(Bloomberg) — Asian equities were set to advance Friday after a fourth day of gains on Wall Street as the latest batch of economic data did little to dissuade investors about the trajectory of anticipated Federal Reserve rate cuts.

Most Read from Bloomberg

Equity futures in Japan, Australia and Hong Kong climbed, with each rising by less than 1% in a sign of muted risk appetite. The yen found early support Friday, trading at around 141 per dollar to hold on to run of strengthening against the greenback.

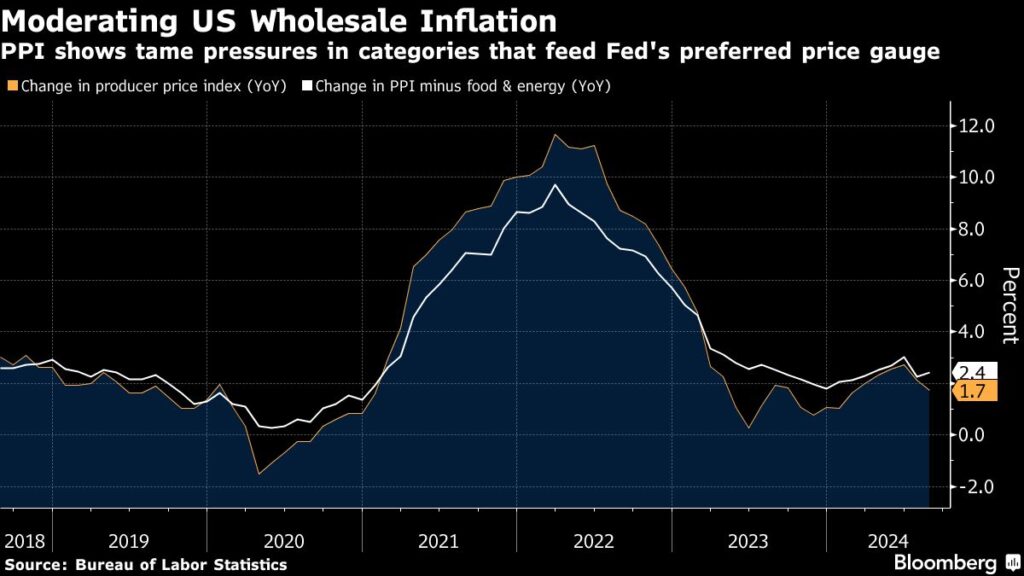

The US producer price index picked up slightly in August after the previous month’s numbers were revised lower, and categories that feed into the Fed’s preferred inflation gauge were muted. Treasuries saw mild losses on Thursday as separate numbers showed jobless claims ticked up.

The data did little to alter expectations that the Fed will trim rates when its monetary policy committee meets next week, but for some it kept alive the idea the first cut may be 50 basis points, twice the regular cadence.

“We think PPI sustains a lingering possibility of a starter 50, which would take less risk with the soft landing,” said Krishna Guha at Evercore.

Thursday’s wholesale inflation data followed the more closely watched consumer price index, which showed underlying inflation accelerated in August. Yet policymakers have made it clear that they’re currently highly focused on softness in the labor market, which is more likely to drive policy discussions in the months ahead.

“With PPI basically repeating yesterday’s CPI reading and jobless claims in line with expectations, the decks have been cleared for the Fed to kick off a rate-cutting cycle,” said Chris Larkin at E*Trade from Morgan Stanley. “The markets are anticipating an initial 25 basis-point cut, but the discussion will soon turn to how far and fast the Fed is likely to trim rates over time.

BOJ Hike

In Japan, just over half of central bank watchers see authorities conducting their next rate hike in December, while none expects a policy move when the board meets next week, according to a Bloomberg survey.

In the past four weeks, five of nine board members have telegraphed their intention to raise rates again if the bank’s inflation outlook is realized. Market volatility in the days after the Bank of Japan’s July 31 rate hike hasn’t spooked policymakers enough to derail them from the normalization path.

“Chances are extremely low for a rate hike at this meeting,” Masamichi Adachi, chief Japan economist at UBS Securities, said. “It’s too early to discern the impact of the July rate hike and market rout.”

Elsewhere in Asia, data set for release includes Japan industrial production, trade balance figures for India and gross domestic product for Sri Lanka. Australian and New Zealand sovereign bond yields were little changed on Friday.

West Texas Intermediate, the US oil price, rose more than 2% Thursday after storm Francine disrupted production in the Gulf of Mexico, while gold hit an all-time high.

Key events this week:

-

Eurozone industrial production, Friday

-

Japan industrial production, Friday

-

U. Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 8:15 a.m. Tokyo time

-

Hang Seng futures rose 0.2%

-

S&P/ASX 200 futures rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1076

-

The Japanese yen rose 0.1% to 141.64 per dollar

-

The offshore yuan was little changed at 7.1185 per dollar

-

The Australian dollar was little changed at $0.6725

Cryptocurrencies

-

Bitcoin fell 0.2% to $58,059.94

-

Ether rose 0.4% to $2,361.13

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here