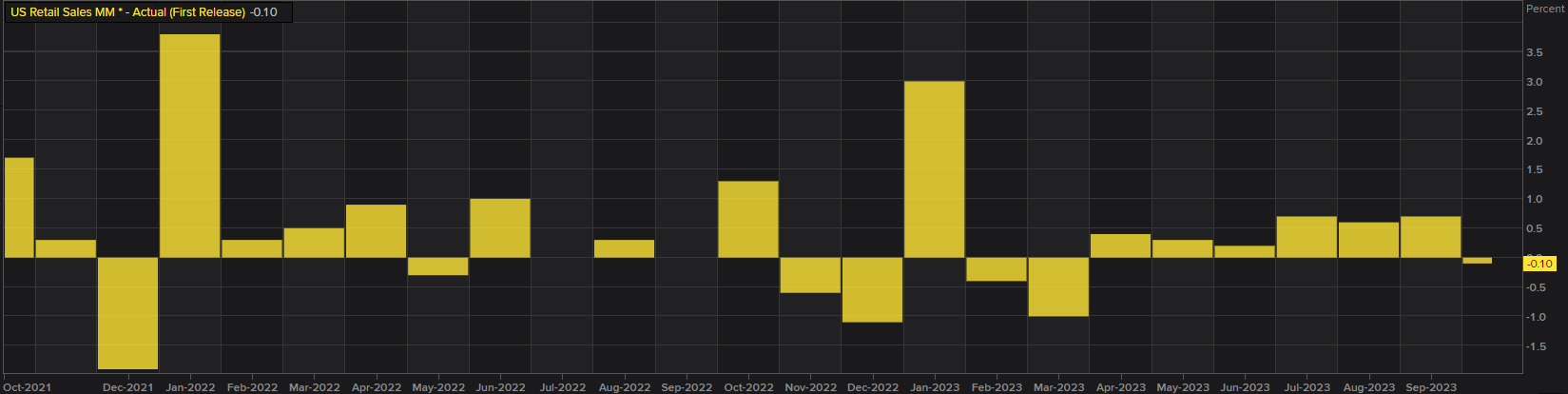

US Retail Sales Turn Lower in October

US retail sales broke its run of six consecutive positive prints in October, dropping 0.1% in the month of October compared to September. In addition, September’s number was revised higher from +0.7% to +0.9%.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Introduction to Forex News Trading

Retail sales has contributed to the strength of the US economy as US consumers played a large part in the massive outperformance in US GDP for Q3. However softening labour data (NFP, average weekly earnings) and yesterday’s lower CPI print set the tone ahead of retail sales.

Markets appear to be reacting to the actual print vs the consensus which has seen the dollar and the 2-year treasury yield rise despite retail sales contracting month on month. Markets will be looking ahead to the Santa rally as we head towards the Christmas period.

US Retail Sales Data Drops in October

Source: US Census Bureau, Refinitiv, prepared by Richard Snow

The dollar and US yields understandable traded slightly higher in the moments after the release while the S&P 500 E-Mini futures edged lower, but still point towards a higher open. Next on the radar is a number of Fed speakers both later today and more so tomorrow.

Multi-Asset Reaction 5-mins chart (DXY, US 2-year Treasury yields, S&P 500 continuous futures)

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Read the full article here