Japanese Yen (USD/JPY) and (EUR/JPY) Prices, Charts, and Analysis

- USD/JPY continues to press against a multi-decade high.

- EUR/JPY prints a fresh 15-year high.

- Fed Chair Powell speaks later in the session.

Recommended by Nick Cawley

Get Your Free JPY Forecast

The current risk-on sentiment dominating a range of financial markets is adding to structural Yen weakness, leaving JPY at risk against a range of other currencies. The Japanese Yen is seen as a safe haven currency in times of risk. The recent risk-on move, bolstered by growing market acceptance that the US is highly unlikely to raise interest rates further, has seen the VIX – a volatility index – tumbling to a fresh two-month low.

VIX Volatility S&P 500 Index Daily Chart

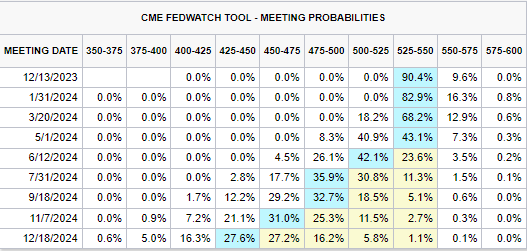

US interest rates are likely to be discussed by Fed Chair Jerome Powell and a group of other Fed members who are all scheduled to speak over the course of today. The latest market pricing suggests that Fed Funds will remain at 525-550 for the next few months before the US central bank begins trimming rates by 25bps at the end of H1 2024. In total, the Fed is seen cutting interest rates by 100 basis points next year.

CME FedWatch Tool

Recommended by Nick Cawley

How to Trade USD/JPY

The daily USD/JPY chart shows the pair within touching distance of last year’s peak at 151.96. A break above here would see USD/JPY at levels last seen 33 years ago. All three simple moving averages remain supportive and may help the pair test the upper limit. The Bank of Japan will be watching closely, and will likely send out a muted warning about the Yen’s weakness, but unless the Japanese central bank acts, it is possible that the pair will move further higher in the weeks ahead.

USD/JPY Daily Price Chart – November 8, 2023

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 11% | 2% | 4% |

| Weekly | 47% | -15% | -7% |

EUR/JPY has broken above a prior level of horizontal resistance and continues to print fresh 15-year highs. All three moving averages are supportive of the move higher and while the CCI indicator suggests that EUR/JPY is overbought, it is not an extreme signal yet. Prior resistance at 159.70 should now act as first-line support before a cluster of prior highs above 158 come into focus.

EUR/JPY Daily Price Chart – November 8, 2023

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Read the full article here