AUD/USD ANALYSIS & TALKING POINTS

- Australian PMI’s concerning but encouraging news from China and a weaker USD keep the AUD elevated.

- Thanksgiving Day sees no additional high impact data scheduled for today.

- AUD/USD faces key resistance at 200-day MA.

Elevate your trading skills and gain a competitive edge. Get your hands on the AUSTRALIAN DOLLAR Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar kicked off the morning with some disappointing PMI data (see economic calendar below). Both Judo Bank manufacturing and services metrics slumped to yearly lows, moving further into contractionary territory. That being said the Reserve Bank of Australia (RBA) meeting minutes hangover remains in place after the board reiterated the inflationary problem as well as the potential for additional interest rate hikes.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

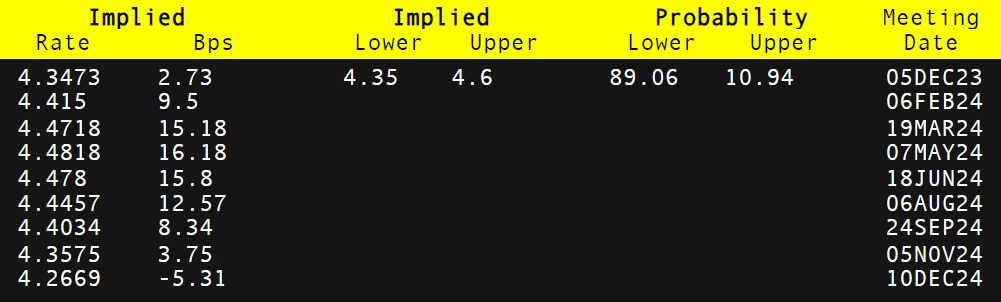

Some positivity out of China supplemented the AUD upside today after Beijing announced that distressed property developers are to received financial aid. With the greenback trading lower and the aforementioned Chinese optimism, some key Australian commodity exports are tracking higher thus supporting the Aussie dollar. There has been a hawkish shift in rate expectations (refer to table below) with a higher probability of a rate hike in 2024.

From a US dollar perspective, markets have reacted negatively after yesterday’s durable goods orders and Michigan consumer sentiment ticked lower although we did see a pullback in initial jobless claims. With today being Thanksgiving Day in the US, there is likely to be minimal volatility and volume across financial markets and I expect the pair to stay relatively subdued.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

AUD/USD daily price action above has not managed to breach the topside of the 200-day moving average (blue) resistance zone and could be showing signs of fatigue as the pair approaches the overbought region of the Relative Strength Index (RSI). Tuesday’s long upper wick close could point to subsequent downside to come where next week’s Australian and US inflation data could be the catalyst for short-term directional bias.

Key support levels:

- 0.6500

- 0.6459

- 50-day MA

- 0.6358

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 59% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here