Este artículo también está disponible en español.

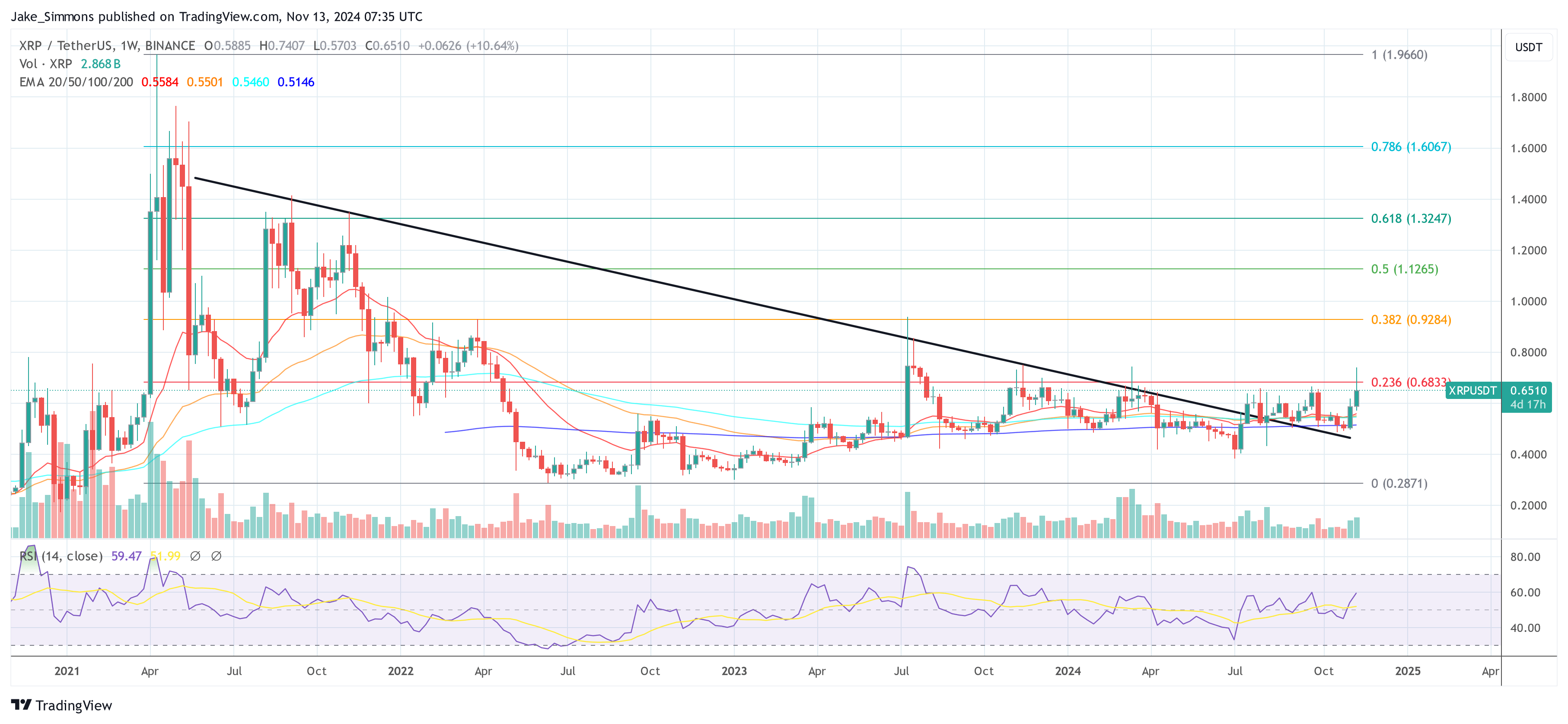

Over the past nine days, XRP has experienced a significant rally, climbing from $0.4957 on November 4 to a peak of $0.7407 today on Binance—a surge of over 50% at one point. Approximately 30% of this ascent occurred within the last 48 hours. However, following this rapid rise, XRP saw a sharp correction, retreating by -12% to $0.65 as of press time. These are the key reasons for the rally:

#1 XRP Funding Rates and Social Dominance Spike

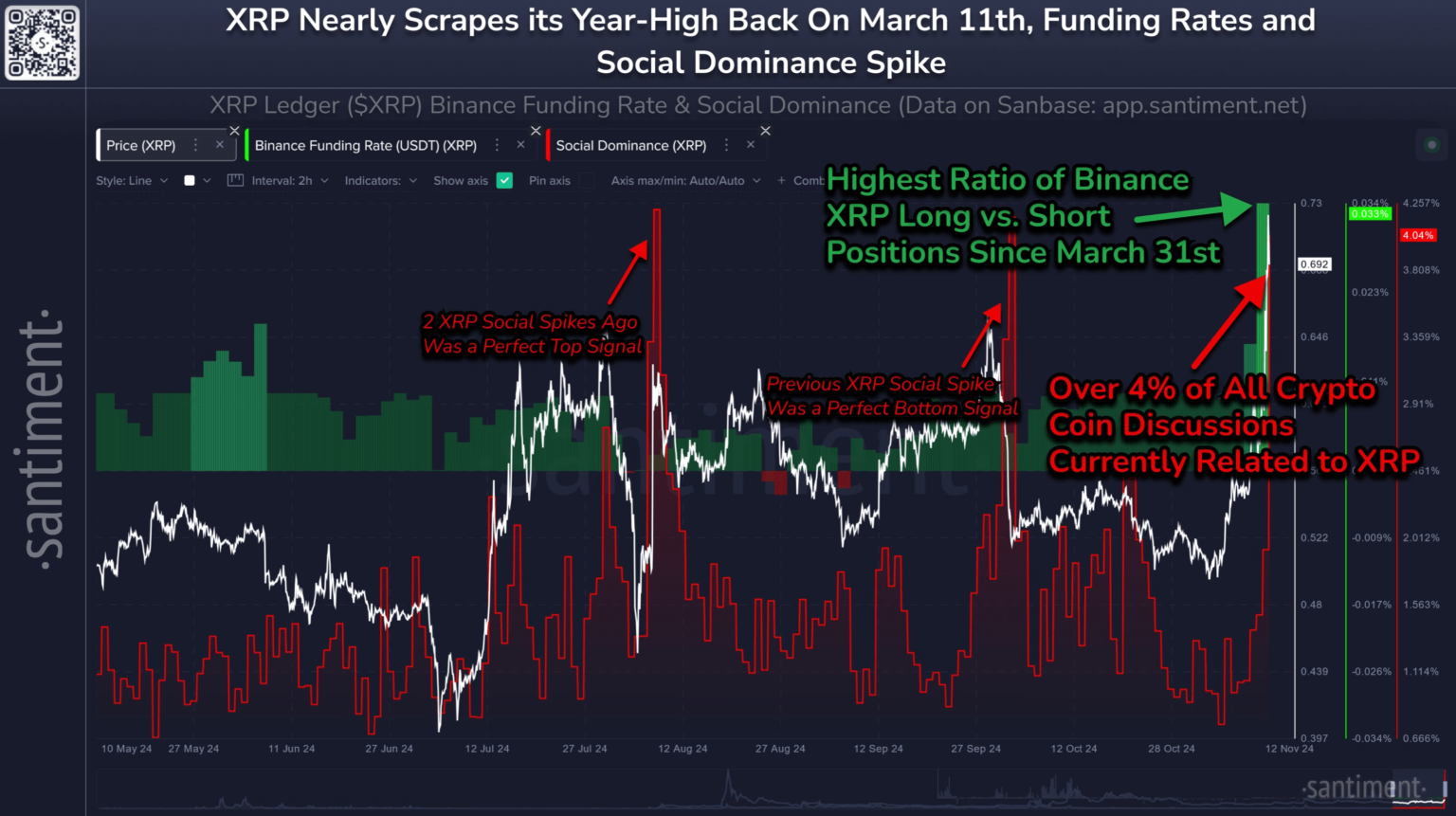

One of the primary drivers behind the XRP price surge appears to be heightened social media activity and shifts in funding rates. On-chain analytics firm Santiment noted via X that the XRP community “has erupted with excitement and discussions related to crypto’s #7 market cap,” with over 4% of all coin discussions currently related to XRP following its 45% breakout over an eight-day span.

The firm emphasized that surpassing $0.74, XRP’s year-high back in March, will largely depend on “FOMO staying at bay, and funding rates on large exchanges like Binance not getting too weighed down by longs.”

Related Reading

Santiment’s analysis highlighted that the ratio of Binance XRP long versus short positions has reached its highest point since March 31, indicating strong bullish sentiment among traders.

They also observed that previous spikes in social dominance, such as those at the beginning of August, served as perfect top signals, suggesting that the current surge in social discussions could precede a market correction. Conversely, Santiment also pointed out that the previous social spike marked a bottom signal.

#2 Gensler Resignation This Week?

Speculation about potential regulatory changes is also influencing XRP’s market dynamics under the Trump administration. Pro-crypto lawyer James “MetaLawMan” Murphy shared an intriguing timeline via X, drawing parallels between US presidential elections and the resignations of SEC chairs.

Related Reading

He noted that after the 2016 and 2020 elections, SEC chairs Mary Jo White and Jay Clayton announced their resignations shortly after the results. Murphy suggested that with the 2024 election, there could be expectations for current SEC Chair Gary Gensler to resign, posting, “Hey Gary Gensler, we’re waiting.”

Time to say Goodbye Gary!

Nov. 8, 2016: Trump elected

Nov. 14, 2016: Mary Jo White (SEC Chair) announces her resignationNov. 3, 2020: Biden elected

Nov. 16, 2020: Jay Clayton announces resignationNov. 5, 2024: Trump elected

Nov. __, 2024: Hey @GaryGensler, we’re waiting— MetaLawMan (@MetaLawMan) November 12, 2024

This speculation is particularly significant for the XRP community because of the ongoing legal battle between Ripple and the SEC. President-elect Donald Trump has explicitly stated his intention to remove Gensler from his position on his first day in office, citing the need for a more crypto-friendly SEC chairman—a statement he made at the Bitcoin 2024 conference.

Ripple CEO Brad Garlinghouse has shown strong support for this potential change, urging Trump to appoint replacements more favorable to the crypto industry, such as Chris Giancarlo, Brian Brooks, or Dan Gallagher. Garlinghouse highlighted the need for regulatory clarity, especially concerning digital assets like Ethereum and XRP.

The speculation among some Ripple supporters is that Gensler’s removal could lead to a more favorable outcome for Ripple, potentially through the SEC dropping its appeal in the case. The market seems to be reacting to this speculation, with investors possibly trying to front-run the news in anticipation of a settlement or regulatory shift.

At press time, XRP traded at $0.65.

Featured image created with DALL.E, chart from TradingView.com

Read the full article here