(Bloomberg) — Asian equities are poised to come under pressure Tuesday after technology stocks dragged down Wall Street as traders repositioned ahead of Nvidia Corp.’s earnings later this week.

Most Read from Bloomberg

Equity futures fell in Japan and Hong Kong, while those for Australia were little changed. In the US, some of the world’s largest technology names pushed stocks lower after a rally that put the market on the brink of its all-time highs. Contracts for US shares edged lower in early Asian trading.

A gauge of the “Magnificent Seven” megacaps slid 1.2% on Monday. While more than half of the shares in the S&P 500 gained, the US equity benchmark edged lower — a consequence of weakness in the tech giants that dominate it. PDD Holdings Inc.’s shares fell the most since 2022 in New York after Temu’s owner warned on revenue growth.

Expectations heading into Nvidia’s earnings on Wednesday are high, with analysts anticipating another strong consensus beat that could prompt the chipmaker to raise its profit guidance. The results may provide further clarity on artificial intelligence demand, with Nvidia being the direct beneficiary of the intense spending by companies building out AI infrastructure.

“Move over Powell – it’s Jensen Huang’s turn to move markets,” said Anthony Saglimbene at Ameriprise, referring to Nvidia’s chief. “In our view, Nvidia’s earnings report this week may actually have more impact on the overall market than Powell’s Jackson Hole speech last week.”

Treasury 10-year yields rose two basis points to 3.82% on Monday, while the dollar strengthened as markets monitored the extent to which the Federal Reserve is likely to cut interest rates next month. Fed Bank of San Francisco President Mary Daly said it’s appropriate to begin cutting rates, while her Richmond counterpart Thomas Barkin said he still saw upside risks for inflation, though he supported “dialing down” rates.

US inflation figures this week will reinforce that long-awaited rate cuts are coming soon, while a reading on consumer spending is seen indicating that the central bank has been successful at keeping the expansion intact.

Economists see the personal consumption expenditures price index excluding food and energy — the Fed’s preferred measure of underlying inflation — rising 0.2% in July for a second month. That would pull the three-month annualized rate of so-called core inflation down to 2.1%, a smidgen above the central bank’s 2% goal.

“Powell sealed the deal for a September cut at Jackson Hole — leaving intact our thesis for continued broadening/rotation,” said Ohsung Kwon at Bank of America Corp. “But don’t sleep on Nvidia earnings, a consistent driver of S&P returns and still a risk to markets if they disappoint.”

In Asia, China urged Canada to immediately correct the “wrong practices” of new tariffs against the Asian nation. Canada, an export-driven economy that relies heavily on trade with the US, has been closely watching moves by the Biden administration to erect a much higher tariff wall against Chinese EVs, batteries, solar cells, steel and other products.

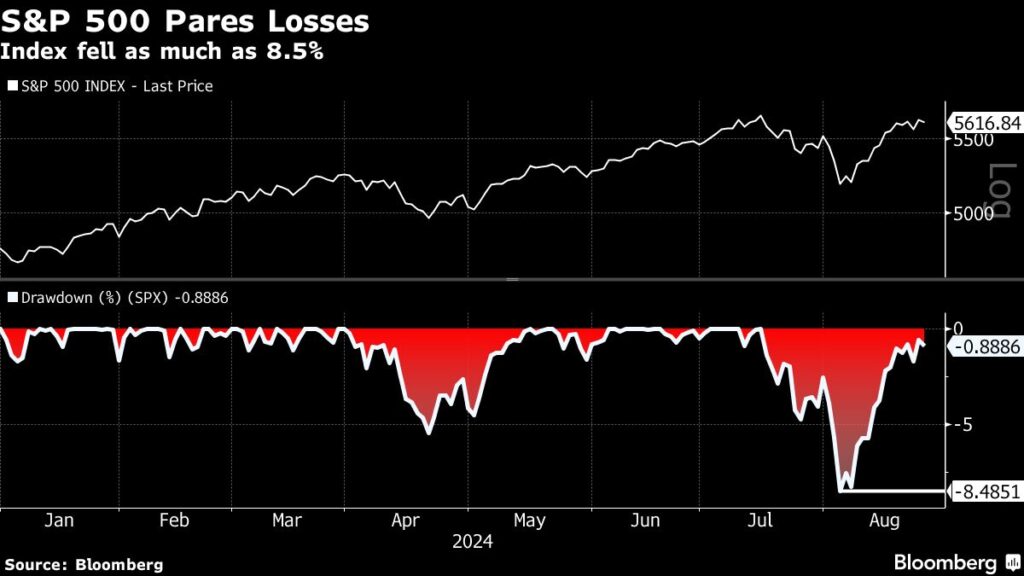

The S&P 500 fell to 5,616.84 on Monday amid thin trading volume. An equal-weighted version of the gauge — one that gives Target Corp. as much clout as Microsoft Corp. — hovered near all-time highs. The tech-heavy Nasdaq 100 slid 1%.

The market has been on a healthier track over the past few weeks, moving away from the overly strong reliance on a few big tech names that we saw in the first seven months this year, according to Mark Hackett at Nationwide. With that said, we are currently in what can best be described as a “market pause,” he noted.

“September is historically the worst month on the calendar, so investors should expect some volatility, especially if key indicators like the PCE inflation data, Nvidia earnings, or upcoming payroll disappoint,” he said.

In commodities, oil edged lower early Tuesday, following gains on Monday as Libya’s eastern government said it will halt exports. Gold was little changed.

Key events this week:

-

China industrial profits, Tuesday

-

Germany GDP, Tuesday

-

US Conference Board consumer confidence, Tuesday

-

Nvidia earnings, Wednesday

-

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

-

Eurozone consumer confidence, Thurrsday

-

US GDP, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

-

Eurozone CPI, unemployment, Friday

-

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 8:19 a.m. Tokyo time

-

Hang Seng futures fell 0.6%

-

S&P/ASX 200 futures were little changed

-

Nikkei 225 futures fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1164

-

The Japanese yen rose 0.2% to 144.26 per dollar

-

The offshore yuan was little changed at 7.1218 per dollar

-

The Australian dollar was unchanged at $0.6772

Cryptocurrencies

-

Bitcoin fell 0.7% to $63,004.8

-

Ether was little changed at $2,689.53

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here