Oil was rising for the first time in seven sessions on Friday, with some attributing the lift to verbal support by Russia and Saudi Arabia. Prices were still headed for a seventh straight weekly loss.

Price action

-

West Texas Intermediate crude for January delivery

CL00,

+1.59%

CL.1,

+1.59%

CLF24,

+1.59%

rose $1, or 1.4%, to $70.34 a barrel after closing down 0.1% to settle at $69.34 a barrel on the New York Mercantile Exchange on Thursday. -

February Brent crude

BRN00,

+1.61%BRNG24,

+1.61%,

the global benchmark, rose $1.14, or 2.6%, to $75.93 a barrel, after closing down 0.3% to $74.05. Both Brent and WTI crude have fallen for six sessions, the longest losing streak for both since February, according to Dow Jones Market Data. -

January gasoline

RBF24,

+2.03%

rose 2.3% to $2.046 a gallon, while January heating oil

HOF24,

+1.69%

gained 2% to $2.59 a gallon. -

Natural gas for January delivery

NGF24,

+0.66%

rose 0.2% to $2.59 per million British thermal units.

Market drivers

Oil prices have been under additional pressure since an underwhelming Nov. 30 OPEC+ meeting that offered more voluntary cuts for the first quarter of 2024, but left traders questioning whether all countries would adhere to those.

At the meeting, OPEC+ producers agreed to voluntarily cut around 2.2 million barrels a day (mbd) of crude from the market in the first quarter of next year. That pledge included a widely expected extension of Saudi Arabia’s 1 mbd voluntary output cut and Russia’s 300,000 barrel a day cut to crude exports.

Some credit the rise in prices on Friday to verbal support from Russia and Saudi Arabia.

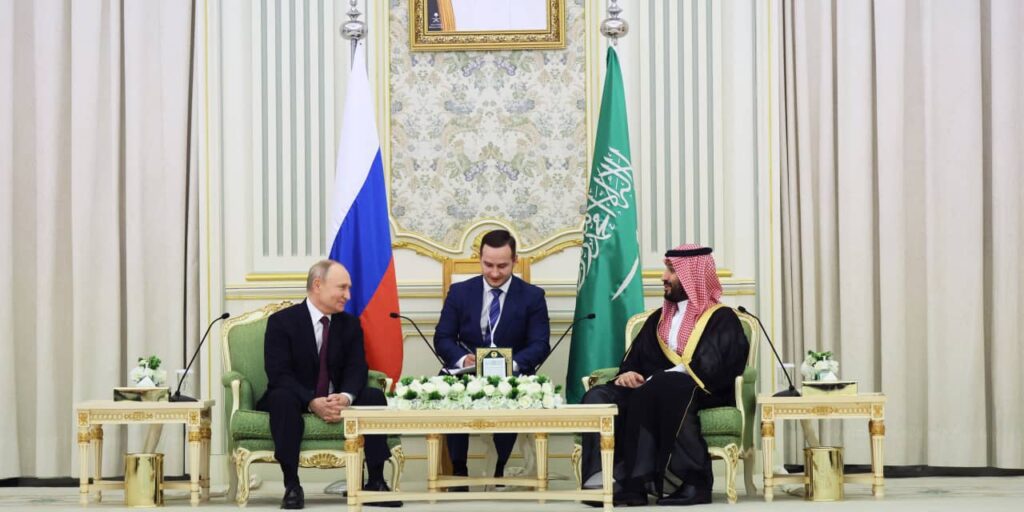

“This bounce came after a meeting between Russian leader Vladimir Putin and Saudi Crown Prince Mohammed bin Salman, emphasizing the ongoing efforts to stabilize global oil markets and manage production levels,” said Stephen Innes, managing partner at SPI Asset Management, in a note to clients.

A joint statement was released on Thursday following Putin’s visit to Riyadh with the Saudi Crown Prince. “In the field of energy, the two sides commended the close cooperation between them and the successful efforts of the OPEC+ countries in enhancing the stability of global oil markets,” said the statement released by the Kremlin.

“They stressed the importance of continuing this cooperation, and the need for all participating countries to adhere to the OPEC+ agreement, in a way that serves the interests of producers and consumers and supports the growth of the global economy,” the statement added.

WTI and Brent are headed for their seventh straight week of losses, of around 6% each. On a continuous basis, oil prices haven’t seen a weekly loss run like that since 2018, according to FactSet data.

“Crude oil prices have steadied with Brent trading around $75 but remains on track to record its longest weekly losing streak since 2018 amid ample global supply and doubts some OPEC+ producers will deliver their promised cuts, while a further drop towards $70 will likely raise the risk of an emergency OPEC+ meeting,” said Ole Hansen, head of commodity strategy at Saxo Bank, in a note to clients.

Investors also have grown worried about China demand, as crude imports from that country fell 10% in November, according to S&P Global Commodity Insights.

In addition, oil traders are keeping watch on any market developments tied to the approval of a referendum in Venezuela last weekend to claim sovereignty over an oil-rich piece of land from Guyana.

Read: What the Venezuela-Guyana border dispute means for oil prices

Read the full article here