China’s economic recovery story has been a largely disappointing one, but the economic powerhouse is seeing stellar growth in one particular sector, said Standard Chartered’s Bill Winters.

“Electric vehicles and everything around sustainability and renewable power technology. In those areas, China’s absolutely booming,” the bank’s CEO told CNBC’s Emily Tan on the sidelines of the Global Financial Leaders’ Investment Summit on Tuesday.

While China’s recovery is still “a bit bumpy,” the country is also building is a more resilient, sustainable and stronger economy, he said.

And its playbook? “Gradually decompressing the old economy sectors, and accelerating in the new economy sectors,” Winters added.

China boasts the world’s largest EV market with 5.9 million units sold in 2022, capturing 59% of EVs sold globally, according to research from Canalys. Additionally, Counterpoint Research data showed that domestic brands make up 81% of the EV market — with BYD, Wuling, Chery, Changan and GAC among the top players.

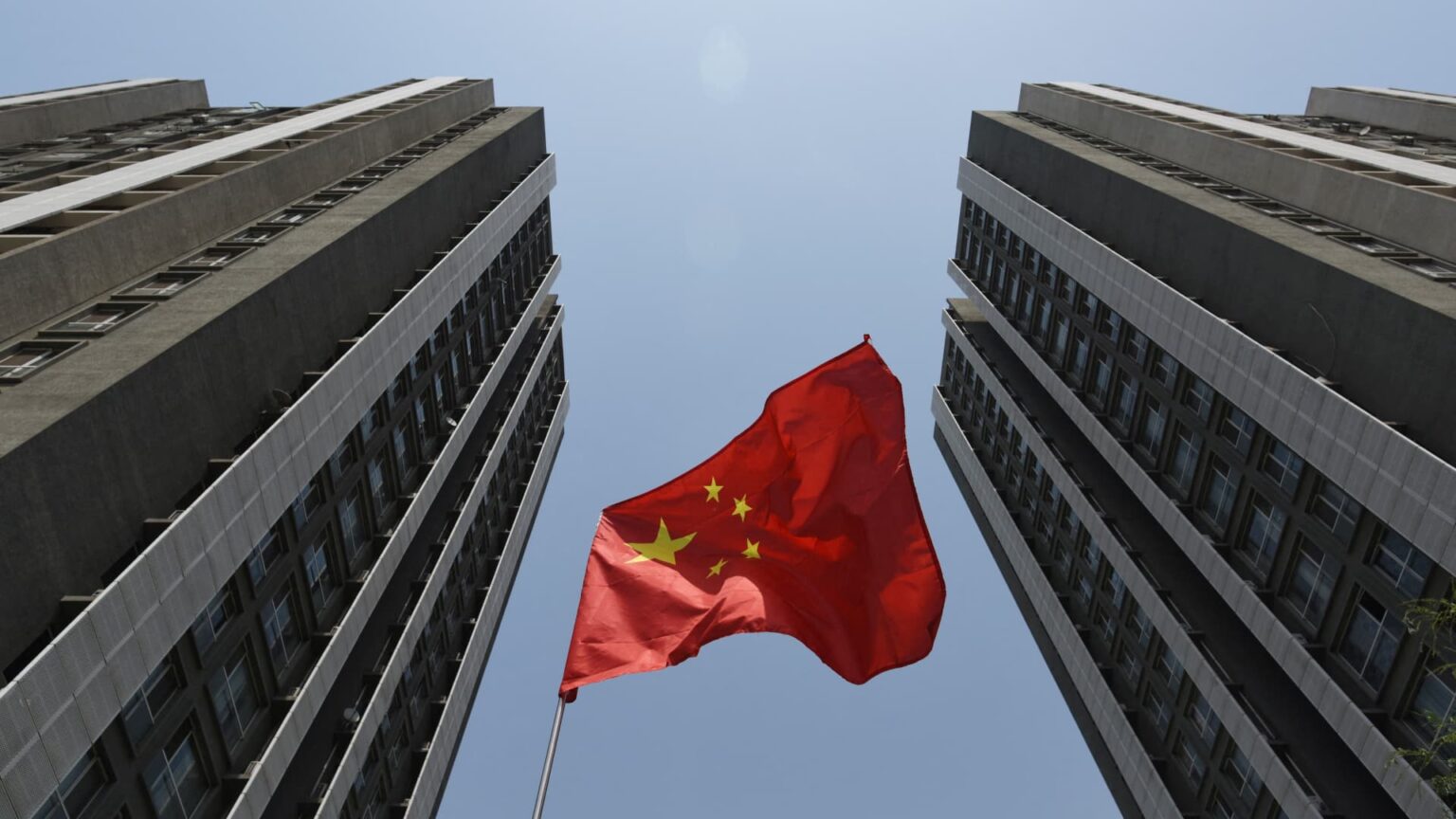

Conversely, the property market has been embattled by faltering consumer confidence, as real estate giants Evergrande and Country Garden continue to be mired in debt problems.

Standard Chartered has been cutting exposure to China’s troubled property sector and is well buffeted against that market, said Winters. While he said it’s not prudent to call a bottom to China’s real estate market just yet, the markets are “well into the second half of that property decompression.”

Just last week, the UK-headquartered bank announced that its pre-tax profit for the third quarter of this year slumped 33%.

China’s post-Covid rebound has been slowing since April. Further impeding the recovery is the property slump which accelerated over the summer, despite many large cities easing restrictions for buying apartments.

That said, China remains an important market for the bank. Others include India, the United Arab Emirates, South Korea, Singapore — and Hong Kong.

“Hong Kong is a core market for us. We’ve been here for almost 170 years. It’s our largest single market,” Winters continued.

Standard Chartered’s offshore business, with Hong Kong as the hub, is growing between 50% to 60% per annum, said Winters. “So it’s a huge growth story for us.”

Read the full article here