The Thursday trading session brought another record-breaking advance for the stock market, additionally fueled by the FOMC’s interest rate cut. The S&P 500 index gained 0.74%, reaching a new record high of 5,983.84. However, the Fed announcement did little to sustain a rally, as the market moved sideways afterward. This morning, S&P 500 futures indicate a 0.1% lower opening, suggesting potential fluctuations and consolidation.

The investor sentiment improved once again, as shown in the Wednesday’s AAII Investor Sentiment Survey, which reported that 41.5% of individual investors are bullish, while 27.6% of them are bearish.

The S&P 500 keeps reaching new records after Wednesday’s breakout, as we can see on the daily chart.

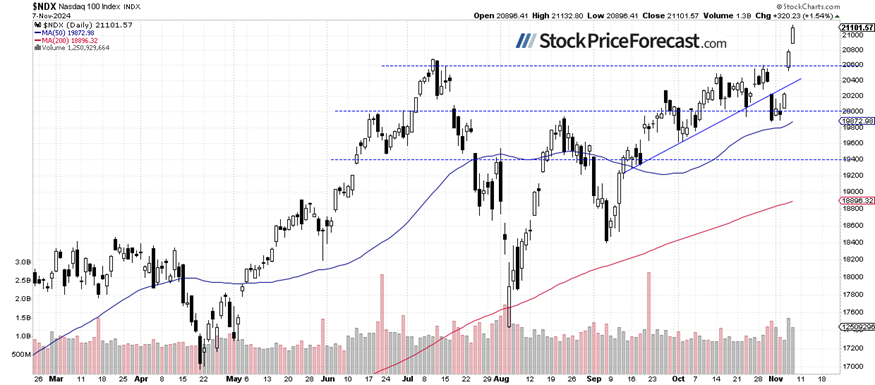

Nasdaq 100: New records above 21,000

The Nasdaq 100 gained 1.54% yesterday, extending Wednesday’s 2.7% rally and hitting a record high of 21,132.80. Today, it is expected to open 0.2% lower and may consolidate. The support level is now between 20,800 and 20,900, marked by yesterday’s gap up.

VIX dipped near 15

The VIX index, a measure of market volatility, declined by over 20% on Wednesday, moving back below the 20 level and nearing the 15 level. This confirmed risk-on sentiment and a lack of fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures contract flirting with 6,000

The S&P 500 futures contract is approaching new highs this morning, surpassing the 6,000 level. Support remains at 5,900-5,920, marked by recent highs. Although the market appears overbought in the short term, no confirmed negative signals are evident.

Conclusion

Stocks rallied following the election results, raising the question: Is this the start of a new uptrend or the final phase of a multi-month advance? End-of-year seasonality still supports the bullish outlook. There may be a pullback due to short-term overbought conditions; however, no negative signals are evident.

In my Stock Price Forecast for November 2024, I wrote “The key question is: Will this sell-off mark the start of a medium-term downtrend, or is it merely a downward correction within an uptrend? For now, it appears to be a correction, but next week’s presidential elections could add to volatility.”

For now, my short-term outlook is neutral.

Here’s the breakdown:

-

The S&P 500 extended its record-braking advance.

-

The market showed minimal reaction to the Fed rate decision and may enter a short-term consolidation.

-

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Read the full article here