The Federal Reserve’s FOMC committee will meet today, and with the pace of inflation down to an annualized rate of 2.5%, the conventional wisdom expects the central bank to start cutting rates. The Fed has held its key funds rate at the 5.25% to 5.50% range since July of last year, in response to a generational spike in inflation.

Most Fed watchers are predicting that the bank’s governors will approve a cut of 25 basis points, or 0.25%. While modest, that would mark the end of a 14-month tight money policy.

For Bank of America, the Fed meeting is likely to provide a catalyst to the markets. “This week, the Fed is expected to officially start its cutting cycle after its longest hold at the peak of a hiking cycle in its history,” the bank’s equity strategist, Ohsung Kwon, noted. “We expect the Fed to cut rates by a typical 25bp, but markets see a relatively high likelihood of a 50bp cut. In our view, the data do not warrant a 50bp cut as activity remains healthy. That said, the market uncertainty over 25bp or 50bp means that the meeting will be a trading catalyst…”

Meanwhile, against this backdrop, Bank of America analysts are bullish on two particular stocks, forecasting double-digit upside potential for each. We’ve used the TipRanks database to see if these picks align with Wall Street analysts’ views. Let’s take a closer look.

Hewlett Packard Enterprise (HPE)

The first stock on our BofA-backed list is Hewlett Packard Enterprise, a company spun off from Hewlett-Packard in 2015. HPE inherited its parent company’s server, storage, and networking businesses, and took them public on its own hook. The company now provides a range of solutions, for everything from data collection and intelligence, to data security, to edge-to-cloud computing, to hybrid cloud operations. These are all services in high demand from AI companies and developers – and the boom in AI promises a boon to HPE.

In a transaction that is sure to garner plenty of attention, HPE is in the process of completing its acquisition of Juniper Networks. The $14 billion deal is expected to bring advantages to HPE’s cloud and AI-native networking capabilities, and to be accretive to earnings in the first year post-close. The Juniper deal is expected to finalize before the end of this year.

At the beginning of this year, HPE brought on board a new CFO, Marie Myers, who had previously served at the firm’s parent company. Myers has a reputation for pushing innovation and performance, and her remit with HPE includes cutting costs and improving efficiency.

On the financial side, HPE’s strong AI product lines, and an ongoing cyclical improvement in the AI sector’s outlook, proved to be a revenue driver in the recently reported fiscal 3Q24 (July quarter). The company’s top line was up just over 10% year-over-year, to reach $7.7 billion, and beat the estimates by $40 million. At the bottom line, HPE realized a profit of 50 cents per share in non-GAAP measures, a figure that was 3 cents per share ahead of the forecast.

Return-minded investors should note that HPE has also declared its next dividend payment, at 13 cents per common share. This payment, scheduled for this coming October 18, annualizes to 52 cents per common share and gives a sound forward yield of 2.9%.

For Bank of America’s 5-star analyst Wamsi Mohan, this stock brings several solid advantages to the table. In his review, Mohan lays them out clearly, writing, “We view shares as attractive as we see the opportunity for (1) Significant cost cuts driven by new CFO Marie Myers with a proven track record at HPQ, (2) Cyclical recovery across servers, storage and particularly networking, (3) Rev and increased cost synergies with the upcoming Juniper acquisition, (4) High Performance Compute (HPC) margin recovery from depressed levels and (5) AI beneficiary as Enterprise/Sovereign demand increases.”

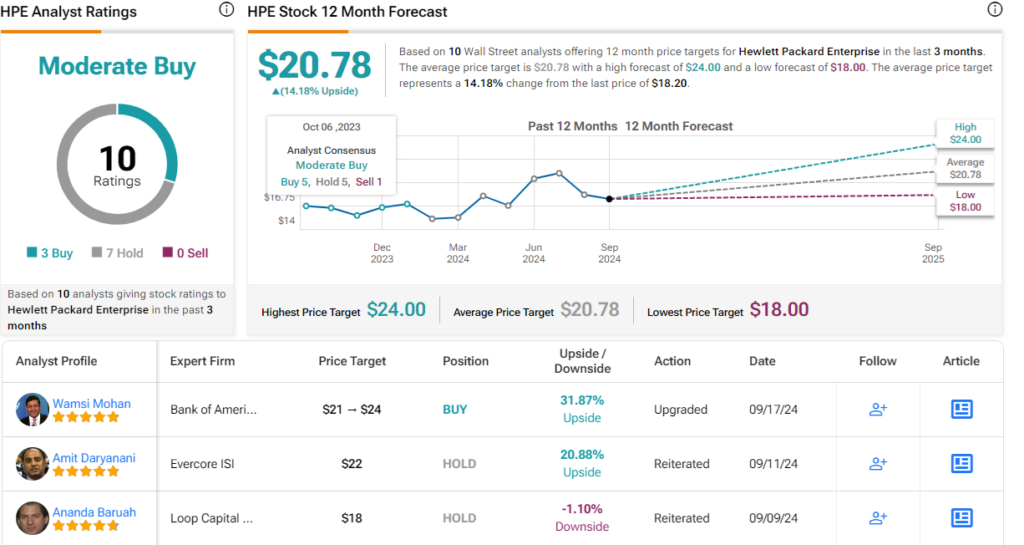

These factors support Mohan’s rating upgrade, to a Buy (from Neutral). His price target, set at $24, implies the stock will gain 32% in the year ahead. (To watch Mohan’s track record, click here)

Turning now to the rest of the Street, where HPE has a Moderate Buy consensus rating based on 10 reviews that include 3 Buys and 7 Holds. The shares are trading for $18.20 and the average price target of $20.78 suggests a one-year upside potential of 14%. (See HPE stock forecast)

GE Vernova (GEV)

Next on our BofA-endorsed list is another company that originated as a spin-off from a large parent firm. GE Vernova was formed as an independent company earlier this year, when the parent firm General Electric first merged, and then spun off, its GE Power and GE Renewable Energy divisions. GE Vernova is an electric power company, manufacturing and providing energy equipment, and providing support services. The company has a focus on ‘green’ technology, and has a publicly stated target of reaching carbon neutrality in its operations and facilities by the year 2030. GE Vernova’s customers generate approximately 25% of the world’s electricity, putting this green tech firm in a position to lead the global transition to cleaner power.

Counting back to the parent company’s founding, GE Vernova can bank on 130 years of experience in the field. The company has approximately 55,000 wind turbines and 7,000 gas turbines currently in operation, and employs more than 75,000 people in more than 100 countries.

In addition to its wind and gas turbine technologies and products, GE Vernova also offers solutions for hydroelectric power, nuclear power, and even steam power generation. All of these have contributions to make to the global need for electric power, and each has varying combinations of attributes to fit any situation imaginable. GEV’s hydro power solutions are currently in use with more than 25% of the world’s installed hydroelectric generating capacity. The company’s services business has a 65% backlog, which is expected to provide a steady cash flow stream going forward.

GE Vernova has released two sets of financial results since going public this past spring. The more recent of the two, released in July, covered 2Q24 and showed a top line of $8.2 billion. While this missed the forecast by $60 million, it’s important to note that the company also reported $11.8 billion in total orders, a metric that bodes well going forward. At the bottom line, GE Vernova had earnings of $4.65 per share. The company’s cash balance was $5.8 billion, up significantly from the $4.2 billion the firm had at the time of its spin-off.

Andrew Obin, another 5-star analyst from Bank of America, believes this company shows plenty of underlying strength. He writes of its overall potential, “We believe GEV shares can deliver beat and raise results in many coming quarters. We see the December 10th investor event as a positive catalyst. We expect management to raise its medium-term targets and potentially announce a buyback, given the build-up of excess cash. We argue US electrical growth is poised to accelerate and GE Vernova has greater US exposure relative to peers.”

Getting into more specifics, Obin adds, “Given our higher growth and profitability estimates for Gas Power Services, we raise our 2025 adj. EBITDA estimate by $0.5bn to $3.6bn and 2026 by $1.1bn to $5.4bn. Our estimates are 16% above/27% higher than current consensus, respectively.”

In Obin’s eyes, this is another stock worth a ratings upgrade from Neutral to a Buy. He complements that with a $300 price target to show his confidence in a one-year gain of 26.5%. (To watch Obin’s track record, click here)

Overall, this newly public stock has a Strong Buy consensus rating based on 13 recent reviews that break down to a lopsided 12 Buys and 1 Hold. That said, considering the shares’ big gains (up by 73% over the past 6 months), the average price target of $238.23 suggests the stock will stay rangebound for the time being. (See GEV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Read the full article here