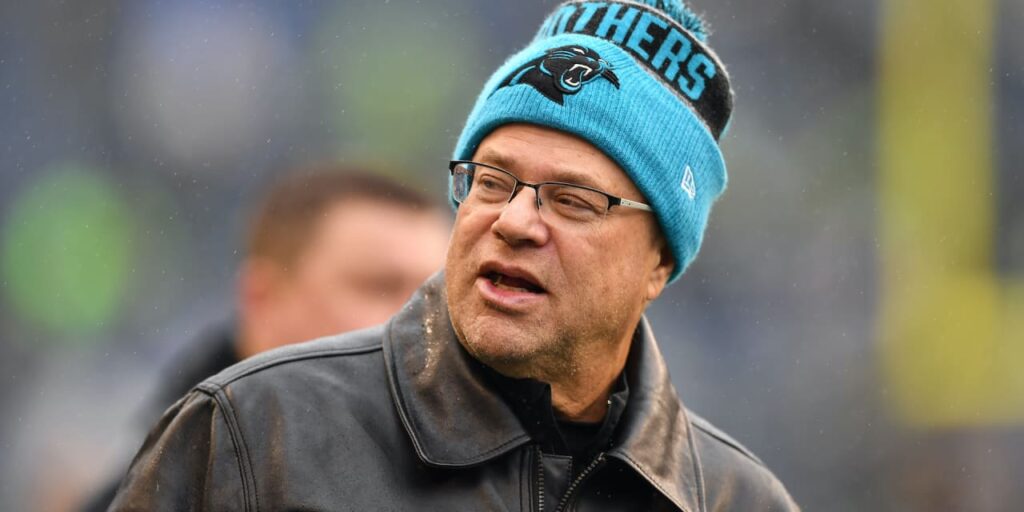

David Tepper had a pair of “cartoonishly huge and grotesquely veiny” brass testicles on the desk of his office at the hedge fund he co-founded, a nugget that was in a New York Magazine story on the billionaire years before he purchased the Carolina Panthers.

The decoration, of course, was a metaphor for how Tepper runs Appaloosa Management, which allowed him to accumulate an estimated net worth of more than $20 billion.

But as his last five years as Panthers owner have shown, buying stakes in distressed and undervalued companies isn’t the same as running an NFL franchise.

“His track record is exactly what I expected it would be,” a former NFL executive told Front Office Sports. “There’s a difference between being an investor and an owner. People like Tepper have made a lot of money, but that doesn’t necessarily translate into them being good owners. They don’t know what it’s like to build things.”

Plus: Tepper’s Appaloosa dumps Apple stake and loads up on Amazon’s stock

Tepper dropped an F-bomb when he exited the locker room Nov. 26 after the Panthers fell to 1-10. The next day, he fired Frank Reich, his second in-season coaching change in as many seasons. Chris Tabor was promoted from special teams coordinator to become the sixth Panthers head coach, including interims, since Tepper purchased the club for $2.275 billion in 2018.

The string of changes — and lack of success so far — mirrors how Dan Snyder ran the Washington Commanders after the telecommunications and advertising mogul purchased the team for the then-record price of $800 million in 1999.

Snyder inherited head coach Norv Turner, who had been in the job five seasons. Turner, who Snyder wanted gone before the coach guided the team into the divisional round of the playoffs in 1999, lasted 29 games before Snyder fired him late in the 2000 season.

Ron Rivera, who coincidentally was the last coach Snyder hired and is likely in his last under new Commanders owner Josh Harris, was fired 28 games into Tepper’s tenure, a move made late in the 2019 season.

Through 93 games under Tepper, the Panthers are 30-63 (32.26% winning percentage). Snyder was 42-51 over the same 93-game span (45.16%).

“When you run a hedge fund, you are making decisions constantly every day,” said Dr. Doug Gardner, the founder of ThinkSport Consulting. “Being an NFL owner requires a different skill set. What made Tepper successful doesn’t necessarily translate to building an organization and a team that is built for short- and long-term success.”

Gardner, beyond assisting athletes, has expanded his business in recent years to include coaching executives.

“If they’re resistant to change or if they’re resistant to hearing other approaches and ideas about how to go about doing things, then you’re not going to get anywhere with anybody,” Gardner said. “You can’t treat players and others like they’re a stock that you can buy and sell and make profit off of. Running a hedge fund is different because you’re not necessarily making a long-term investment in human capital.”

Tepper, however, stated at a Nov. 28 news conference that he does “have patience,” but he continues to “evolve.”

“Things are constantly evolving, and they’ll continue to evolve,” Tepper said. “Trying to make things better is what you always try to do. Obviously, that record is not good enough, and there’s no hiding it. … We’re going to self-reflect and make it better.”

At the same news conference, Tepper defended drafting Bryce Young with the first overall pick in the 2023 NFL Draft over C.J. Stroud. Young has struggled in his rookie season, while Stroud, who was selected by the Houston Texans with the No. 2 pick, has excelled.

“Everything that’s right here, everything that’s wrong here, ultimately it’s my fault,” Tepper said. “I’ve got the final say. … I believe it was a unanimous decision from the coaches and the scouts [to draft Young], and [there were] very strong opinions at the time.”

Charlotte Observer columnist Scott Fowler, a regular critic of Tepper, wasn’t allowed to ask questions at the news conference, creating another parallel to Snyder. The NFL had to step in after Snyder cut access, made TV stations broadcast from the parking lot and tried to get newspapers to pay the team to use “Redskins” in stories.

Also on MarketWatch: Sports apparel retailers hope holidays will improve a post-pandemic slump

Despite not making the playoffs even once under Tepper, the Panthers — thanks largely to the sales of the Denver Broncos and Washington Commanders — are now valued at $4.1 billion — a 44% premium on what Tepper paid after Jerry Richardson sold the Panthers amid allegations of sexual harassment and the use of a racial slur.

The Broncos were purchased by Walmart

WMT,

-0.55%

heir Rob Walton for $4.65 billion in 2022 before the trend toward big-money investor owners swung back to Harris, who led a group of more than 20 others to purchase the Commanders for $6.05 billion earlier this year.

Harris, who comes from the private equity world, also benefited from owning the Philadelphia 76ers and New Jersey Devils for years — and didn’t make rash decisions with those franchises.

Also read: How an NFL bettor just turned $500,000 into $6 million — one of the biggest parlay payouts ever

Given the requirement that team purchases be made with at least 30% cash, the next new NFL owner will likely continue the trend of owners coming from the financial world.

“Team prices are getting to the point where you are only going to have those sorts of people,” the former NFL executive said. “They’re not going to want to learn on the job. There are very few owners who can do that. [Dallas Cowboys owner] Jerry Jones is one of the few, but that’s because he played football, and even there he had a lot of fallow periods.”

Read the original article on FrontOfficeSports.com.

Read the full article here