EUR/USD ANALYSIS

- Euro area economic situation stays weak but EUR bulls capitalize on US data.

- NFP and US ISM services PMI in focus tomorrow.

- EUR/USD stays within developing rising wedge.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro pushed higher after disappointing Euro area data showed weak manufacturing PMI’s (see economic calendar below) continue to plague the region. The HCOB manufacturing PMI release slumped to 3-month lows and the 16th consecutive print below the 50 level that marks the change from contraction to expansion. German and French PMI’s that were released prior also suggested significant weakness in demand via new order statistics that declined at a rapid rate. That being said, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank stated that the Eurozone may be at its lows and could see an ascension in the months to come. This could be difficult with the current tight monetary policy environment and geopolitical uncertainty keeping business and investors on edge.

US labor data through the jobless claims print showed an increase relative to forecasts that could signal the beginning of an unwinding jobs market. Although there is minimal correlation between this report and the Non-Farm Payroll (NFP) figure tomorrow, coupled with the miss on ADP employment change yesterday, markets may be expectant of a weaker overall NFP release tomorrow.

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

TECHNICAL ANALYSIS

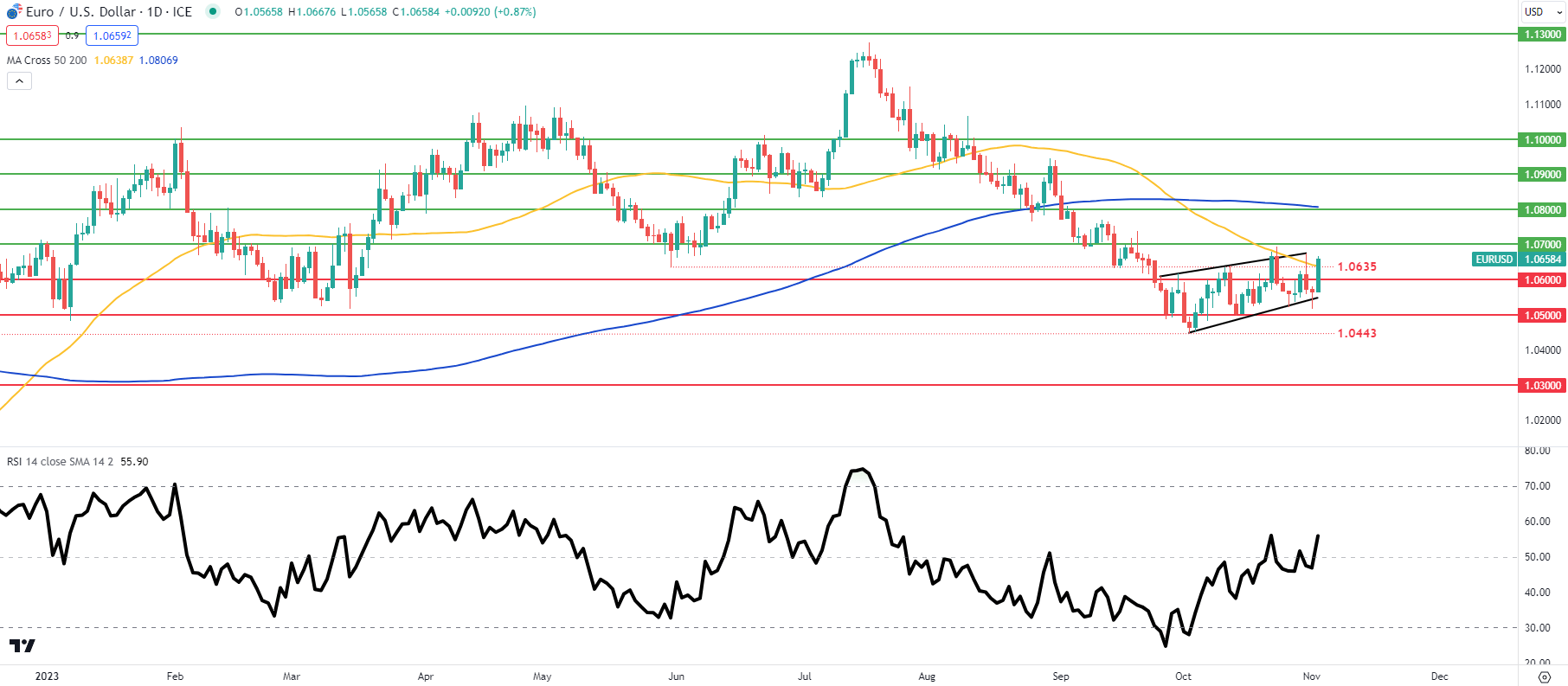

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD daily chart remains within the pattern rising wedge (black) after testing wedge support yesterday. The lower long wick close yesterday naturally saw prices push higher today but this may be brief considering the weak economic data in the Euro area. Short-term directional bias hinges on tomorrow’s US NFP and ISM services PMI.

Resistance levels:

- 1.0800

- 1.0700

- Wedge resistance

Support levels:

- 1.0635/50-day MA

- 1.0600

- Wedge support

- 1.0500

- 1.0443

- 1.0300

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 55% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here