlier projections of 4.5% to 6.5% and original guidance of 3% to 5%.

For full-year adjusted EBITDA, Cava management now expects the metric to come in between $109 to $114 million. This is up from its prior outlook of between $100 million to $105 million and original guidance of $86 million to $92 million. Cava also increased its expected restaurant openings for this fiscal year to between 50 to 57, up from earlier guidance of 50 to 54 and an original outlook of 48 to 52 new locations.

|

Metric |

Full-Year Guidance |

Full-Year Guidance |

Original Guidance |

|---|---|---|---|

|

Same-store sale growth |

8.5% to 9.5% |

4.5% to 6.5% |

3% to 5% |

|

New restaurant openings |

50 to 57 |

50 to 54 |

48 to 52 |

|

Adjusted EBITDA |

$109 to $114 million |

$100 million to $105 million |

$86 million to $92 million |

Is it too late to buy Cava stock?

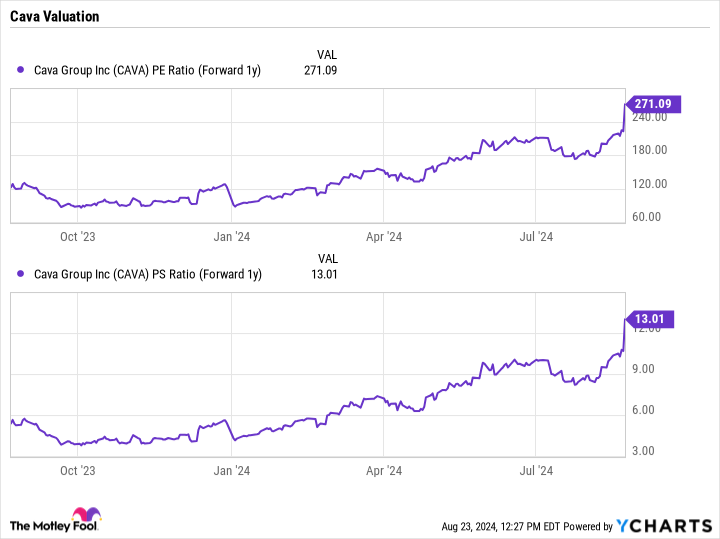

From a traditional valuation standpoint, Cava’s stock looks expensive. It trades at a forward price-to-earnings (P/E) of 271 times and a price-to-sales of 13 times next fiscal year’s analyst estimates.

Investors in the restaurant space generally look for companies that strongly grow same-store sales with an enormous amount of expansion opportunities. In other words, they are trying to find the next Chipotle Mexican Grill (NYSE: CMG). Because if a restaurant operator’s concept is strong enough to support and fund huge expansion, the sky is really the limit.

With double-digit same-store sales growth and solid free cash flow, Cava looks like it is in the running to be the next Chipotle-type growth story. With about a tenth of the locations (341) as Chipotle (3,530), you can see the type of growth that is possible for the company. Cava still needs to grow its average unit volume (AUV), which was nearly $2.7 million, to match Chipotle’s $3.1 billion, but its restaurant-level operating margins are pretty similar (Chipotle guided Q3 RLMs to be 25% versus Cava guiding to a high of 24.7% for the year) and the company should continue to benefit from scale as well as a new tool to improve labor efficiency being rolled out next year.

With a current market cap of $14.3 billion compared to $70.2 billion for Chipotle, it’s not hard to see where Cava stock could head over the next 10 to 15 years if it can continue to put up solid same-store sales, fund its store expansion through cash flow, increase its AUV, and greatly expand its number of locations.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Cava Stock Continues to Shine. Is It Too Late to Buy It? was originally published by The Motley Fool

Read the full article here