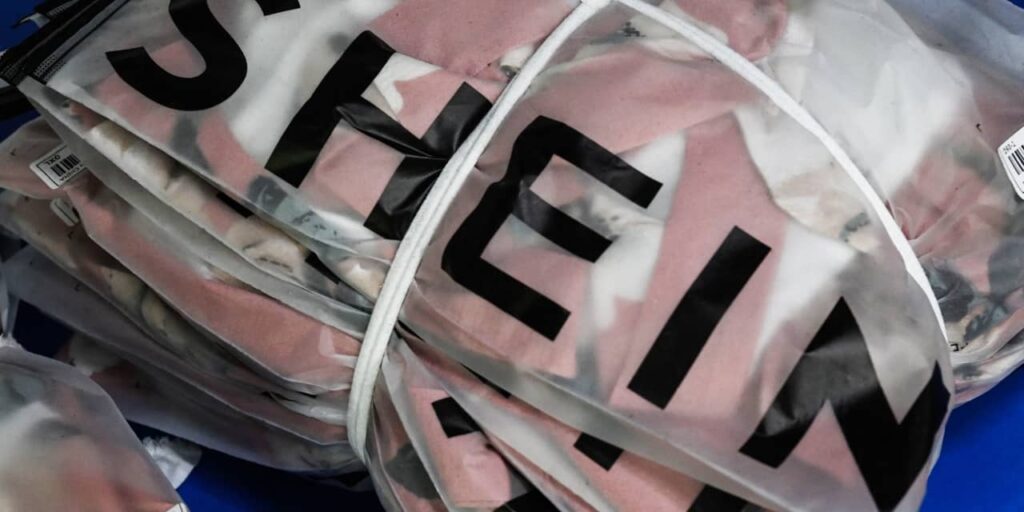

Singapore-based fashion retailer Shein has filed confidentially with the Securities and Exchange Commission for an initial public offering, according to The Wall Street Journal.

The deal will reportedly be underwritten by a group led by

Goldman Sachs,

JPMorgan Chase,

and

Morgan Stanley.

Shein, which was founded in China but shifted its headquarters to Singapore in 2019, was valued at about $66 billion in a $2 billion May 2023 fund-raising round that included General Atlantic, Mubadala, and Sequoia Capital China, according to Crunchbase.

Shein was the subject of a June 2023 Barron’s cover story that noted that Shein—famed for its ultralow apparel prices—had become the world’s most popular shopping app. The story noted there had been previous media reports Shein was planning an IPO.

CB Insights lists Shein as the third-most valued venture-backed “unicorn,” trailing only TikTok-parent ByteDance and Elon Musk’s rocket company SpaceX.

A spokesperson for the company declined to comment on the report.

Write to Eric J. Savitz at eric.savitz@barrons.com

Read the full article here