RAND TALKING POINTS & ANALYSIS

- SARB keeps rates at 8.25% since their last hike in May 2023.

- Low trading volumes today will likely extend throughout the remaining trading session.

- USD/ZAR hovers around key resistance.

Macro-economic fundamentals underpin almost all markets in the global economy via growth, inflation and employment – Get you FREE guide now!

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand was in firm focus today without any US interference due to Thanksgiving Day. All eyes were on the South African Reserve Bank (SARB) today with the Governor Lesetja Kganyago announcing that the committee will keep interest rates on hold (see economic calendar below). Some key comments by the Mr. Kganyago were related to modest growth outlook and long-term uncertainty. Further to that, the South African economy remains sensitive to external shocks and aligns itself with risk on/off sentiment from a global perspective.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Inflation concerns persist as the primary goal for the SARB to bring within its midpoint zone of its target band of 3% – 6%. Taking into account yesterday’s inflation beat was not enough to push the MPC or any of its members to opt for an interest rate hike. Clearly, the SARB has taken the inflation print as a once off as one data point does not make a trend. Food, fuel and electricity have been the major contributors to this elevated inflation level but with ‘loadshedding’ forecasts expected to lessen, greater capacity could assist in economic growth and lower inflation.

A more recent challenge for the South African economy has stemmed from backlogs in ports across the country and may prove to be a negative for the country alongside the ZAR. In summary, the current rate level was said to be sufficiently restrictive in order to bring inflation down going forward. The path is likely influenced by other major central banks like the Federal Reserve who are taking a ‘wait and see’ approach (data dependency). Future rate hikes were not dismissed either, and higher inflation could lead to additional monetary policy if required.

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

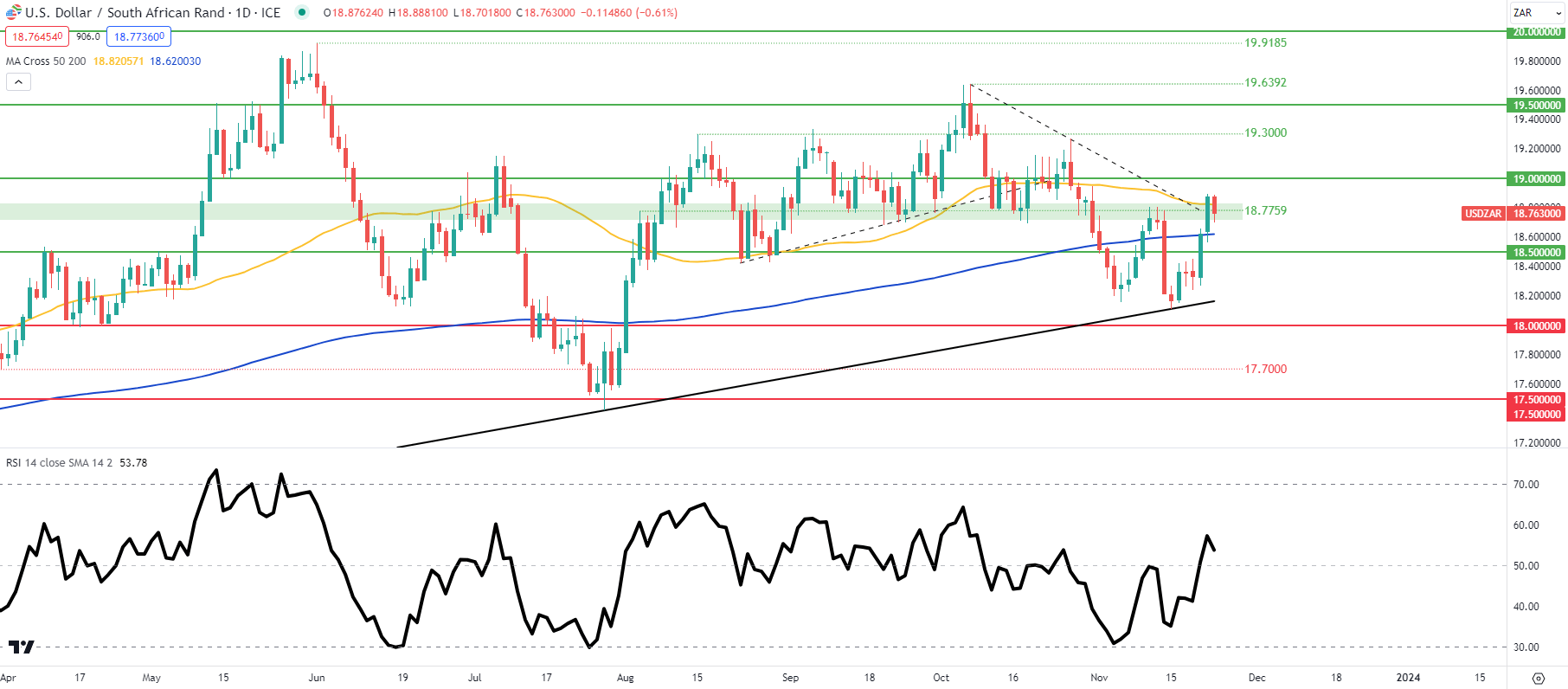

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

The daily USD/ZAR chart above reveals minimal change post-SARB as it tests the 50-day moving average (yellow). Should we see another close above this level, the 19.0000 psychological level may well come into consideration. With US markets closed, low volumes may be contributing to the lack of volatility as US inflation comes into focus next week.

Resistance levels:

- 19.0000

- 50-day MA (yellow)

- 18.7759

Support levels:

Contact and followWarrenon Twitter:@WVenketas

Read the full article here